FREE Investor Database

Top Venture Investors in United States 2025 | Unicorn Nest Directory

Top Venture Investors in United States 2025 | Unicorn Nest Directory

Browse verified VC and CVC firms funding startups in United States. Discover your ideal investor match and find contacts of the right investors on Unicorn Nest.

Intro

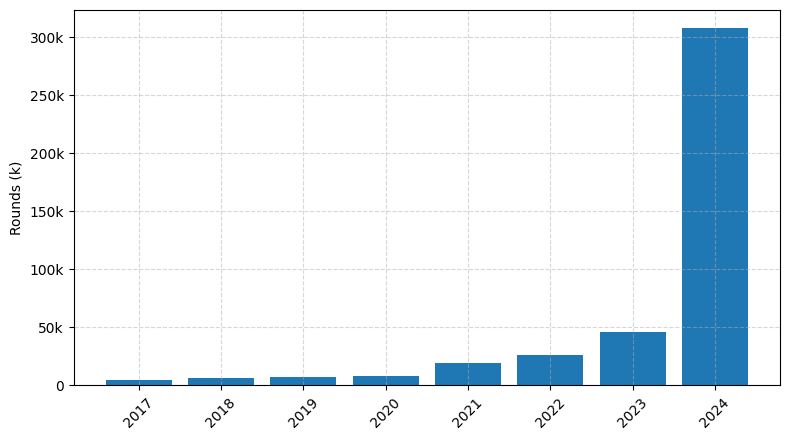

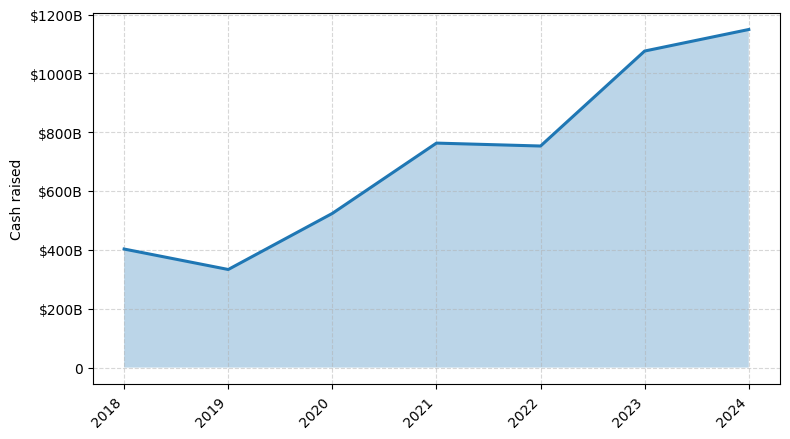

The United States has long been a hub for venture capital (VC) investment, and the past three years have been no exception. Since 2022, the VC landscape has continued to evolve, with a significant increase in the number of funding rounds and the total amount of capital invested.

According to industry reports, the US witnessed over 30,000 venture capital rounds in the last three years, with a total investment exceeding $500 billion. Some of the notable startups that received substantial funding during this period include Instacart, which raised $265 million in 2022, and Stripe, which secured a $600 million investment in 2021.

The top venture capital funds in the US include Andreessen Horowitz, Sequoia Capital, and Kleiner Perkins, each with a proven track record of identifying and supporting innovative companies. These funds have played a crucial role in shaping the startup ecosystem and driving economic growth in the country.

In summary, the US venture capital market has remained robust, with a surge in investment activity and the emergence of groundbreaking startups that are poised to transform various industries.

According to industry reports, the US witnessed over 30,000 venture capital rounds in the last three years, with a total investment exceeding $500 billion. Some of the notable startups that received substantial funding during this period include Instacart, which raised $265 million in 2022, and Stripe, which secured a $600 million investment in 2021.

The top venture capital funds in the US include Andreessen Horowitz, Sequoia Capital, and Kleiner Perkins, each with a proven track record of identifying and supporting innovative companies. These funds have played a crucial role in shaping the startup ecosystem and driving economic growth in the country.

In summary, the US venture capital market has remained robust, with a surge in investment activity and the emergence of groundbreaking startups that are poised to transform various industries.

98 active VC investors in United States

In the past three years, the US venture capital landscape has seen significant activity, with leading firms like Andreessen Horowitz, Sequoia Capital, and Kleiner Perkins investing in a wide range of startups. One notable example is Instacart's $600 million Series H round in 2021, which was one of the largest venture capital deals in recent years. This late-stage investment, led by Andreessen Horowitz, aimed to support Instacart's growth in the rapidly expanding online grocery delivery industry, showcasing the continued interest of top VC firms in disruptive technologies and innovative business models.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zynext Ventures | healthcare, biotech | Series A, Seed, Series B | |||

| ZX Ventures | beverage, direct to consumer, circular ventures, future of socializing | Seed, Series C, Series A, Series B | |||

| Zorax Capital | blockchain | ||||

| Zoom Apps Fund | customers | United States; Israel | Seed, Series A, Series B | ||

| Zoma Capital | early childhood development, workforce, community economic development, water and energy | Generalist | |||

| Zoic Capital | healthcare, life science, med-tech, biotech | United States | Seed, Pre-Seed, Series A | ||

| ZMT Capital | web 3.0 | Generalist | Seed | ||

| Zillionize | enterprise software | United States | Seed | ||

| Zigg Capital | real estate | Generalist | Seed | USD 225000000 | |

| Zetta Venture Partners | enterprise, data, ai | Canada; United States; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Seed, Pre-Seed | USD 100000000 |

95 active CVC investors in United States

Active corporate venture capital firms in the U.S. have been investing heavily in emerging technologies, with a focus on sectors like fintech, healthcare, and sustainability. Notable deals include Walmart's investment in Cruise, the self-driving car company, and Microsoft's backing of OpenAI, the artificial intelligence research lab.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zynext Ventures | healthcare, biotech | Series A, Seed, Series B | |||

| ZX Ventures | beverage, direct to consumer, circular ventures, future of socializing | Seed, Series C, Series A, Series B | |||

| Zoom Apps Fund | customers | United States; Israel | Seed, Series A, Series B | ||

| Zeon Ventures | sustainable, healthy, sustainable planet, human health, amplified intelligence, materials, sustainability, climate, health | Series A, Seed, Series B | |||

| Yamaha Motor Ventures & Laboratory Silicon Valley | transportation, robotics, digital health, wellness, fintech, insurtech, data, ai, agriculture, carbon management, removal, energy, advanced materials | France; United States; Canada | Seed | ||

| Xerox Ventures | Seed | ||||

| WRF Capital | life sciences, biotechnology, pharmaceuticals, medical devices and digital health, enterprise software, advanced materials, scientific instrumentation | United States, District of Columbia, Washington | Seed | ||

| Wormhole Capital | Series A, Seed, Series B, Series C | ||||

| Workday Ventures | financial management, human capital, planning, analytics, collaboration, productivity, intelligent automation, mixed reality, blockchain | Series D, Series A, Series E, Series F, Series B, Series C | |||

| Wipro Ventures | industrial internet of things, conversational ai, sd wan, cybersecurity, analytics | United States; Israel | Seed |