research about venture capital (“VC”) syndication, so it is time to go deeper and understand key features in syndicated co-investment. This type of investment is a quite common process for VC deals; however, their structure is quite diverse: it depends on investor type, startup specialization, geography, stage of development, and many other factors.

To make a deal, both the startup and the fund must understand what side encouraged joining the syndicate, what part will be covered by the lead investor, and the reasons forcing the funds to join the syndicate. The UN research team asked those questions to 210 foundations worldwide and found a lot of outstanding insights that describe in depth the behavior of investors in the syndicate, its context of geography, industries and investment stages.

Would you like to know more?

A closer look at respondents

Among the 210 funds the Unicorn Nest decided to ask, 56% comes from North America, 28% goes to Europe, 13% are based in Asia, around 2% in Oceania and 1% in South America. These funds are divided primarily into investment stages this way:

- 19% invest on a seed stage;

- 56% support on an early stage;

- 25% prefer to invest in the late stage.

A significant part of these funds make up to 4 investments per year (64%), 5-9 investments are common for 23%, up to 20 investments are working only for 10%, and 3% of funds provide over 20 investments per year.

Discovery of key points

The most important insights can be divided into three groups: a source of an offer to participate in a syndicate deal, part of the total round covered by the lead investor and most common reasons to join a syndicate deal.

As for the first one, key insiders are:

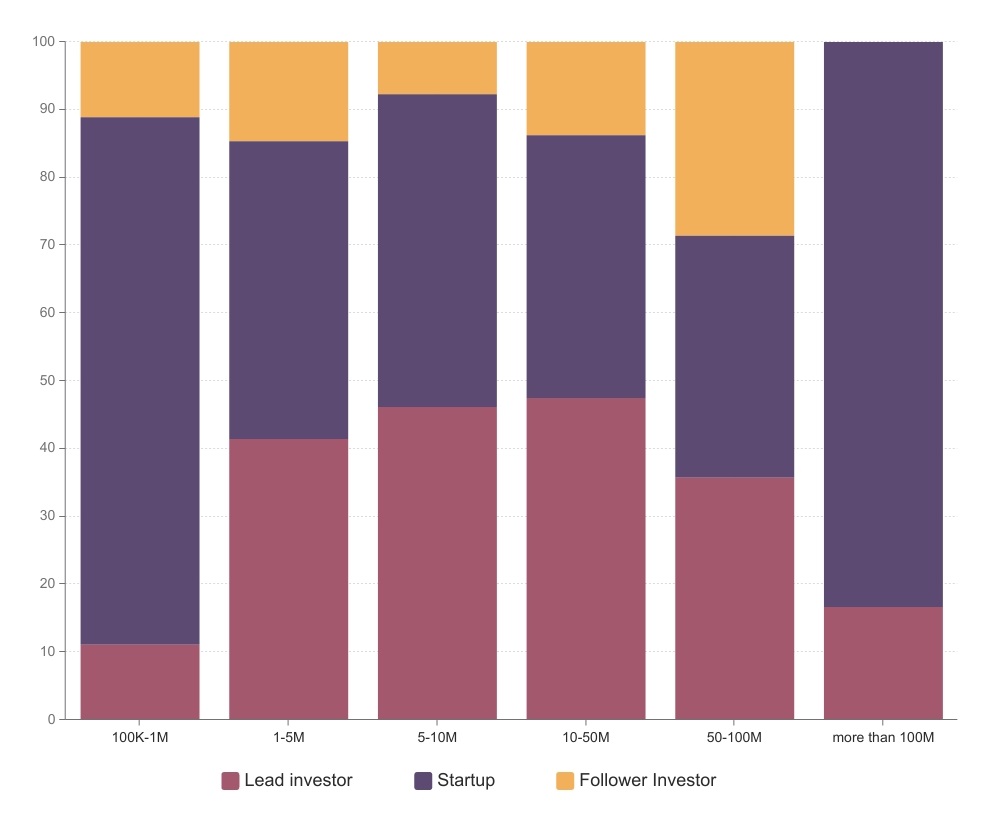

- The initiative to join a syndicate most often comes equally from startups and leading investors (according to 86% of respondents). Follower investor, being the rarest source, occupies the largest share for respondents from China, the Russian Federation and the UAE, as well as for respondents who most often invest in China;

- With the growth of startups mature at the time of the deal, the initiative gradually flows from the lead investor to the startup. Lead investors more often than others attract new participants in the Software Industry and Biotechnology, startups – attracts Internet and E-Commerce, follower investors bring Marketing and Finance;

- More active funds prefer the initiative from startups. The more often a fund acts as a lead investor, the more often it expects initiative from lead investors. At the same time, the category of funds with the lowest share of lead investments expects initiatives from lead investors more than other categories. Follow-on investments are mostly made by those funds that are attracted from lead investors and follower investors;

- The situation with the round’s size looks like a parabola: up to the $10-50M mark, a part of the main source in the form of a lead investor grows, and then falls (the situation is opposite for a source represented by startups).

- The older the average age of the fund’s portfolio, the less often the fund is attracted by startups. The more rounds a startup has, the more the startup itself is the main source of syndicate participants for the next round.

