FREE Investor Database

Top Venture Investors in Turkey 2025 | Unicorn Nest Directory

Top Venture Investors in Turkey 2025 | Unicorn Nest Directory

Browse verified VC and CVC firms funding startups in Turkey. Discover your ideal investor match and find contacts of the right investors on Unicorn Nest.

Intro

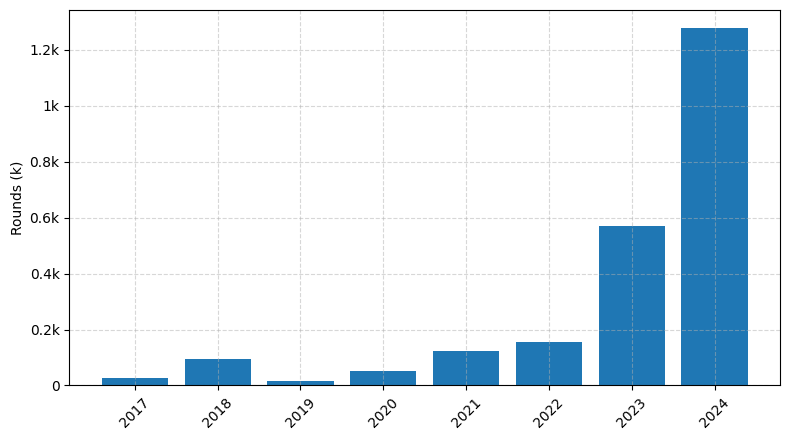

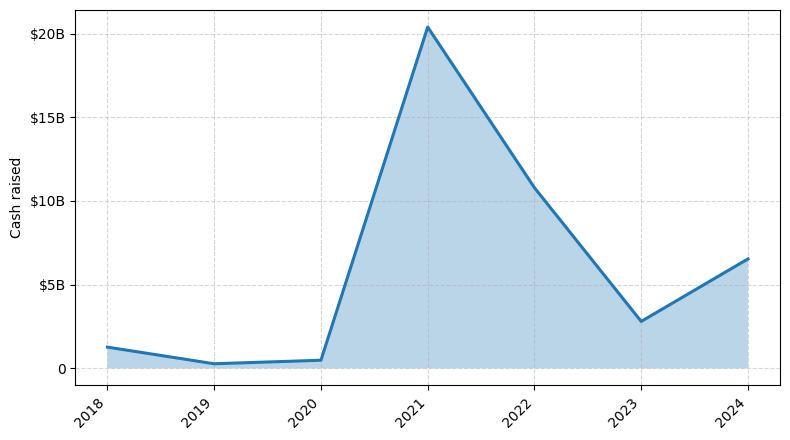

Turkey's venture capital (VC) landscape has seen a remarkable transformation in the last three years, with a surge in investment activity and the emergence of promising startups. Since 2022, the country has witnessed a significant increase in the number of VC rounds, with over 150 deals completed. The total amount of capital invested during this period has reached an impressive $1.5 billion, showcasing the growing appetite for innovative businesses.

Among the core startups that have received substantial investments are Getir, a leading instant delivery service, which has raised over $1 billion; Trendyol, an e-commerce platform that has attracted investments from global giants like Alibaba; and Insider, a marketing technology company that has secured funding from renowned VC firms such as Sequoia Capital and Riverwood Capital.

The Turkish VC landscape is dominated by prominent funds like 212, Earlybird Venture Capital, and Endeavor Catalyst, which have been actively investing in the country's thriving startup ecosystem.

In summary, Turkey's VC market has experienced a remarkable transformation, with a surge in investment activity, the emergence of successful startups, and the presence of well-established VC funds, positioning the country as an attractive destination for entrepreneurial ventures.

Among the core startups that have received substantial investments are Getir, a leading instant delivery service, which has raised over $1 billion; Trendyol, an e-commerce platform that has attracted investments from global giants like Alibaba; and Insider, a marketing technology company that has secured funding from renowned VC firms such as Sequoia Capital and Riverwood Capital.

The Turkish VC landscape is dominated by prominent funds like 212, Earlybird Venture Capital, and Endeavor Catalyst, which have been actively investing in the country's thriving startup ecosystem.

