FREE Investor Database

Top investors in United Kingdom

Top investors in United Kingdom

Discover investors with active investments in 2025

Intro

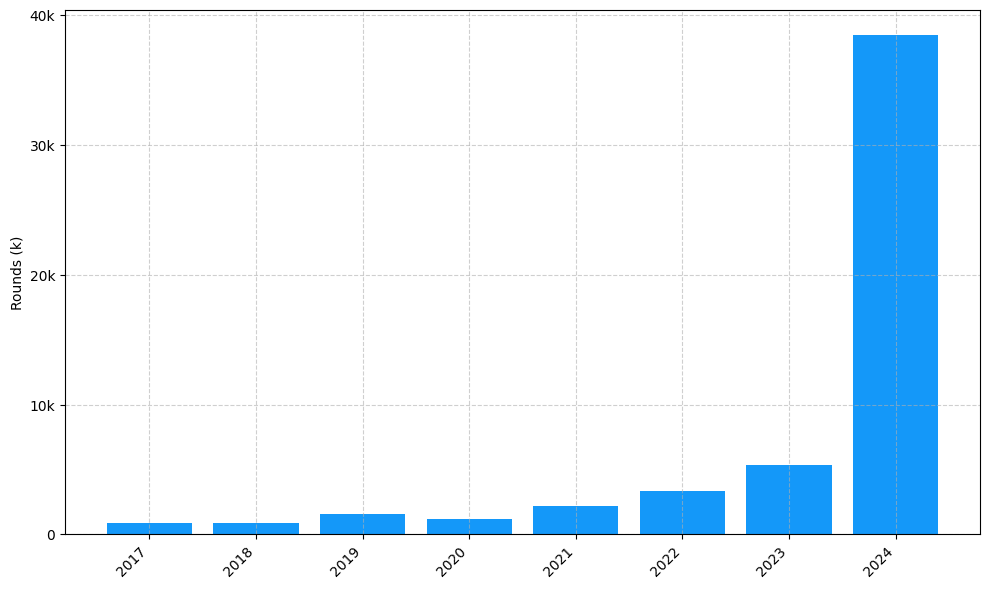

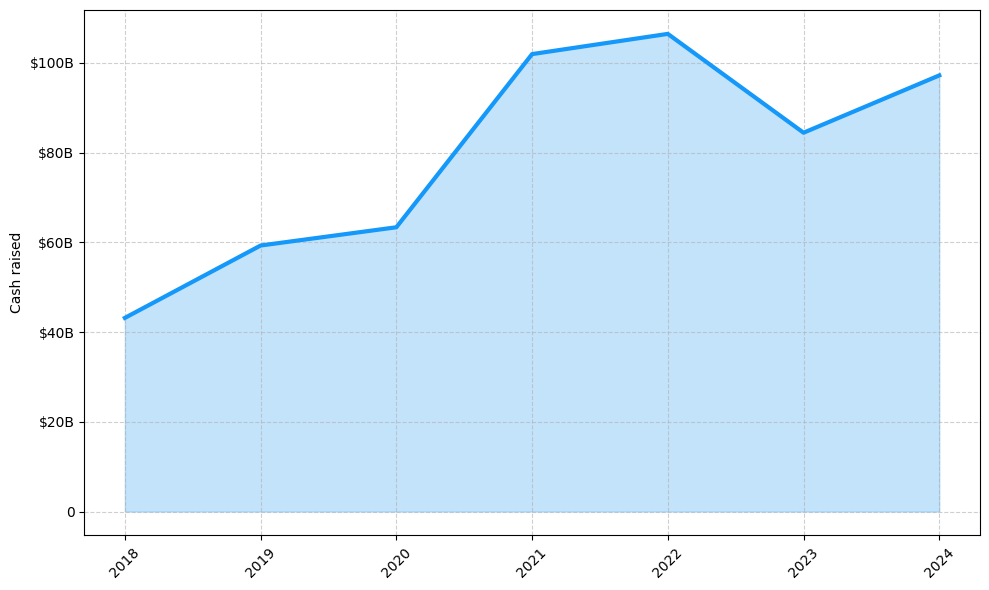

The United Kingdom has long been a hub for venture capital (VC) investment, and the past three years have been no exception. Since 2022, the UK has witnessed a surge in VC activity, with a record number of funding rounds and significant capital injections into the country's thriving startup ecosystem.