For the second insight, concerning the lead investor part, key insiders are:

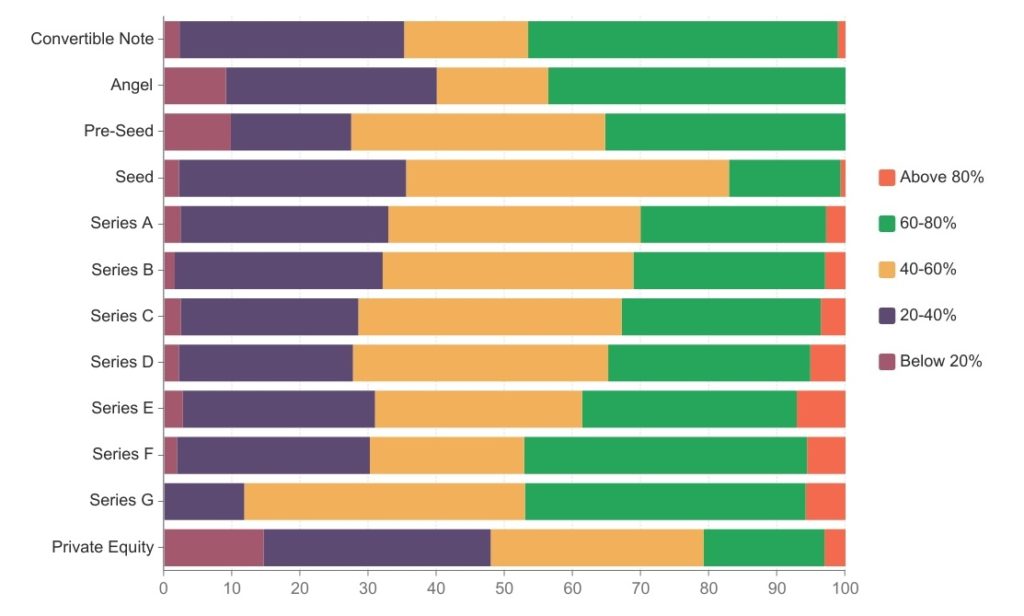

- Most often, the lead investor covers from 20 to 60% of the total deal amount. More share of the round to be covered by lead investors for respondents from the USA, China, Germany, as well as respondents with a focus on Germany, France and Israel;

- The most significant polarization is observed in the earliest and the latest rounds;

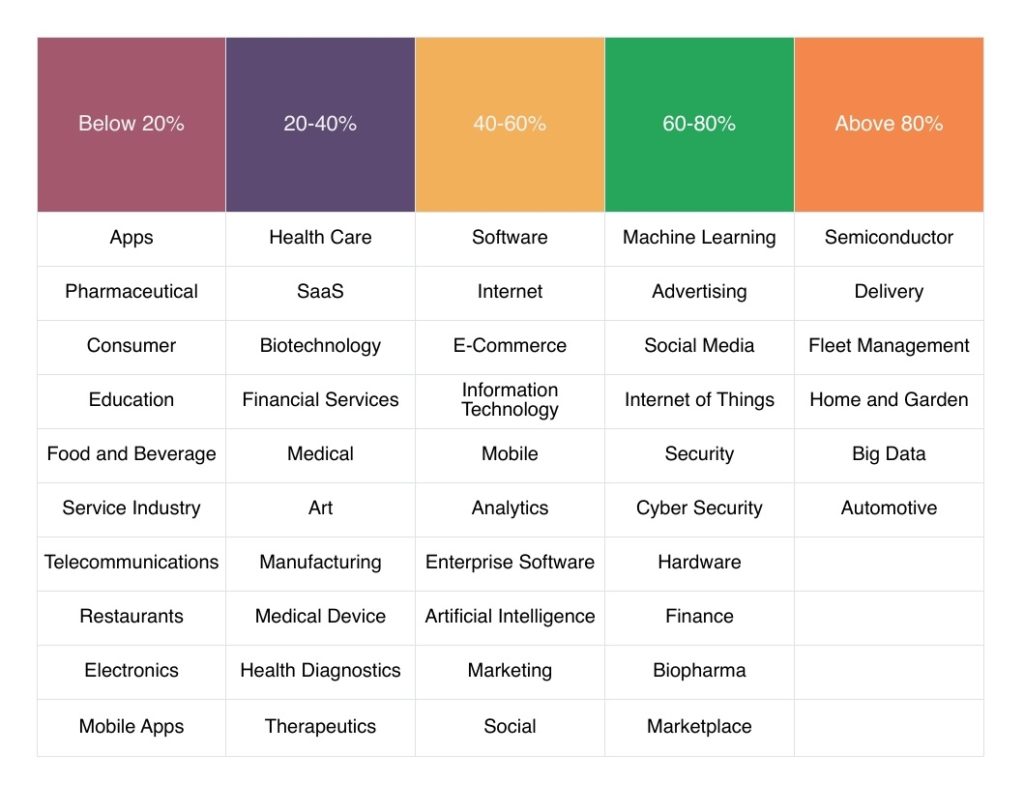

- Less than 20% of the round is covered by the lead investor in Apps and Pharmaceutical industries, 20-40% in Health Care and SaaS, 40-60% in Software and Internet, 60-80% in Machine Learning and Advertising, above 80% in Semiconductor and Delivery;

- The more often a fund acts as a lead investor, the smaller part of the total deal it expects to cover at the expense of the lead investor;

- Funds with a large number of unicorns in their portfolio expect a bigger share of the total round from lead investors than others;

- The higher the average age of exits in the portfolio, the less part of the round the fund expects from the lead investor. The same situation is observed for funds whose average round size is higher than the others.

