FREE Investor Database

Top Venture Investors in Spain 2025 | Unicorn Nest Directory

Top Venture Investors in Spain 2025 | Unicorn Nest Directory

Browse verified VC and CVC firms funding startups in Spain. Discover your ideal investor match and find contacts of the right investors on Unicorn Nest.

Intro

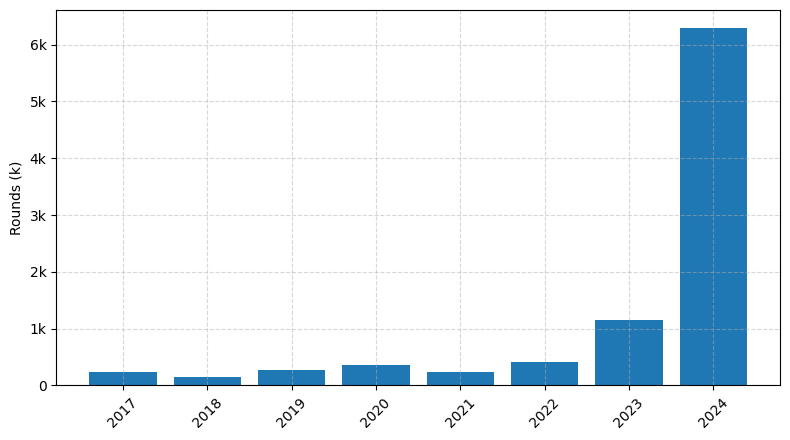

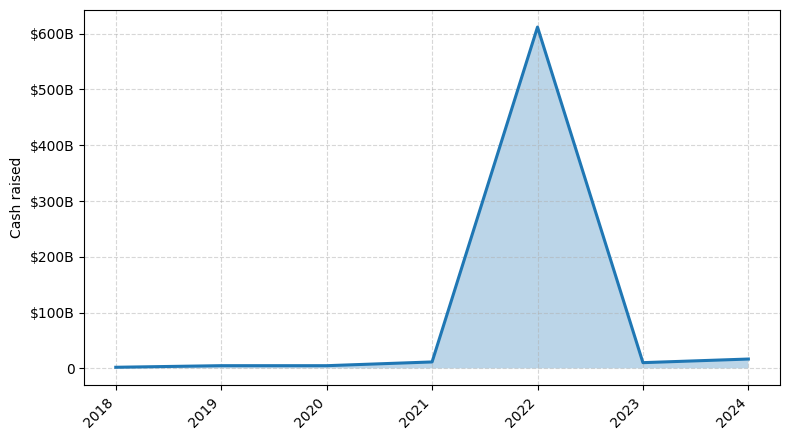

Spain has emerged as a thriving hub for venture capital (VC) investments in recent years. Since 2022, the country has witnessed a surge in VC activity, with a significant increase in the number of funding rounds and the total amount of capital invested.

According to industry reports, Spain has seen over 500 venture capital rounds in the last three years, with a total investment value exceeding €5 billion. Some of the notable startups that have received substantial VC funding during this period include Glovo, a leading on-demand delivery platform, which raised €450 million, and Cabify, a ride-hailing service, which secured €400 million in funding.

The Spanish VC landscape is dominated by prominent funds such as Seaya Ventures, Kibo Ventures, and Adara Ventures, which have been actively investing in the country's thriving startup ecosystem. These funds have played a crucial role in supporting the growth and development of innovative companies across various sectors, from e-commerce and fintech to mobility and sustainability.

In summary, Spain's venture capital market has experienced a remarkable transformation in the last three years, with a growing number of funding rounds and substantial investments in promising startups, positioning the country as an attractive destination for entrepreneurs and investors alike.

According to industry reports, Spain has seen over 500 venture capital rounds in the last three years, with a total investment value exceeding €5 billion. Some of the notable startups that have received substantial VC funding during this period include Glovo, a leading on-demand delivery platform, which raised €450 million, and Cabify, a ride-hailing service, which secured €400 million in funding.