According to industry data, the UK has seen over 3,000 venture capital rounds in the last three years, with a total investment value exceeding £30 billion. Some of the notable startups that have received substantial VC funding during this period include Revolut, a leading fintech company, Graphcore, a pioneering AI chip maker, and Cazoo, an online used car retailer.

The UK's VC landscape is dominated by prominent funds such as Accel, Index Ventures, and Balderton Capital, which have consistently backed the country's most promising tech startups. These funds have played a crucial role in fueling the growth and innovation that has made the UK a global leader in the startup and VC space.

In summary, the UK's venture capital landscape has experienced a remarkable period of growth and investment, solidifying its position as a premier destination for entrepreneurs and investors alike.

According to industry data, the UK has seen over 3,000 venture capital rounds in the last three years, with a total investment value exceeding £30 billion. Some of the notable startups that have received substantial VC funding during this period include Revolut, a leading fintech company, Graphcore, a pioneering AI chip maker, and Cazoo, an online used car retailer.

The UK's VC landscape is dominated by prominent funds such as Accel, Index Ventures, and Balderton Capital, which have consistently backed the country's most promising tech startups. These funds have played a crucial role in fueling the growth and innovation that has made the UK a global leader in the startup and VC space.

In summary, the UK's venture capital landscape has experienced a remarkable period of growth and investment, solidifying its position as a premier destination for entrepreneurs and investors alike.

98 active VC investors in United Kingdom

In the past three years, the UK's venture capital landscape has seen significant activity, with leading firms like Sequoia Capital, Accel, and Index Ventures investing in a range of innovative startups. One notable example is Revolut, a fintech unicorn that raised a $800 million Series E round in 2021, making it one of the largest venture capital deals in the UK during this period. The funding, led by SoftBank and Tiger Global, will enable Revolut to accelerate its global expansion and further develop its financial services platform. This investment highlights the UK's thriving startup ecosystem and the continued interest from top-tier venture capital firms.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Atempo Growth | Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Series A, Series B, Series C, Series D, Pre-IPO | USD 300000000 | ||

| Common Magic | community | United States | Pre-Seed, Seed | GBP 10000000 | |

| Innvotec | fintech, healthtech, consumertech, cleantech, digital transformation | United Kingdom; Canada; United States | Series A, Series B | ||

| Low Carbon Innovation Fund | clean transport, renewable energy, energy storage, efficiency, hydrogen, carbon capture, sustainable agriculture, advanced materials, internet of things, recycling, smart grids, resource management. | ||||

| Pallinghurst | metals, mining | ||||

| Block Rock Capital | |||||

| Pente Capital | wireframes, code, physical products, ideas | United Kingdom | Seed | ||

| Martlet | United Kingdom | Pre-Seed, Seed | |||

| Enterprise Equity | Ireland | Seed, Series A, Series B, Series C, Series D, Series E | |||

| Astel Ventures |

48 active CVC investors in United Kingdom

Active corporate venture capital firms in the UK have been investing heavily in innovative startups across various sectors. In the last 3 years, these firms have backed disruptive technologies, with a notable deal being Tesco's investment in online grocery platform Ocado, which has transformed the UK's retail landscape.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Aviva Ventures | data, ai, open finance, wellbeing, mobility, insurtech, fintech | Seed | |||

| Pacific & Orient Properties | Series A, Series B | ||||

| Mercuri | United Kingdom | Seed | |||

| Christie's Ventures | fintech, Web3, AI, Hardware | United States | Series A, Series B | ||

| UK Infrastructure Bank | clean energy, transport, digital, water, waste | ||||

| Foresight WAE Technology Funds (FWT) | technology innovation, engineering innovation | United Kingdom | Series A, Series B | ||

| Man Capital | education, healthcare, logistics, renewable energy, real estate, technology, telecommunications, sport | ||||

| Mishcon de Reya | legaltech | Generalist | Seed, Pre-Seed | ||

| BBC Ventures | media, content | ||||

| Boost Fund | United Kingdom | Pre-Seed, Seed |