Speaking about the most common reasons for a fund to join a syndication deal, UN-researchers discovered the following:

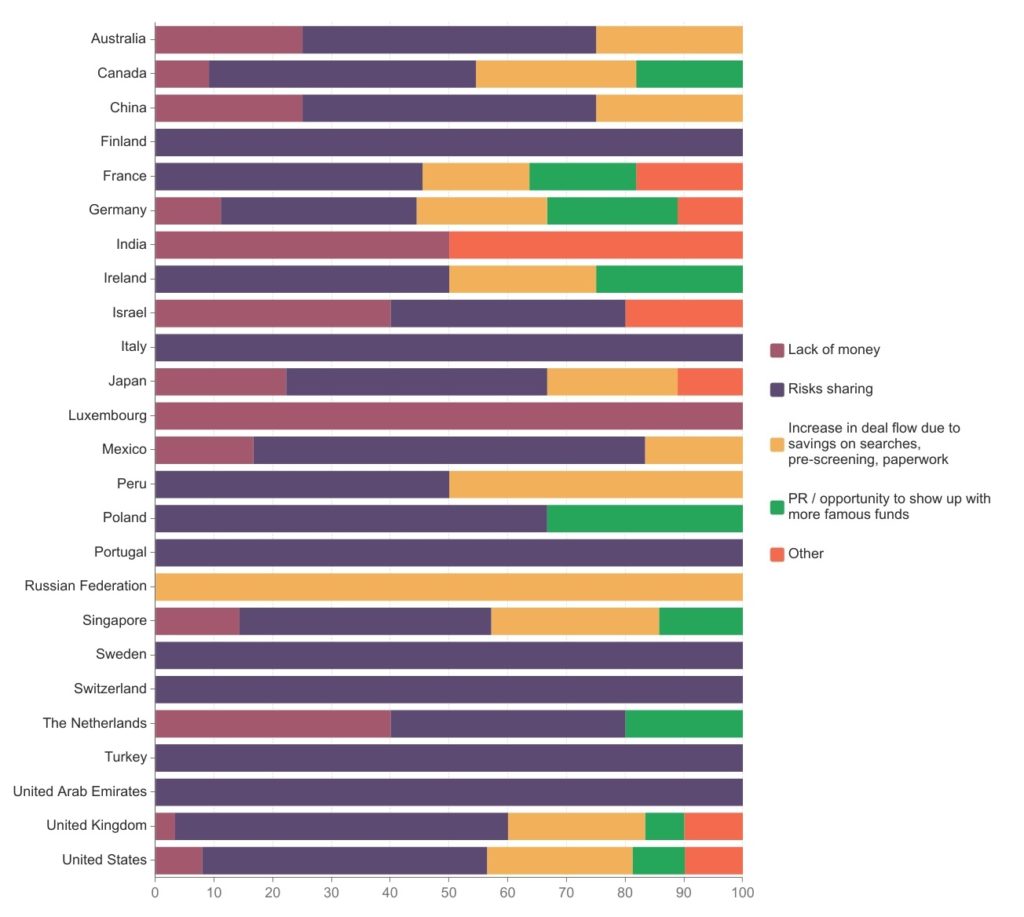

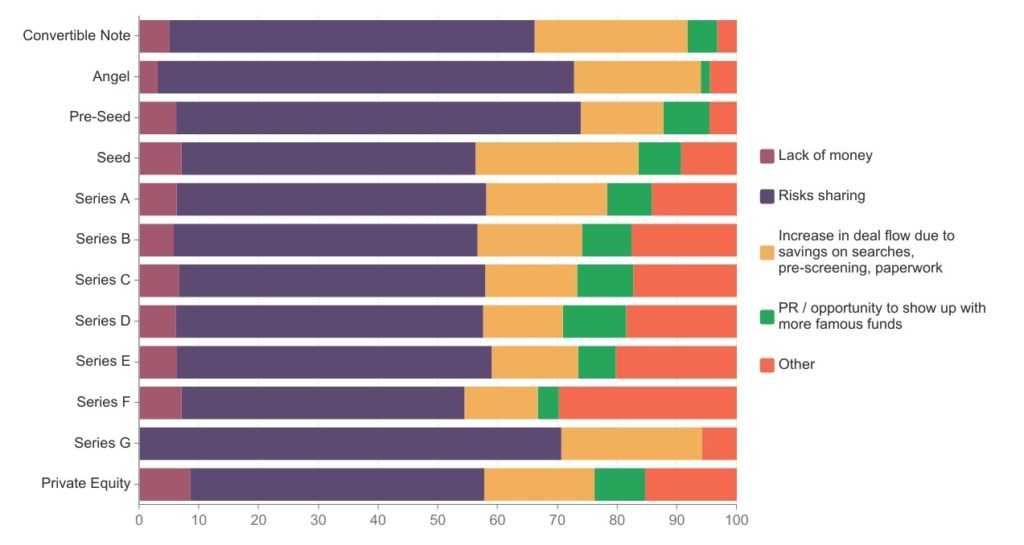

- The most popular reason for joining the syndicate was risk sharing – 49%. This answer is the most popular for respondents from the Middle East, North and Southern Europe. The reason for the increase in deal flow was noted by 20% of respondents. These are mainly funds with a focus on East and Southeast Asia. Other reasons (Lack of money, PR, Other) were chosen each by 10% of respondents;

- At different development stages of startups, PR and lack of money always occupy approximately the same shares. Risk sharing and increase in deal flow are reduced for more mature startups in favor of other reasons that were not suggested in the survey;

