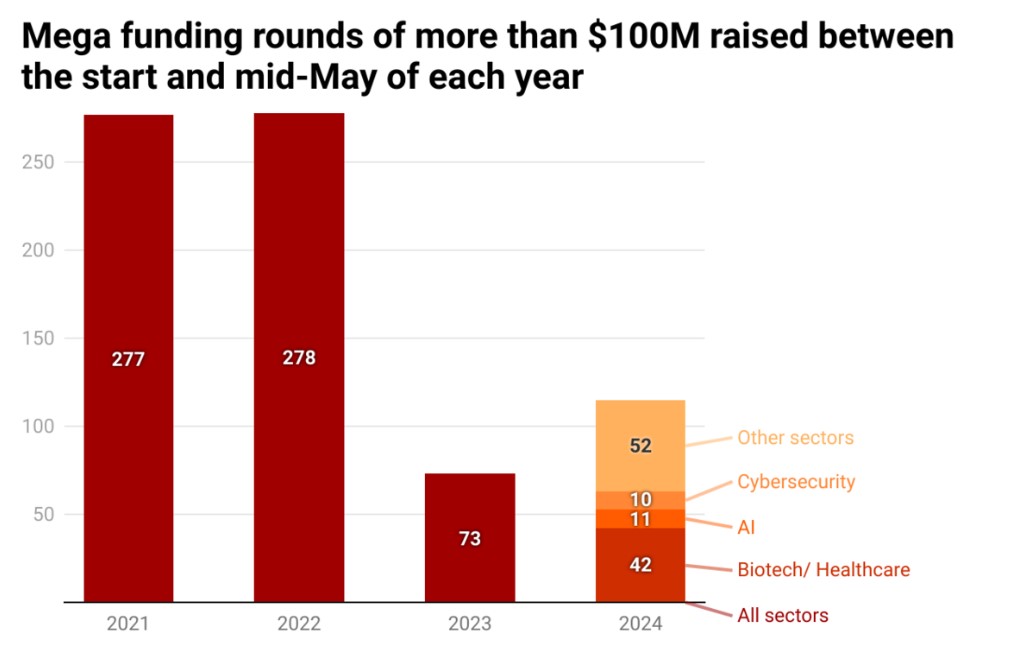

In a surprising turn for the VC landscape, the number of mega rounds has surged by 58% in 2024 compared to the same period last year. This significant uptick is notable, especially given the overall stagnation in venture funding. However, the 116 mega rounds this year still fall short of the nearly 280 mega rounds closed during the same period in 2021 and 2022.

While the current numbers are not yet at the record levels of 2021-2022, the 2024 spike in mega deals indicates a renewed investor confidence in startups with immense potential and scalability. Investors are showing a clear preference for high-stakes bets, concentrating their funds on fewer but more promising ventures.

Healthcare and biotech sectors have emerged as the frontrunners in securing these mega deals, with 42 rounds closed so far this year. Leading the pack is Xaira Therapeutics, an AI-driven drug discovery firm that recently came out of stealth mode with a whopping $1 billion funding round led by Arch Venture Partners and Foresite Capital.

Other sectors seeing significant mega round activity include artificial intelligence (AI) with 11 deals, cybersecurity with 10, energy with 6, and fintech with 4 major rounds. This distribution underscores a strategic focus on innovative technologies and solutions that promise substantial returns and scalability.

The surge in mega rounds amidst a general stagnation in venture funding suggests that while VCs are cautious, they are willing to invest heavily in startups that demonstrate exceptional potential. This trend is likely to shape the investment landscape in the coming years, steering significant capital toward transformative innovations.

For more insights into the venture capital trends and mega deals, stay tuned to our updates and expert analyses.