FREE Investor Database

Top Venture Investors in Switzerland 2025 | Unicorn Nest Directory

Top Venture Investors in Switzerland 2025 | Unicorn Nest Directory

Browse verified VC and CVC firms funding startups in Switzerland. Discover your ideal investor match and find contacts of the right investors on Unicorn Nest.

Intro

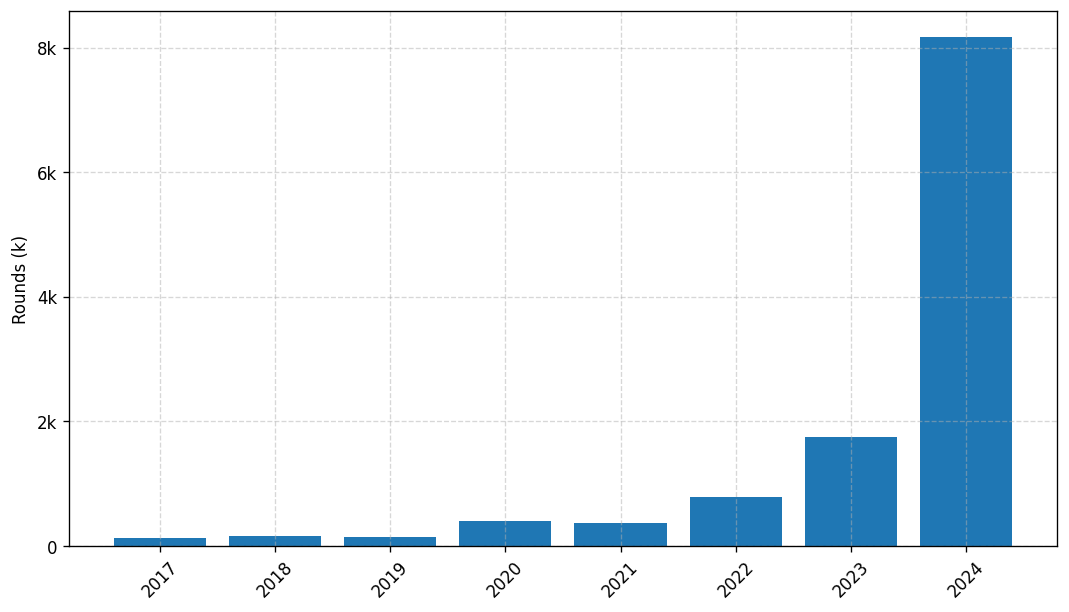

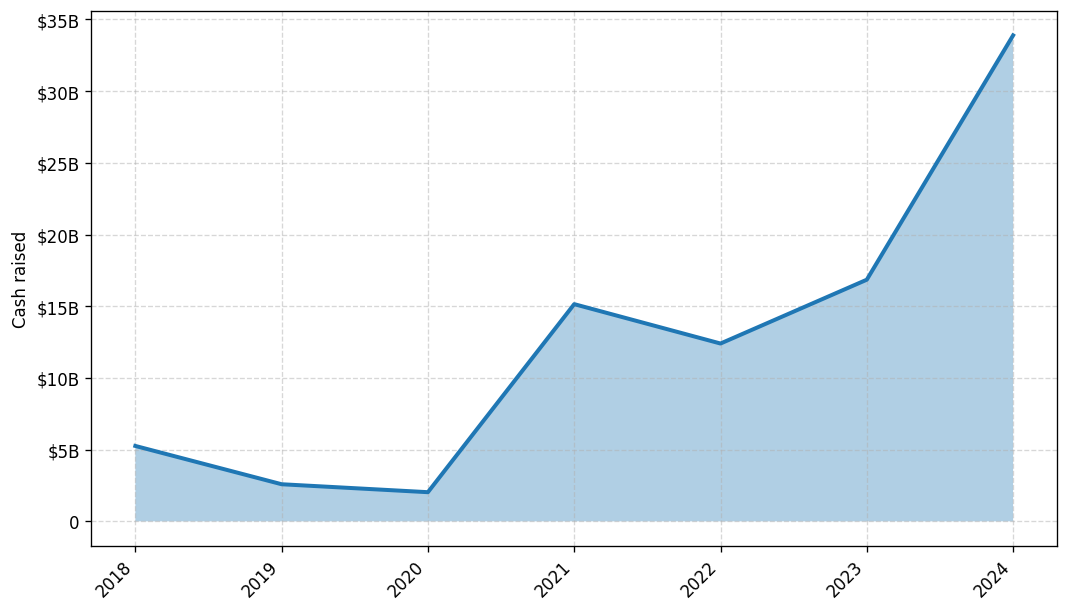

Switzerland has emerged as a thriving hub for venture capital (VC) investments in recent years. Since 2022, the Swiss VC landscape has witnessed a surge in activity, with a significant increase in the number of venture capital rounds and the total amount of money invested.

Over the past three years, Switzerland has seen a total of 342 venture capital rounds, with a staggering total investment of €3.2 billion. Some of the core startups that have received notable investments include Climeworks, a leading carbon capture and storage company, which raised €600 million in 2022, and Ledgy, a startup that provides equity management solutions, which secured €30 million in 2021.