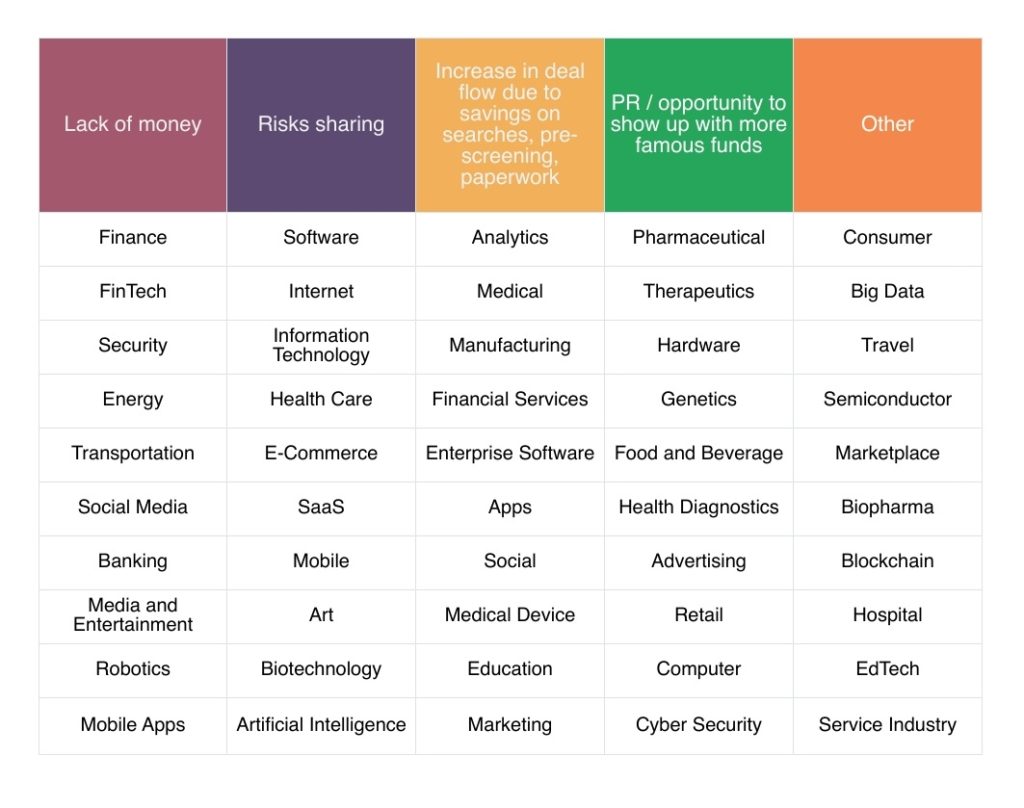

- Lack of money is the main reason for syndicating funds that invest in Finance and FinTech industries, Risk sharing for Software and Internet, Increase in deal flow for Analytics and Medical, PR for Pharmaceutical and Therapeutics, Other for Consumer and Big Data.

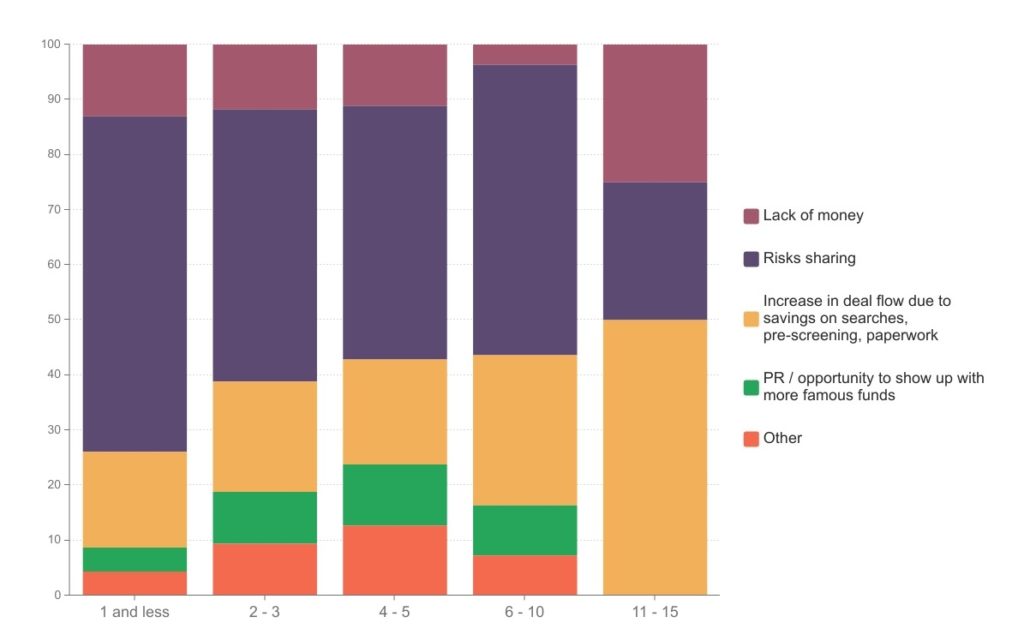

- More active investors are joining the syndicates primarily for Risk Sharing, least of all for PR. Funds that have unicorns in their portfolio differ in their selection of PR as the main reason for joining a syndicate.

- Most often, follow-on investments are made by those funds that enter into syndicates to increase deal flow. A similar situation is observed for funds that have the highest average portfolio age and the highest average exit age of portfolio companies.

