As the crypto market basks in the warmth of a bullish Bitcoin rally, venture capital (VC) firms are scrambling to raise new funds in a bid to capitalize on the burgeoning momentum. However, their efforts are being met with a lukewarm reception from limited partners (LPs), who remain wary of the industry's tumultuous past and the hard-learned lessons of recent implosions like Three Arrows Capital and FTX.

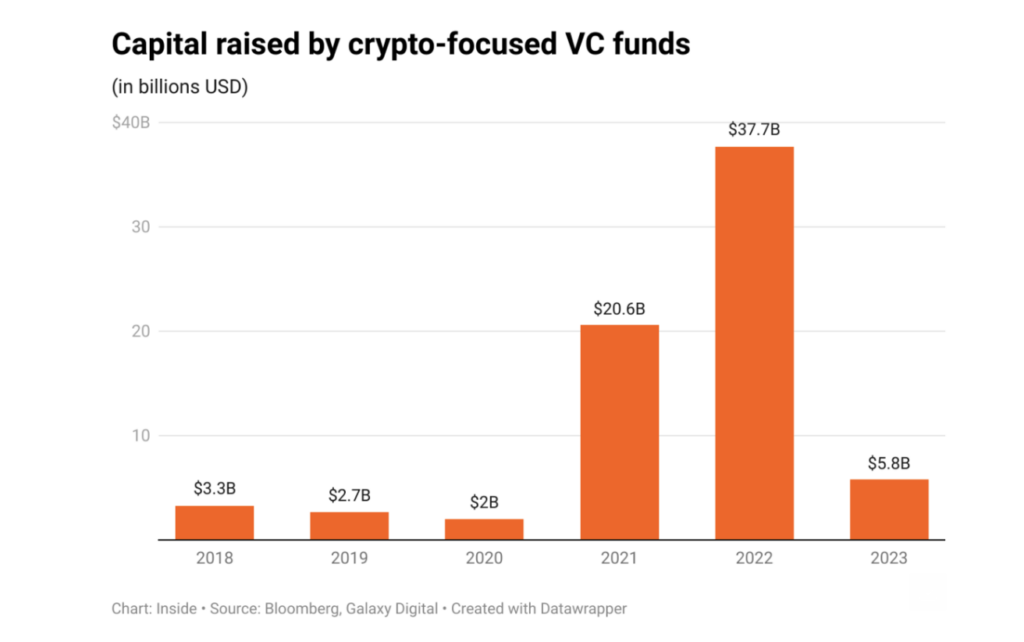

According to data from Galaxy Digital, crypto-focused VCs raised a respectable $5.8 billion in funds last year. However, this figure pales in comparison to the staggering $20 billion and $38 billion raised in 2021 and 2022, respectively, highlighting the industry's precipitous fall from grace and the lingering skepticism that hangs over it.

Compounding the challenge for crypto-focused VCs is the crowded market landscape, where differentiation is an increasingly elusive pursuit. Ray Hindi, managing partner at L1 Digital AG, aptly summarizes the conundrum: "Too many venture capital firms in the space are raising at the moment, and the competition is really high, but the demand isn't as strong as it once was, so they are struggling."

Despite the current market hype, the actual distributed to paid-in capital (DPI) metric for many funds with a 2021 vintage remains stubbornly at zero. This stark reality has put immense pressure on funds to deliver tangible DPI returns, with some LPs expecting payouts by the end of 2024. LPs, weary of simply riding the wave of rising paper valuations fueled by the market rally, are increasingly scrutinizing funds' ability to generate actual payouts.

As the crypto industry navigates this precarious landscape, VC firms find themselves caught in a catch-22: While the allure of capitalizing on the market's bullish trajectory is undeniable, the skepticism of LPs, informed by past missteps and unfulfilled promises, creates a formidable barrier to raising the necessary funds.

The path forward for crypto VCs is fraught with challenges, but those who can successfully navigate the treacherous waters of LP scrutiny and market volatility may emerge as the industry's prized navigators, guiding the way to a more sustainable and profitable future for all stakeholders.