In summary, Turkey's VC market has experienced a remarkable transformation, with a surge in investment activity, the emergence of successful startups, and the presence of well-established VC funds, positioning the country as an attractive destination for entrepreneurial ventures.

68 active VC investors in Turkey

In the last three years, Turkey's venture capital landscape has seen significant activity, with several prominent firms investing in the country's thriving startup ecosystem. Leading the charge are firms like 500 Startups, Earlybird Venture Capital, and Endeavor Catalyst, which have collectively poured millions into Turkish startups across various industries. One of the most notable deals was the $100 million Series C round raised by e-commerce platform Trendyol in 2021, which was led by Softbank Vision Fund and Princeville Capital. This investment underscores the growing appeal of Turkey's digital economy and the confidence international investors have in the country's startup potential.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zen Girişim | |||||

| Yıldız Tekno GSYO | artificial intelligence, ar, vr, financial technologies, robotics, insurance technologies, health technologies | Turkey | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | ||

| Yildiz Ventures | food, consumer goods, retail, agritech, deeptech, saas, ecommerce, mobility, logistics, fintech, gaming, hrtech | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Vestel Ventures | media, productivity, ar, hr tech, retail, biotech, advertising, smart city, iot, ai, vr software, medical, consumer products , energy, consumer electronics, cyber security | Seed, Series A | |||

| Vera Capital | Turkey; Canada; United States; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania; | Seed, Series A | |||

| twozero Ventures | sports, media, entertainment, technology, esports, games, fashion, wellness, mental health, physical health, sports clubs, dfs, sports betting, data analysis, ip, health, fitness, ecommerce, wearable technologies, sponsorship, online broadcast, vr, ar, content | Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine | Series A, Series B, Seed | ||

| Teknoloji Yatirim | saas, health and life quality technologies, agriculture and food technologies, clean technologies | Turkey | Series B, Series A | EUR 20000000 | |

| Teknasyon | b2c mobile app | Seed | |||

| TechOne VC | innovative tech | Generalist | Series A, Seed | ||

| StartupFon | United States | Series B, Series A, Seed |

15 active CVC investors in Turkey

Active corporate venture capital firms have been increasingly investing in Turkey's thriving startup ecosystem over the past three years. Notable deals include Vodafone Ventures' investment in the fintech startup Papara and Unilever Ventures' backing of the e-commerce platform Trendyol. Turkey's strategic location and growing digital economy continue to attract global corporate investors.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Yildiz Ventures | food, consumer goods, retail, agritech, deeptech, saas, ecommerce, mobility, logistics, fintech, gaming, hrtech | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Teknoloji Yatirim | saas, health and life quality technologies, agriculture and food technologies, clean technologies | Turkey | Series B, Series A | EUR 20000000 | |

| Teknasyon | b2c mobile app | Seed | |||

| Sankonline | health-tech, energy, gaming, mobility, foodtech, blockchain, nft based games, drones, logistics | Turkey; United States | Series B, Seed, Series A | ||

| Nomos Ventures | construction, automotive, food, architecture, investment, proptech, martech, energy, adtech, fintech | Series A, Series B | |||

| Kalyon Venture Capital | construction technologies, property technologies, renewable energy, climate technologies, transportation technologies | Series A, Seed | |||

| ITK Ventures | education, health, logistics, financial technologies, online learning, tech learning, early childhood education, career development, learning management system, learning analytics, nextgen school, school management, smarttech, health technology, ltl, fintech | ||||

| Inventram | medtech, fintech, saas, gaming, data analytics, deep technology | Turkey | Series B, Series A, Series E, Series D, Seed, Series C | ||

| Gozde Tech Ventures | financial technologies, ecommerce, saas, gaming, blockchain, artificial intelligence | Turkey | Series A, Series B, Seed | ||

| FPlus Ventures | transportation, logistic, delivery, routing optimization, smart fleet, driver centric solutions, cargo management, mobility, point travel solutions, smart parking, smart public transportation, intermodal mobility, electrification, shared cars, car pooling, ride sharing, social shipping, social parking, vehicles, smart vehicles, connected vehicles, micro mobility vehicles, drones, autonomous vehicles, new materials, information, iot, geographic data processing, navigation, big data analytics, vehicle connections, digital market solutions, ar, vr | Turkey; United Kingdom | Seed, Series A, Series B |