Participation in a syndication deal: deep analysis

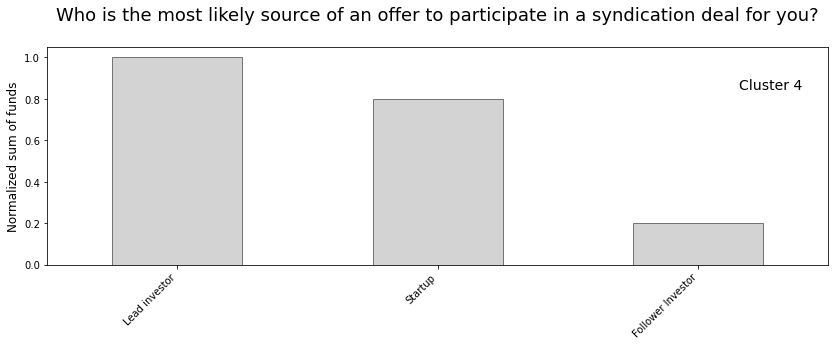

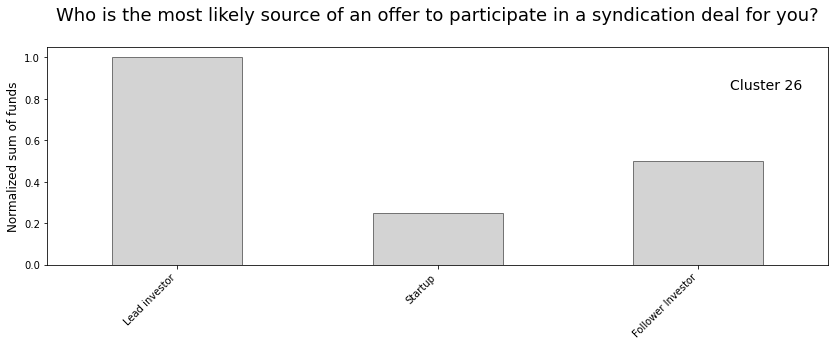

In terms of an offer to participate in a syndication deal, making offers is divided between the lead investor (79 of funds-respondents) and a startup itself (82 of funds-respondents). Only 14% of 26 funds-respondents answered that an offer came from a follower investor.

Geographically mostly all countries got funds that had an offer from all three – lead investor, a startup and the following investor, but there are some remarkable exceptions:

- Russian Federation, UAE and a major part of Chinese funds got offers only from follower investors;

- Italy, India, Luxembourg, Peru and Sweden funds have an offer only from the lead investor;

- Finland, Portugal, Switzerland and Turkey funds have an offer only from startups.

Top-3 industries to invest in for lead investors are Software, Biotech and Financial service, startups are Internet, E-commerce and Healthcare, and follower investor – Marketing, Finance, and Social.

In terms of age, a suggestion to participate comes from startups for companies with portfolios aged 0-10 years, while only lead and follower investors offer to participate in a startup aged 11-15 years. As for average investment round size, only startups and lead investors offer to participate in rounds over $100M, while follower investors prefer round sizes from $50-100M and $1-5M.

How lead investor covers an average round

When you hear about a lead fund, how much do you think it covers? 30%? 50%? 80%? The correct answer is “it depends on the geography, funding types, industries and other factors.”

A close look at data can tell us that among 210 funds, 17 covers below 20% being a lead investor, 77 covers from 20 to 40%, 80 funds cover 40-60%, 12 covers 60-80% and only two funds can invest above 80% of the round.

Those two funds are based in the United States and invest in local US startups. Italy, Luxemburg, Russian Federation and UAE always invest 20-40% of a lead investor’s round. Finland, Peru, Portugal, Sweden, and The Netherlands have the same situation, but with 40-60%. The only country funding no more than 20% is Turkey.

In terms of geo focus, startups based in Italy, Nigeria and Poland receive from a leading investor 20-40% of the total round; Australia, Finland, Portugal, Sweden and The Netherlands got 40-60%; other countries got a mashed mix from 20 to 80%.

Funding types or lead funds are connected with the percentage of coverage in a round, but there are similar features:

- lead investors with up to 20% in round usually invest on the angel, pre-seed and private equity stage;

- lead investors from 20% to 40% are mostly equally spread between all stages, except Series G, which got two times less than average;

- 40% to 60% are the most popular sum of a round in pre-seed, seed, Series G and private equity;

- over 80% are in the top on Series E, G and F.

The most popular industries for lead investors depends on a part of the total round covered. Top-10 industries can be found below, however, in all five groups, those industries do not duplicate.

Why funds join a syndication deal?

As we already mentioned, there are several reasons, but the most popular is risk-sharing. In this paragraph, additional reasons will be shown.

Here are the top-5 reasons from top to bottom:

- risk-sharing – 125 out of 210 respondents;

- increase in deal flow due to savings on searches, pre-screening, paperwork – 55 out of 210 respondents;

- lack of money – 27 out of 210 respondents;

- PR / opportunity to show up with more famous funds – 24 out of 210 respondents;

- other reasons – 22 out of 210 respondents;

Top risk-sharers are Finland, Italy, Portugal, Sweden, Switzerland, Turkey and UAE; top-3 PR-makers – Ireland, Poland and Germany; lack of money is a key reason only for Luxemburg, increase in deal flow due to savings on searches, pre-screening, paperwork is a key reason only for the Russian Federation.

Main investment geo focus of funds and their reasons to join a syndication deal is divided into the following groups:

- lack of money - Australia and The Netherlands;

- risk-sharing - Finland, Italy, Poland, Portugal and Sweden;

- other countries got melted reasons to be invested in with a syndicate.

Main funding types got an average assignment of all five reasons, except Series G, which don't have any lack o money and PR issues.

Top-3 industries with lack of money reasons are Finance, Fintech and Security, top-3 PR industries are Pharmaceutical, Therapeutics and Hardware; the most “risky” industries are Software, Internet and IT.

A correlation between risk-sharing and the age of a startup was found – the older the startup is, the less there is a risk-sharing factor for funds. At the same time, an aspect of savings on searches, pre-screening, paperwork increases with age.

