FREE Investor Database

Top Venture Investors in Sweden 2025 | Unicorn Nest Directory

Top Venture Investors in Sweden 2025 | Unicorn Nest Directory

Browse verified VC and CVC firms funding startups in Sweden. Discover your ideal investor match and find contacts of the right investors on Unicorn Nest.

Intro

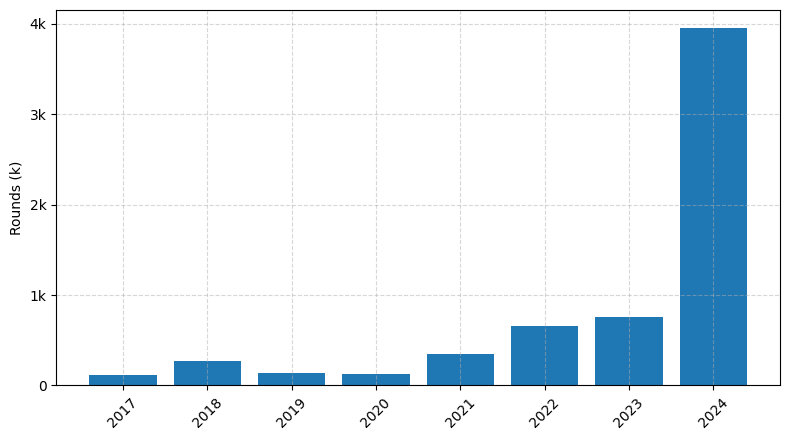

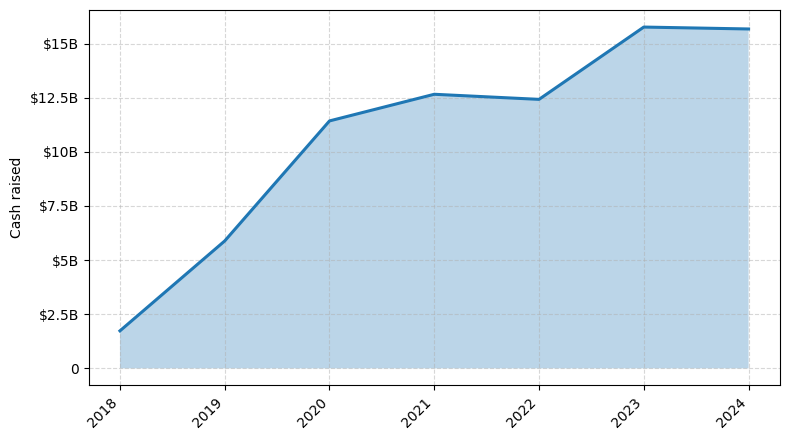

Sweden has emerged as a thriving hub for venture capital (VC) investments in recent years. Over the past three years since 2022, the Swedish startup ecosystem has witnessed a surge in VC activity, with a significant number of funding rounds and substantial capital infusion.

According to industry reports, Sweden has seen over 500 venture capital rounds in the last three years, with a total investment value exceeding $5 billion. Some of the notable startups that have received substantial investments include Klarna, a leading fintech company, Northvolt, a pioneering battery manufacturer, and Truecaller, a popular communication app.

The Swedish VC landscape is dominated by prominent funds such as EQT Ventures, Creandum, and Northzone, which have played a crucial role in supporting the growth of the country's innovative startups. These funds have consistently demonstrated their commitment to fostering the next generation of tech leaders in Sweden.

In summary, Sweden's venture capital ecosystem has experienced remarkable growth in the last three years, attracting substantial investments and nurturing the development of innovative startups that are poised to shape the future of various industries.

According to industry reports, Sweden has seen over 500 venture capital rounds in the last three years, with a total investment value exceeding $5 billion. Some of the notable startups that have received substantial investments include Klarna, a leading fintech company, Northvolt, a pioneering battery manufacturer, and Truecaller, a popular communication app.

The Swedish VC landscape is dominated by prominent funds such as EQT Ventures, Creandum, and Northzone, which have played a crucial role in supporting the growth of the country's innovative startups. These funds have consistently demonstrated their commitment to fostering the next generation of tech leaders in Sweden.

In summary, Sweden's venture capital ecosystem has experienced remarkable growth in the last three years, attracting substantial investments and nurturing the development of innovative startups that are poised to shape the future of various industries.

98 active VC investors in Sweden

Sweden's venture capital landscape has seen significant activity in the last three years, with leading firms like EQT Ventures, Creandum, and Northzone leading the charge. One notable example is Klarna's $650 million Series E round in 2021, which was one of the largest venture capital deals in Sweden's history. The round, led by SoftBank Vision Fund 2, aimed to support Klarna's expansion and solidify its position as a leading global fintech player. This investment highlights Sweden's growing reputation as a hub for innovative startups and the increasing interest of international investors in the country's thriving tech ecosystem.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zobito | enterprise software | Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | ||

| Zentro Founders | media, fintech, marketplaces | ||||

| Zenith Ventures | b2b, ai | Denmark; Finland; Iceland; Norway; Sweden | Series B, Seed, Series A | ||

| Wellstreet | e-commerce, edtech, fintech, greentech, health, martech, media, proptech, regtech, sportstech | Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Seed, Series A, Series B | SEK 175000000 | |

| Walerud Ventures | deep tech | Denmark; Finland; Iceland; Norway; Sweden | Pre-Seed | ||

| Volvo Cars Tech Fund | mobility | Seed, Series A, Series B | |||

| VNV Global | marketplaces, mobility, health, wellness | Generalist | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | ||

| Vidici Ventures | fintech | Denmark; Finland; Iceland; Norway; Sweden | Series A, Series B | ||

| VEQ | tech, digital products, software | Denmark; Norway; Sweden; Finland; Iceland; Greenland | Pre-Seed, Seed | ||

| VEF | fintech, digital financial services, payments, credit, mobile money, wealth advisors | Brazil; Mexico; India; Pakistan | Series D, Series C, Series E |

8 active CVC investors in Sweden

Active corporate venture capital firms have been increasingly investing in Sweden's thriving startup ecosystem over the past three years. Notable deals include Volvo Cars' investment in electric vehicle startup Polestar, and Ericsson's backing of IoT platform Telia Sense. Sweden's strong tech talent and innovative spirit continue to attract global corporate investors.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Volvo Cars Tech Fund | mobility | Seed, Series A, Series B | |||

| Scania Growth Capital | mobility, transport | Germany; Canada; Sweden; United Kingdom | Seed, Series A, Series B, Series C, Series D, Series E | EUR 183500000 | |

| Saab Ventures | saab, energy | Sweden | Seed | ||

| Nidoco | Generalist; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Seed, Series A | |||

| Ericsson Ventures | networking, core technologies, artificial intellegence, iot, security, quantum technology, cloud computing, data analytics, enterprise software | Generalist | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | ||

| EQT Ventures | tech | United States; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Series A, Series B | USD 1100000000 | |

| Bonnier Ventures | Seed | ||||

| Backstage AB | Denmark; Norway; Sweden; Finland; Iceland | Series E, Series D, Series C |