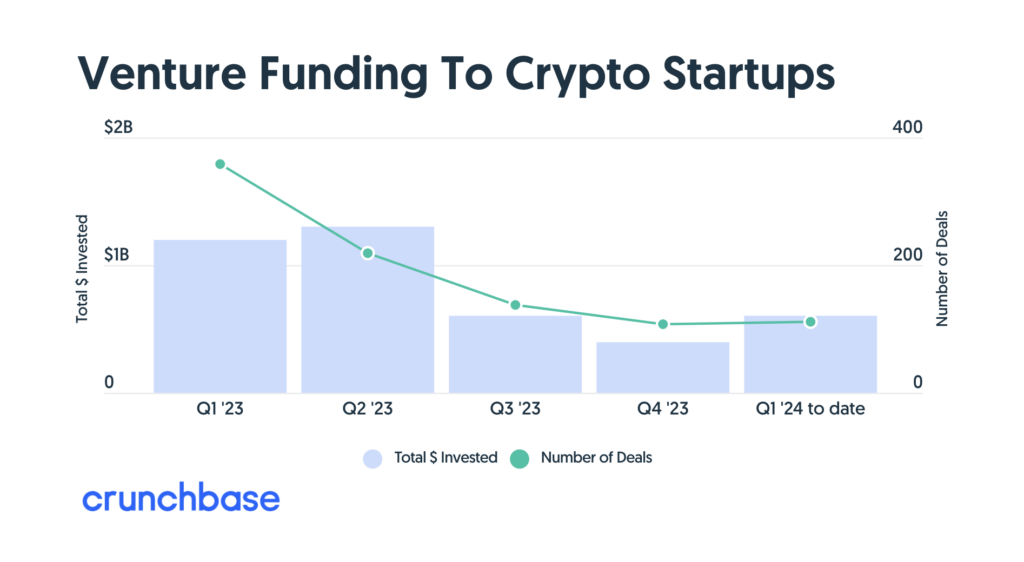

In the ever-evolving landscape of cryptocurrency and blockchain technology, the beginning of 2024 has marked a notable uptick in venture capital (VC) investment within the sector. According to recent data from Crunchbase, crypto startups have raised an impressive $625 million through 111 deals so far this quarter. This marks a significant increase from the $446.3 million secured in Q4 2023, highlighting a resurgence of investor confidence and interest in the crypto space.

A Comparative Look at Funding Trends

Reflecting on the previous year, crypto startups amassed $3.6 billion across 821 deals. When compared to the $16.2 billion raised in 2022, it's clear that 2023 experienced a substantial 78% decline in funding. This downturn was largely influenced by the fallout of the FTX collapse and a general slump in VC funding across all sectors. Despite these challenges, the current quarter has seen noteworthy funding rounds, including Freechat's $80 million Series A, Flowdesk's $50 million Series B, and Sygnum's $40.6 million funding rounds, signaling a positive shift in investor sentiment.

Regulatory Developments Spur Optimism

A significant factor contributing to the renewed interest in crypto investments is the regulatory clarity emerging from the U.S. Securities and Exchange Commission's (SEC) decision to allow exchange-traded funds (ETFs) to trade digital currencies. Since this announcement, the top nine leading Bitcoin ETFs have attracted approximately $10 billion from investors, underscoring the potential for growth and innovation within the sector. This regulatory milestone has been pivotal in stabilizing the market and encouraging more strategic investments in crypto startups.

Future Outlook and Cautionary Advice

Despite the current surge in VC funding for crypto startups, industry experts, including Telstra Ventures' general partner Yash Patel, urge caution. Patel notes, "I don't think you'll see a big uptick in investment this year, but 2025 could be bigger." This perspective suggests that while the immediate future shows promise, the crypto sector's investment landscape will continue to evolve, with more significant growth potentially on the horizon in 2025.

Conclusion

As we navigate through 2024, the crypto sector stands at a crossroads of opportunity and scrutiny. The increase in VC funding in the early months of the year is a positive indicator of the sector's resilience and potential. However, the road ahead will require careful navigation, balancing optimism with a strategic approach to investing. As regulatory environments continue to develop and investors become more discerning, the crypto startup ecosystem is poised for a journey of growth, innovation, and perhaps, more stable funding cycles.