FREE Investor Database

Top Venture Investors in Israel 2025 | Unicorn Nest Directory

Top Venture Investors in Israel 2025 | Unicorn Nest Directory

Browse verified VC and CVC firms funding startups in Israel. Discover your ideal investor match and find contacts of the right investors on Unicorn Nest.

Intro

Israel has long been a hub for innovation and entrepreneurship, and the country's venture capital (VC) landscape has been thriving in recent years. Since 2022, Israel has witnessed a surge in VC activity, with a record number of funding rounds and significant investment volumes.

Over the past three years, Israel has seen over 1,500 venture capital rounds, with a total investment of more than $30 billion. Some of the notable startups that have received substantial investments include Wiz, a cloud security platform that raised $250 million in 2022, and Gong, a revenue intelligence platform that secured $250 million in 2021.

The Israeli VC ecosystem is dominated by leading funds such as Insight Partners, Sequoia Capital, and Lightspeed Venture Partners, which have all made significant investments in the country's thriving tech sector. These funds have played a crucial role in nurturing and supporting the growth of Israel's most promising startups.

In summary, Israel's VC landscape has experienced remarkable growth in the last three years, with a substantial increase in funding rounds and investment volumes, highlighting the country's continued status as a global hub for innovation and entrepreneurship.

Over the past three years, Israel has seen over 1,500 venture capital rounds, with a total investment of more than $30 billion. Some of the notable startups that have received substantial investments include Wiz, a cloud security platform that raised $250 million in 2022, and Gong, a revenue intelligence platform that secured $250 million in 2021.

The Israeli VC ecosystem is dominated by leading funds such as Insight Partners, Sequoia Capital, and Lightspeed Venture Partners, which have all made significant investments in the country's thriving tech sector. These funds have played a crucial role in nurturing and supporting the growth of Israel's most promising startups.

In summary, Israel's VC landscape has experienced remarkable growth in the last three years, with a substantial increase in funding rounds and investment volumes, highlighting the country's continued status as a global hub for innovation and entrepreneurship.

99 active VC investors in Israel

In the last three years, Israel's thriving startup ecosystem has attracted significant venture capital investments. Top firms like Insight Partners, Sequoia Capital, and Lightspeed Venture Partners have been actively funding Israeli startups across various industries. One notable example is the $550 million Series E round raised by Wiz, a cloud security startup, in 2021. This late-stage investment highlights the growing appetite of venture capitalists for Israeli cybersecurity solutions. The country's strong technical talent, innovative mindset, and supportive ecosystem continue to make it a prime destination for venture capital firms seeking high-growth opportunities.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| ZORA Ventures | climate change, sustainable food systems, deep tech | Israel | Series A, Series B | ||

| ZIM Ventures | Israel | Seed | |||

| Yozma Group | communications, it, medical technologies | Armenia; Azerbaijan; Bahrain; Bangladesh; Bhutan; Brunei; Cambodia; China; Cyprus; East Timor; Egypt; Georgia; India; Indonesia; Iraq; Israel; Japan; Jordan; Kazakhstan; Kuwait; Kyrgyzstan; Laos; Lebanon; Malaysia; Maldives; Mongolia; Myanmar; Nepal; Oman; Pakistan; Philippines; Qatar; Saudi Arabia; Singapore; South Korea; Sri Lanka; Taiwan; Tajikistan; Thailand; Turkey; Turkmenistan; United Arab Emirates; Uzbekistan; Vietnam; Yemen | Generalist, Seed, Series E, Series A, Series D, Pre-Seed, Series C, Series B | ||

| XT Hi-Tech | Israel; United States | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Xenia Venture Capital | Israel | Series A, Series B, Series C | |||

| Wix Capital | saas applications, developer tools, e-commerce, customer service automation, highly scalable infrastructure technologies, financial services including payments solutions, smb technologies and solutions | United Kingdom; Israel; United States | Generalist, Seed, Series E, Series A, Series D, Pre-Seed, Series C, Series B | ||

| Welltech Ventures | prevention and personalized medicine, nutrition, wellness sustainability, mental health and sleep, remote and self-care, longevity, physical activity, social wellness | United States; Israel | Seed, Series A | ||

| VLX Incubator | Series A, Seed, Series B | ||||

| Vintage Investment Partners | ai, big data, b2b, enterprise, cloud, infrastructure, consumer, retail, developer tools, ecommerce, edtech, fintech, media, content, productivity | Generalist; Israel; United States; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Series C, Series D, Series E | USD 200000000 | |

| Vertex Ventures Israel | enterprise saas, vertical saas, cyber security, ai, climate tech, commerce, communications, consumer, defense, devtools, digital health, finops, fintech, hrtech, ipo, impact, industrial, insuretech, media & communication, quantum | Generalist; United States | Seed, Series A, Series B | USD 230000000 |