The Spanish VC landscape is dominated by prominent funds such as Seaya Ventures, Kibo Ventures, and Adara Ventures, which have been actively investing in the country's thriving startup ecosystem. These funds have played a crucial role in supporting the growth and development of innovative companies across various sectors, from e-commerce and fintech to mobility and sustainability.

In summary, Spain's venture capital market has experienced a remarkable transformation in the last three years, with a growing number of funding rounds and substantial investments in promising startups, positioning the country as an attractive destination for entrepreneurs and investors alike.

95 active VC investors in Spain

In the last three years, Spain's venture capital landscape has seen significant activity, with leading firms like Seaya Ventures, Kibo Ventures, and Antai Venture Builder investing in promising startups. One notable example is the €100 million Series B round raised by Glovo, a delivery platform, in 2020. This investment, one of the largest in Spain during this period, highlights the growing interest of venture capitalists in the country's thriving tech ecosystem, particularly in sectors like e-commerce, logistics, and on-demand services.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zubi Capital | quality employment, education, demographic challenge, health, poverty, gender equality, climate change, water, biodiversity, sustainable infrastructures, sexual wellbeing, bioscience, robotics, AI | Spain | Seed, Series A | ||

| Zone2boost | fintech, retail | France; Spain; United Kingdom; Ireland | Series A, Seed | ||

| Xesgalicia | biotechnological, industry | Spain, Galicia | Pre-Seed, Seed | ||

| Xesgalicia | Spain, Galicia | Seed | |||

| We Venture Capital | healthcare, diagnostics | Series A, Series B, Seed | |||

| VitaminaK | United States; Spain; Germany | Series A, Series B, Seed | |||

| Vigo Activo | Spain, Galicia | ||||

| Vermú | Series A, Series B | ||||

| VenturCap | ecommerce, health, technological, educational | Spain | Series A, Series B, Series D, Seed, Series E, Series C | ||

| VAS Ventures | Series A, Series B |

16 active CVC investors in Spain

Active corporate venture capital firms in Spain have been investing heavily in innovative startups across various sectors, fueling the country's thriving entrepreneurial ecosystem. In the last 3 years, these firms have backed promising ventures, with a notable investment in a leading fintech startup that has since expanded globally.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zubi Capital | quality employment, education, demographic challenge, health, poverty, gender equality, climate change, water, biodiversity, sustainable infrastructures, sexual wellbeing, bioscience, robotics, AI | Spain | Seed, Series A | ||

| Zone2boost | fintech, retail | France; Spain; United Kingdom; Ireland | Series A, Seed | ||

| We Venture Capital | healthcare, diagnostics | Series A, Series B, Seed | |||

| Telefónica Tech Ventures | |||||

| Telefonica Innovation Ventures | Spain; United Kingdom; Germany; Brazil; United States; Israel; Argentina; Chile; Colombia; Ecuador; Peru; Mexico; Uruguay | Series A, Series B, Series E | |||

| Popular Impact Fund | fintech, financial inclusion, education, health, clean, renewable energy, infrastructure, sustainable food production and consumption, climate change, environmental protection, eco-friendly materials, sustainable cities | Puerto Rico; Virgin Islands; United States | Generalist, Seed, Series C, Series A, Pre-Seed, Series B, Pre-IPO | ||

| Pascual Innoventures | agrifood tech, ag tech, food science, food service, consumer tech, delivery | ||||

| LLYC Venturing | artificial intelligence, blockchain, virtual reality, iot, enterprise software, saas models | United States; Argentina; Bolivia; Brazil; Chile; Colombia; Costa Rica; Ecuador; Guatemala; Honduras; Mexico; Panama; Paraguay; Peru; Uruguay; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czech Republic; Georgia; Hungary; Kosovo; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania; | Series A, Seed, Series B | ||

| Bankinter Venture Capital | Spain; Portugal; Ireland | Seed, Series A | |||

| Fitalent | digital business, manufacturing, biotechnology, pharma, energy | Pre-Seed, Series B, Series A, Seed |