Fund clusters: what are they and how they respond

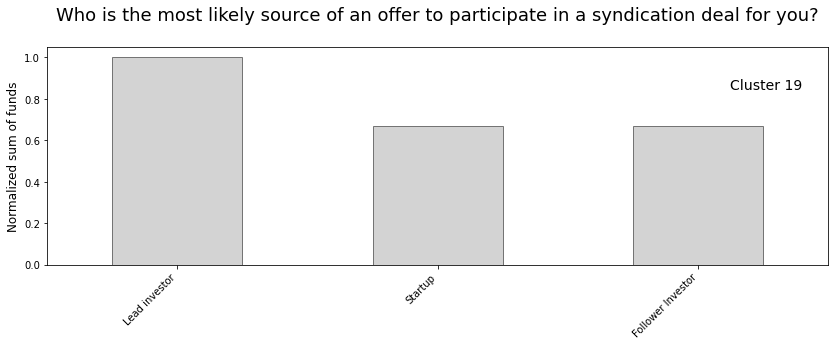

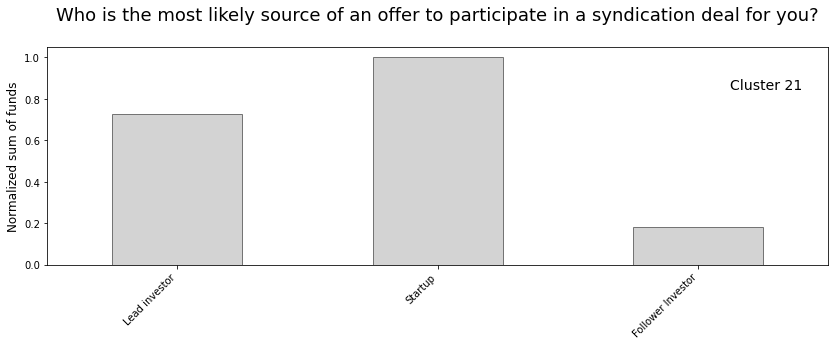

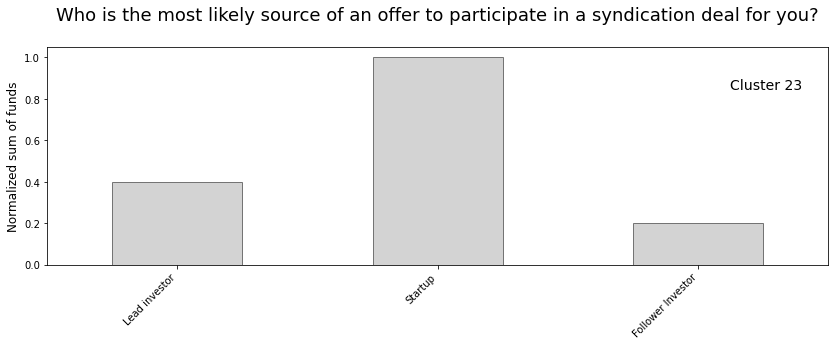

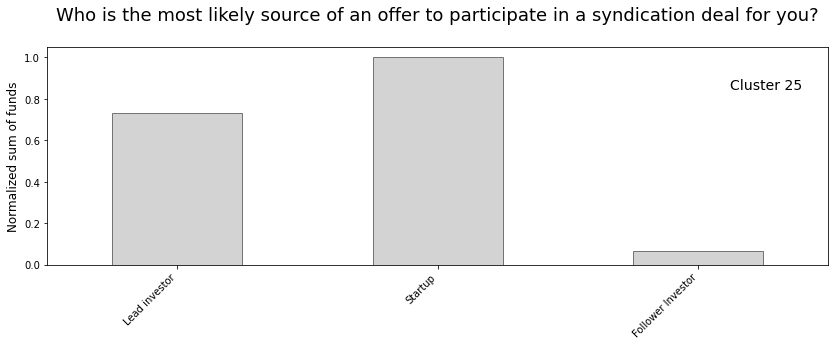

A preliminary cluster analysis was also conducted for better syndication understanding. By using 100 key indicators for funds, the researchers identified 28 clusters among 39,000 funds. 10 of 28 clusters will be described in more detail in order to share the information about characteristics of each of the significant clusters, the distribution of their responses regarding the forecast of the peak of the crisis, and the strategy regarding changes in the number of deals and the average check size.

The main features that describe this cluster are:

- Funds of the 4th cluster were founded in 1998 – 2001;

- Located mostly in North America;

- About 80% of them are Institutional VC;

- Speaking about investment geo focus, mostly there is a match between the country of their foundation and the country of their most frequent investments;

- Most preferred venture investment stages are Non-Equity Assistance, Early Stage, Late Stage;

- They would prefer Late-stage investment in rounds among Seed and Early stages;

- Such Funds have a long history of successful exits. Its number of exits have constantly increased since 2003 despite all the crises;

- The factor that distinguishes such funds from the others is that 2000 became a year with maximum deals for them. They had another peak in the number of deals in 2004 – 2008, but they have no such high activity in recent years.

The main features that describe this cluster are:

- The history on such Funds begins approximately in 1991 with peak of creation in 1998;

- Located mostly in Africa and South America;

- All of the Funds are Institutional VC;

- Regarding investment geo focus, there is a strong match between the country of their foundation and the country of their most frequent investments;

- Only 25% of these Funds Most are operative;

- Most preferred venture investment stage is Private Equity;

- Also, they would prefer Early-stage investment in rounds among Seed and Late stages; for such Funds, 2014 became the most thriving year in terms of the number of successful exits. But there are no other noticeable peaks or growth;

- Since 1999, these Funds have shown constant growth in the number of deals. They had the first peak in 2000, and the second peak was in 2017 that became a year with maximum deals. But during 2018-2019 the number of deals decreased by half;

- The Funds prefer to invest in Startups with an Average Startup Age about 6 years.

The main features that describe this cluster are:

- Funds of the cluster were founded in 2014 – 2016;

- Located mostly in Asia;

- All of them are Institutional VC;

- Speaking about investment geo focus, mostly there is a match between the country of their foundation and the country of their most frequent investments;

- All the Funds in this cluster are operative;

- Most preferred venture investment stages are Early Stage and NonEquity Assistance and Initial Coin Offering. They never take part in Grant stage;

- Also, they would prefer Early-stage investment in rounds among Seed and Late stages;

- Such Funds have a short history of successful exits. Most of the exits were performed in 2014, 2018 and 2019. 2018 became a year with maximum deals for them.