9 active CVC investors in Israel

Active corporate venture capital firms have been increasingly investing in Israel's thriving tech ecosystem over the past three years. Notable deals include Intel Capital's investment in AI startup Hailo and Qualcomm Ventures' backing of cybersecurity firm Cybereason. Israel's reputation for innovation continues to attract global corporate venture capital.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| ZIM Ventures | Israel | Seed | |||

| XT Hi-Tech | Israel; United States | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Wix Capital | saas applications, developer tools, e-commerce, customer service automation, highly scalable infrastructure technologies, financial services including payments solutions, smb technologies and solutions | United Kingdom; Israel; United States | Generalist, Seed, Series E, Series A, Series D, Pre-Seed, Series C, Series B | ||

| Union Tech Ventures | consumer, data, digital health, gaming, insurtech, marketing, mobility, property, retail | Israel | Series A, Series B, Series C, Series D, Series E, Pre-IPO | ||

| Longliv Ventures | Seed, Series A, Series B, Series C, Series D | ||||

| IN Venture | Israel | Series A, Series B | |||

| HBL Hadasit Bio Holdings | Israel | Series A, Series B | |||

| Gandyr Investments | Israel | Series A, Series B | |||

| Dexcel Pharma | new drugs, biopharmaceutical, therapeutic modalities, therapeutic areas, novel drugs commercialization, rd |

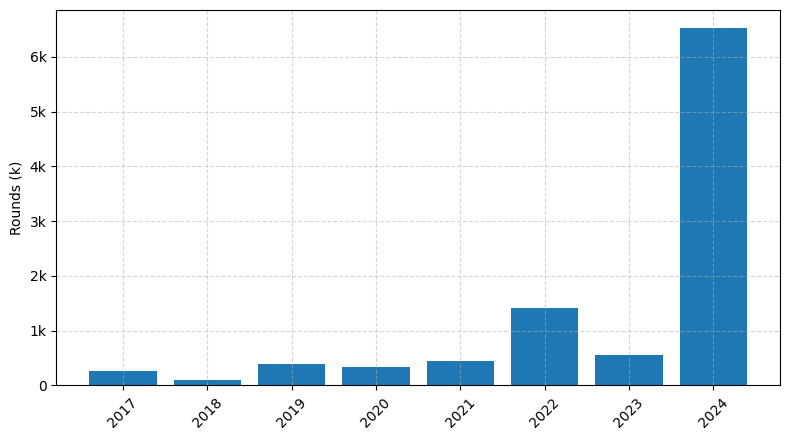

Investments by year: Round

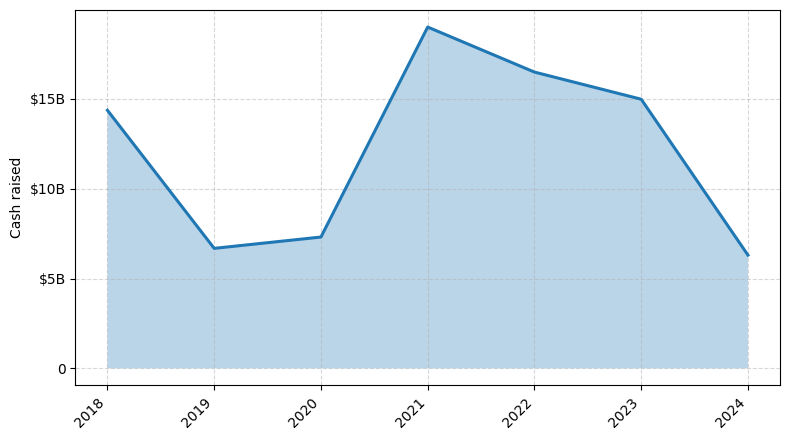

Investments by year: Cash raised

VCs in countries neighboring to Israel

| Country | Total raised | Investments |

|---|---|---|

| Italy | 35.03$B | 353 |

| Saudi Arabia | 34.87$B | 132 |

| Turkey | 6.49$B | 152 |

| Greece | 1.38$B | 21 |

| Egypt | 0.79$B | 114 |

| Cyprus | 0.53$B | 28 |

| Jordan | 0.09$B | 8 |

| Lebanon | 0.00$B | 7 |

| Iraq | 0.00$B | 4 |