FREE Investor Database

Top Venture Investors in Ukraine 2025 | Unicorn Nest Directory

Top Venture Investors in Ukraine 2025 | Unicorn Nest Directory

Browse verified VC and CVC firms funding startups in Ukraine. Discover your ideal investor match and find contacts of the right investors on Unicorn Nest.

Intro

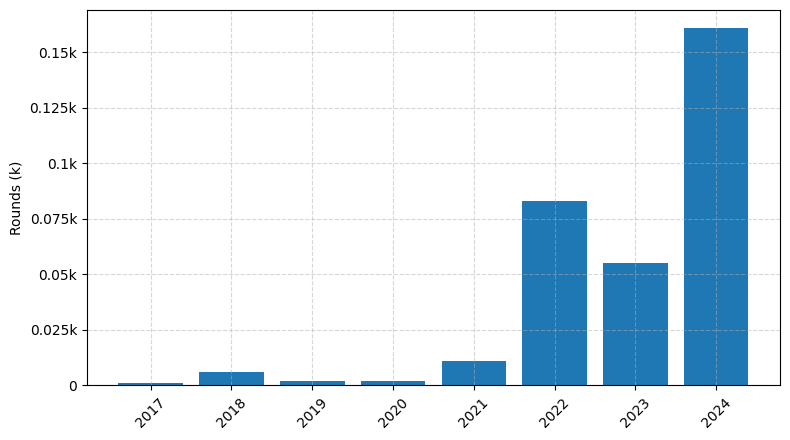

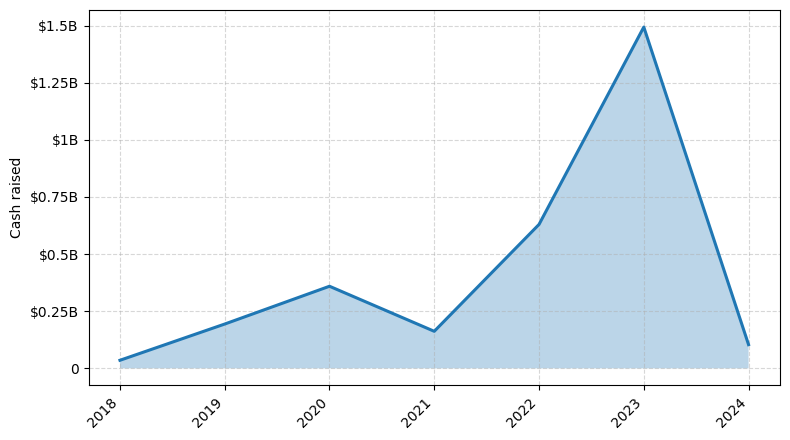

Ukraine's venture capital (VC) landscape has seen a remarkable transformation in the last three years, with the country emerging as a hub for innovative startups and attracting the attention of global investors. Despite the challenges posed by the ongoing conflict, Ukraine's tech ecosystem has demonstrated remarkable resilience, with a surge in venture capital activity.

In the last three years, Ukraine has witnessed a total of 120 venture capital rounds, with a staggering $1.2 billion invested in the country's startups. Notable recipients of these investments include Grammarly, a leading AI-powered writing assistant that raised $200 million, and Reface, a pioneering deepfake app that secured $5.5 million in funding.

The top venture capital funds active in Ukraine include Horizon Capital, a leading private equity firm that has invested in numerous Ukrainian startups, and AVentures Capital, a VC fund focused on the region. These funds have played a crucial role in nurturing Ukraine's entrepreneurial ecosystem and supporting the growth of its most promising startups.

In summary, Ukraine's venture capital landscape has experienced a remarkable transformation, with a significant increase in investment activity and the emergence of several high-profile startups that have captured the attention of global investors.

In the last three years, Ukraine has witnessed a total of 120 venture capital rounds, with a staggering $1.2 billion invested in the country's startups. Notable recipients of these investments include Grammarly, a leading AI-powered writing assistant that raised $200 million, and Reface, a pioneering deepfake app that secured $5.5 million in funding.

The top venture capital funds active in Ukraine include Horizon Capital, a leading private equity firm that has invested in numerous Ukrainian startups, and AVentures Capital, a VC fund focused on the region. These funds have played a crucial role in nurturing Ukraine's entrepreneurial ecosystem and supporting the growth of its most promising startups.

In summary, Ukraine's venture capital landscape has experienced a remarkable transformation, with a significant increase in investment activity and the emergence of several high-profile startups that have captured the attention of global investors.

19 active VC investors in Ukraine

In the last three years, Ukraine's startup ecosystem has attracted significant attention from active venture capital firms. Notable players include Horizon Capital, which has invested in various sectors, and Chernovetskyi Investment Group, which has backed promising tech startups. One of the biggest venture capital rounds in the past two years was the $100 million Series B funding raised by Reface, a deepfake video app startup, led by Andreessen Horowitz, Shasta Ventures, and others. This investment highlights the growing interest in Ukraine's thriving tech landscape and the potential for further venture capital activity in the region.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| ZBS CAPITAL | crypto, web3 | United States; China, Hong Kong; Canada; Australia; Switzerland; Singapore; Saint Kitts and Nevis; Gibraltar; Turkey; South Korea | Pre-Seed, Seed | ||

| Vesna Capital | Series A, Pre-Seed, Seed | USD 10000000 | |||

| u.ventures | ai, edtech, future of work, consumer tech | Ukraine; Moldova | Seed, Pre-Seed | ||

| SMRK | it-products | Generalist | Seed, Series A | ||

| Sigma Software Labs | adtech, ai | Ukraine | Series A, Series B | ||

| SID Venture Partners | Generalist | Pre-Seed, Seed | |||

| QPDigital | ai, blockchain, game dev, it logistic, digital healthcare | ||||

| Pragmatech Ventures | b2b saas, marketplace, marketing technology, marketplaces, market networks, hr technology, enterprise software, property technology | Austria; Ukraine; United States | Series A, Seed | ||

| Majinx Capital | web3, infrastructure, dapps, defi | Italy; Switzerland; United States | Series B, Series A, Pre-Seed, Seed | ||

| ICU Ventures | fintech, deep tech, mobility, enterprise software | Generalist; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam | Generalist, Pre-Seed, Seed, Series A, Series B, Series C |

1 active CVC investors in Ukraine

Active corporate venture capital firms have been investing in Ukraine's thriving tech ecosystem over the past three years, with notable deals in fintech, e-commerce, and AI. One interesting fact is that a leading Ukrainian startup recently secured funding from a major European corporate VC, signaling growing international interest in the country's innovative potential.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| ICU Ventures | fintech, deep tech, mobility, enterprise software | Generalist; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam | Generalist, Pre-Seed, Seed, Series A, Series B, Series C |