The main features that describe this cluster are:

- The history of such Funds begins approximately in 1983 and then have several peaks of creation in 2000, 2006 and 2013;

- Located mostly in North America;

- Half of them are Institutional VC;

- In regard to investment geo focus, mostly there is a match between the country of their foundation and the country of their most frequent investments;

- About 50% of such Funds in this cluster are operative;

- Most preferred venture investment stages are Debt Stage, Crowdfunding and Grant Stage;

- Also, they would prefer Seed-stage investment in rounds among Early and Late stages;

- For such Funds, 2018 and 2019 became the most thriving years in terms of the number of successful exits. Also, they stood out in 2010 and 2011 as having more successful exits than other funds;

- Since 2009, these Funds have shown constant growth in the number of deals till 2015, which became a year with maximum deals. They had another peak of the number of deals in 2018;

- Have the highest average number of deals in 2018 and 2019 among the other clusters which is more than 10 when other clusters have less than 6.

The main features that describe this cluster are:

- Located mostly in Australia and South America;

- Neither of them are Institutional VC;

- Speaking about investment geo focus, in more than 50% cases there is no match between the country of their foundation and the country of their most frequent investments;

- Most preferred venture investment stages are Seed and Grant;

- For such Funds, 2014 became the most thriving year in terms of the number of successful exits, but there are no other noticeable peaks or growth;

- Since 2010, these Funds have shown constant growth in the number of deals till 2015, which became a year with maximum deals. But after this year there is a noticeable decline;

- Have the biggest average group size during a round which is equal to 5;

- Their amount of Average Round is one of the smallest and is close to $7.7М.

The main features that describe this cluster are:

- Noticeable growth of such funds began in 1993 and have had several peaks of creation in 2000, 2006 and 2015;

- Located mostly in North America;

- Half of them are Institutional VC;

- In regard to investment geo focus, mostly there is a match between the country of their foundation and the country of their most frequent investments;

- About 75% of such Funds in this cluster are operative;

- Most preferred venture investment stages are Secondary Market, Private Equity and Post-IPO Stage;

- Also, they would prefer Early and Late-stage investment in rounds rather than Seed Stage;

- Such Funds demonstrate stability in the growth of the number of successful exits since 2014. The year with maximum successful exits is 2019;

- Since 2013, these Funds have shown constant growth in the number of deals. 2019 became a year with maximum deals;

- The Funds prefer to invest in Startups with an Average Startup Age of about 6.88 years.

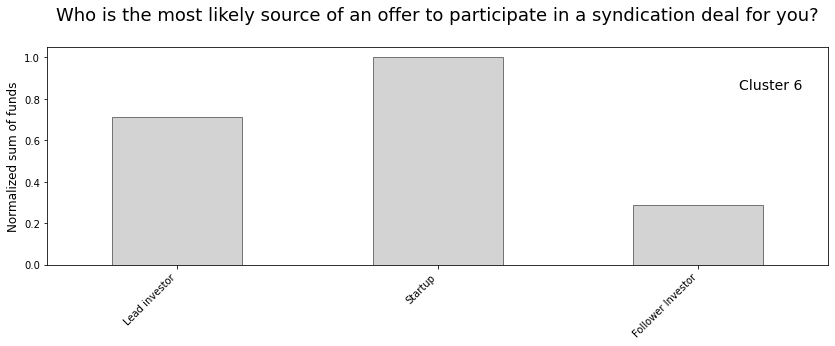

The main features that describe this cluster are:

- The first peak of creation of such Funds was in 1999-2000 and then in 2011-2015;

- Located mostly in Europe and South America;

- More than half of them are Institutional VC;

- Speaking about investment geo focus, for about 50% of funds there is a match between the country of their foundation and the country of their most frequent investments;

- About 75% of such Funds in this cluster are operative;

- Most preferred venture investment stages are Convertible Note, Seed, and Early Stage;

- Also, they would prefer Seed-stage investment in rounds among Early and Late ones;

- Such Funds demonstrate stability in the growth of the number of successful exits since 2014. The year with maximum successful exits was 2019;

- Since 2013, these Funds have shown constant growth in the number of deals. 2018 became a year with maximum deals;

- The average number of Lead Investments among such Funds is 15.42, that is the second-largest amount after Cluster #15.

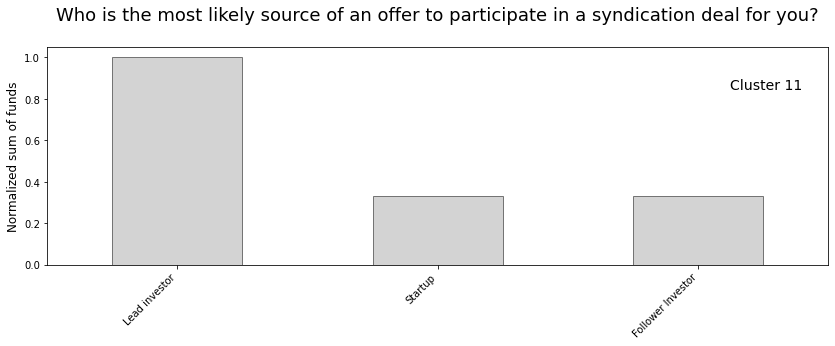

The main features that describe this cluster are:

- Noticeable growth of such funds began in 1990 with peaks of creation in 1998;

- Located in Europe;

- Less than 20% of them are Institutional VC;

- Speaking about investment geo focus, there is a match between the country of their foundation and the country of their most frequent investments;

- They would prefer Early and Late-stage investment in rounds than Seed one;

- For such Funds, 2014 became the most thriving year in terms of the number of successful exits;

- They had the first peak in the number of deals in 2000. Since 2012, these Funds have shown constant growth in the number of deals and 2018-2019 became the years with maximum deals for them;

- They have one of the highest Average portfolio exit age of 9.08 years.

