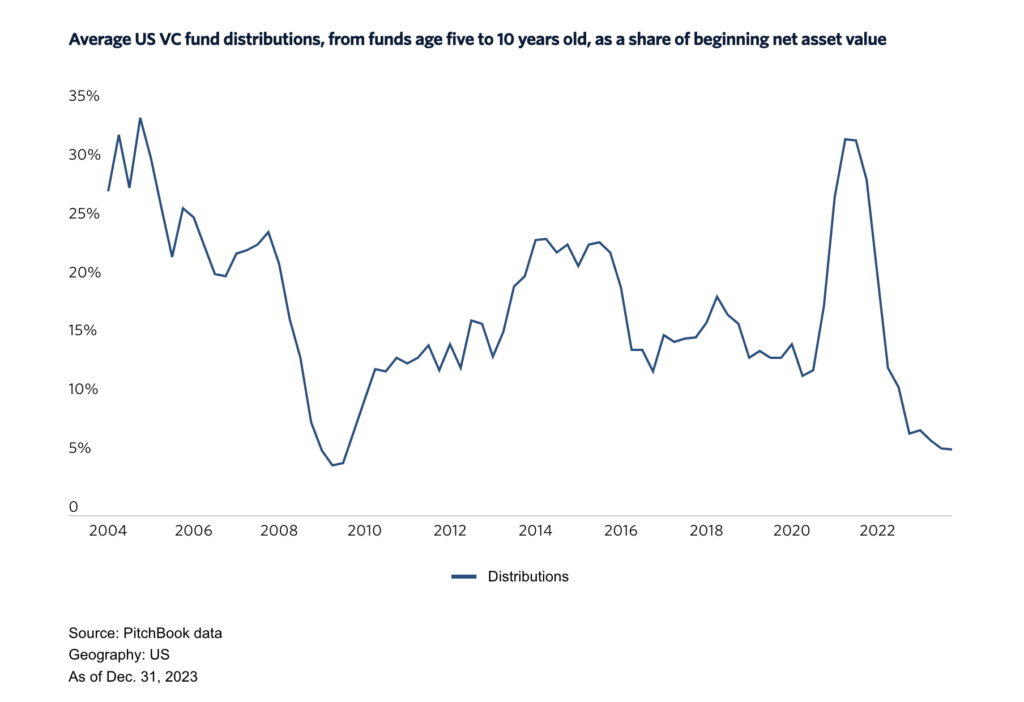

In Q4 2023, the income distributed by US venture capital funds to LPs fell to its lowest level in 14 years.

The peak value was 32% in Q2 2022. Since then, the average distribution of US venture capital funds has been declining every quarter. The exception was a slight increase in Q1 2023.

The main reason for the drop in yields is the lack of exit options. This directly affects the balance of funds that can be reinvested in other venture funds. With such results, LPs are less inclined to invest in new structures and venture capital companies with a poor history of profitability. Preference is given to funds with high DPI and a long history.

The increase in the number of IPOs projected for 2024 should help improve the situation.