The top venture capital funds operating in Switzerland include Lakestar, Redalpine, and Wingman Ventures, each with a strong track record of supporting innovative startups and driving the growth of the Swiss tech ecosystem.

In summary, Switzerland's venture capital landscape has experienced a remarkable transformation, with a steady influx of investments, a thriving startup ecosystem, and the presence of prominent VC funds, positioning the country as a compelling destination for entrepreneurs and investors alike.

Over the past three years, Switzerland has seen a total of 342 venture capital rounds, with a staggering total investment of €3.2 billion. Some of the core startups that have received notable investments include Climeworks, a leading carbon capture and storage company, which raised €600 million in 2022, and Ledgy, a startup that provides equity management solutions, which secured €30 million in 2021.

The top venture capital funds operating in Switzerland include Lakestar, Redalpine, and Wingman Ventures, each with a strong track record of supporting innovative startups and driving the growth of the Swiss tech ecosystem.

In summary, Switzerland's venture capital landscape has experienced a remarkable transformation, with a steady influx of investments, a thriving startup ecosystem, and the presence of prominent VC funds, positioning the country as a compelling destination for entrepreneurs and investors alike.

98 active VC investors in Switzerland

In the last three years, Switzerland's venture capital landscape has seen significant activity, with leading firms like Lakestar, Redalpine, and Wingman Ventures investing in promising startups. One notable example is the $130 million Series B round raised by Climeworks, a Swiss carbon capture and storage startup, in 2021. This late-stage investment highlights Switzerland's strength in sustainable technology and the growing interest of venture capitalists in addressing climate change. The country's thriving startup ecosystem, coupled with the presence of well-established venture firms, continues to attract global attention and investment.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| L1 Digital | crypto | Generalist | Seed | USD 152000000 | |

| Privilege Ventures | deeptech, fertility, marketplace, medtech, software, wearables | Denmark; Estonia; Finland; Iceland; Latvia; Lithuania; Norway; Sweden; Albania; Bosnia and Herzegovina; Croatia; Cyprus; Greece; Italy; Malta; Montenegro; North Macedonia; Portugal; San Marino; Serbia; Slovenia; Spain; Bulgaria; Czechia; Hungary; Poland; Romania; Slovakia; Austria; Estonia; Latvia; Lithuania; Belgium; France; Germany; Ireland; Liechtenstein; Luxembourg; Monaco; Netherlands; Switzerland; United Kingdom | Series A, Pre-Seed, Seed | CHF 20000000 | |

| Prediction Capital | consumertech, fintech | Germany; France, Île-de-France, Paris; Switzerland | Seed, Pre-Seed | USD 30000000 | |

| Swiss Post Ventures | communication, logistics, financial services, business process outsourcing, mobility markets | Generalist; Switzerland | Seed, Series A, Series B | ||

| IHAG Holding | real estate, hotel services | ||||

| Müller-Möhl Group | |||||

| S2S Ventures | education | Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Seed, Pre-Seed | CHF 10000000 | |

| Base58 | crypto | ||||

| MontBlu Capital | technology, saas, ecommerce, markets, business services | United Kingdom | Pre-Seed, Seed, Series A | ||

| BlueOcean Ventures | medical device and diagnostics, life sciences, digital health and nanotechnologies | Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Seed, Series A |

12 active CVC investors in Switzerland

Active corporate venture capital firms in Switzerland have been investing in a diverse range of startups, from fintech to cleantech, in the last three years. One notable deal was Novartis' investment in Sophia Genetics, a leading health tech company, highlighting the growing interest in digital health solutions.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Swiss Post Ventures | communication, logistics, financial services, business process outsourcing, mobility markets | Generalist; Switzerland | Seed, Series A, Series B | ||

| Swiss Crypto Advisors | blockchain, fintech | Generalist | Generalist | ||

| ABB Technology Ventures | energy systems, cities, buildings, future of transportation, future of industry, robotics, industrial iot, ai/machine learning, cybersecurity, electric mobility, smart buildings, distributed energy | Canada; United States; United Kingdom; Switzerland; Sweden | Seed, Series A, Series B, Series C | ||

| SIX FinTech Ventures | Generalist; Switzerland; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Sweden | Seed, Series A, Series B | CHF 50000000 | ||

| Nabtesco Technology Ventures | robotics, motors, sensors, additive manufacturing, artificial intelligence, iot, precision reduction gears, electro hydraulic systems, railroad vehicle technology, prosthetic devices, mobility devices, marine vessel, commercial vehicle, aviation, packaging, systems development, cae, additive manufacturing, surface treatment | Generalist | Seed, Series A, Series B | EUR 75000000 | |

| Serpentine Ventures | medtech, deep tech | Israel; United States; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czech Republic; Georgia; Hungary; Kosovo; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania; | Series A, Seed, Series B, Pre-Seed | ||

| Swisscom Ventures | telecom and it infrastructure, artificial intelligence, cybersecurity | Generalist; Switzerland | Seed, Series C, Series A, Series B | ||

| Trifork Labs | Generalist | Pre-Seed, Seed, Series A, Series B | |||

| International Trade Centre | e-commerce, agriculture, tourism, wellbeing, education | ||||

| CSS Insurance | healthcare |