- The indicator of “Lead investments, difference in percentage points from the average” is close to 0.

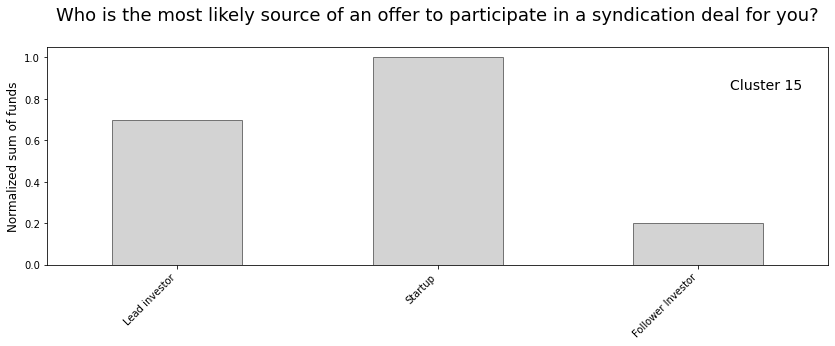

The main features that describe this cluster are:

- Noticeable growth of such funds began in 2003 with peaks of creation in 2015;

- Located in North America;

- All of them are Institutional VC;

- Speaking about investment geo focus, there is a match between the country of their foundation and the country of their most frequent investments;

- All Funds in this cluster are operative;

- Most preferred venture investment stages are Non-Equity Assistance, Convertible Note, Early Stage, and also Initial Coin offering;

- Also, they would prefer Seed and Early-stage investment in rounds;

- Such Funds demonstrate stability in the growth of the number of successful exits since 2014. The year with maximum successful exits was 2019;

- Since 2011, these Funds have shown consistent growth in the number of deals. 2018 became a year with maximum deals;

- The Funds prefer to invest in Startups with an Average Startup Age of about 3.58 years, which is the lowest level among the other clusters;

- The average Round for such Funds is $9M which is the lowest value among the other clusters.

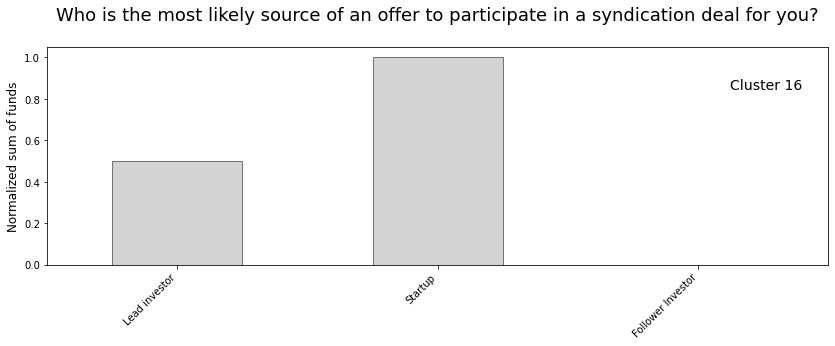

The main features that describe this cluster are:

- Noticeable growth of such funds began in 1984 with peaks of creation in 1999, 2005 and 2014;

- Located mostly in Asia;

- Mostly they are not Institutional VC;

- Regarding investment geo focus, mostly there is no match between the country of their foundation and the country of their most frequent investments.;

- About 75% of such Funds in this cluster are operative;

- They never take part in the Non-Equity Assistance venture investment stage;

- Also, they would prefer Late-stage investment in rounds among Early or Seed ones;

- Such Funds demonstrate stability in the growth of the number of successful exits since 2014. The year with maximum successful exits was 2019;

- Since 2015, these Funds have shown constant growth in the number of deals. 2019 became a year with maximum deals;

- Average Round for such Funds is $87M which is the highest value among the other clusters;

- Have the highest average valuation of portfolio Startups which equals $1.3B.

Practical advice from Unicorn Nest research

After a detailed analysis of all 33 features about sources of offers to participate in a syndication deal, special attention should be paid to the industry focus on Sports, which increases the probability of choosing a lead investor as the main source. At the same time, industry focus on Industrial Manufacturing will increase the probability of choosing startups as the main source. Despite mentioned data, an industry focus on Infrastructure will lead to follower investors as the most popular option.

Among the 58 variables that in one way or another affect the most common reason for joining a syndication deal, having 2012 as a year with maximum successful exits should be taken into account.

The strongest correlations between responses about the source of an offer to participate and the Most common reasons for joining a syndication deal are:

- offer from startups and because of risk sharing (positive correlation), offers from the lead investor and because of risk;

- sharing (negative correlation), offers from follower investors and because of lack of money (positive correlation).

The strongest correlations between responses about source of an offer to participate in a syndication deal and part of the total round usually covered by the lead investor are:

- offer from startup and lead investor covers more than 80% (positive correlation);

- offer from follower investor and lead investor covers 40-60% (positive correlation),

- offer from follower investor and lead investor covers 60-80% (negative correlation).

The strongest correlations between responses about the most common reasons for joining a syndication deal and part of the total round usually covered by the lead investor are: because of increase in deal flow and lead investor covers 60-80% (negative correlation), because of risk sharing and lead investor covers less than 20% (positive correlation), because of PR and lead investor covers 60-80% (negative correlation).

To receive a research presentation click here.