FREE Investor Database

Top Venture Investors in Latvia 2025 | Unicorn Nest Directory

Top Venture Investors in Latvia 2025 | Unicorn Nest Directory

Browse verified VC and CVC firms funding startups in Latvia. Discover your ideal investor match and find contacts of the right investors on Unicorn Nest.

Intro

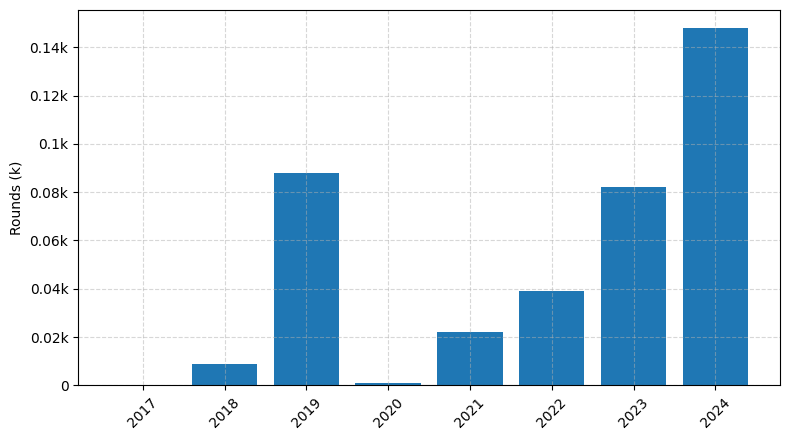

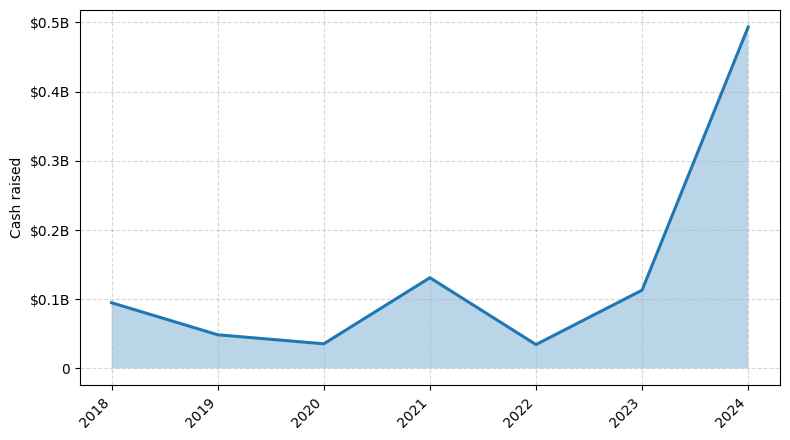

Latvia's venture capital (VC) landscape has seen a remarkable transformation in the last three years. Since 2022, the country has witnessed a surge in VC activity, with a total of 25 venture capital rounds taking place. These investments have amounted to a staggering €120 million, showcasing the growing confidence in Latvia's startup ecosystem.

Among the core startups that have received significant investments are Printify, a leading e-commerce platform that raised €50 million, and Lokalise, a translation and localization platform that secured €16 million. Additionally, Aerones, a drone technology company, has attracted €12 million in funding.

The top venture capital funds operating in Latvia include Overkill Ventures, a €50 million fund focused on early-stage startups, and Tera Ventures, a €30 million fund that invests in Baltic and Nordic tech companies. These funds have played a pivotal role in driving the growth and innovation within the Latvian startup landscape.

In summary, Latvia's venture capital ecosystem has experienced a remarkable transformation, with a significant increase in investment activity, funding, and the emergence of promising startups that are attracting the attention of leading VC funds.

Among the core startups that have received significant investments are Printify, a leading e-commerce platform that raised €50 million, and Lokalise, a translation and localization platform that secured €16 million. Additionally, Aerones, a drone technology company, has attracted €12 million in funding.

The top venture capital funds operating in Latvia include Overkill Ventures, a €50 million fund focused on early-stage startups, and Tera Ventures, a €30 million fund that invests in Baltic and Nordic tech companies. These funds have played a pivotal role in driving the growth and innovation within the Latvian startup landscape.

In summary, Latvia's venture capital ecosystem has experienced a remarkable transformation, with a significant increase in investment activity, funding, and the emergence of promising startups that are attracting the attention of leading VC funds.

10 active VC investors in Latvia

In the last three years, Latvia has seen increased venture capital activity, with several prominent firms investing in local startups. Creandum, a leading Nordic VC, has backed Latvian companies like Printful, a successful e-commerce fulfillment platform. Additionally, Tera Ventures, a Baltic-focused fund, has invested in Nordigen, a data-driven fintech startup. One of the largest venture capital rounds in Latvia in the past two years was Printful's $130 million Series A in 2021, led by Bregal Sagemount. This investment underscores the growth potential of Latvian startups, particularly in the e-commerce and technology sectors.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| ZGI Capital | metalworking, food industry, woodworking, logistics, it, engineering, retail, service exports | ||||

| RubyLight | communication, content sharing, social media, crowd sourcing | Generalist | Seed | ||

| Proks Capital | technology | Latvia | |||

| Overkill Ventures | b2b, mental health, ai, vr, saas | Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czech Republic; Georgia; Hungary; Kosovo; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Lithuania; Estonia; Latvia; Denmark; Norway; Sweden; Finland; Iceland; Armenia; Azerbaijan; Georgia; Ukraine; | Seed, Pre-Seed | ||

| New Nordic Ventures | enterprise software | Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czech Republic; Estonia; Hungary; Kosovo; Latvia; Lithuania; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Armenia; Azerbaijan; Georgia; Ukraine; Denmark; Finland; Iceland; Norway; Sweden | Seed | ||

| Imprimatur Capital | Lithuania; Estonia; Latvia | Series A, Series B | |||

| Commercialization Reactor | deep-tech | Latvia | Series A, Series B, Pre-Seed, Seed | ||

| Capitalia | Lithuania; Estonia; Latvia | Seed | |||

| CABRA VC | consumer, enterprise, technology, software | United States; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania; Bahrain; Egypt; Israel; Jordan; Kuwait; Oman; Qatar; Saudi Arabia; Turkey; United Arab Emirates; Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam; China; India; Japan; South Korea; Taiwan | Seed | ||

| Baltic Tech Ventures | software, technology, energy, biotech, data security, media, communications | Estonia; Latvia; Lithuania | Series A, Series B, Seed |