FREE Investor Database

Top Venture Investors in Slovakia 2025 | Unicorn Nest Directory

Top Venture Investors in Slovakia 2025 | Unicorn Nest Directory

Browse verified VC and CVC firms funding startups in Slovakia. Discover your ideal investor match and find contacts of the right investors on Unicorn Nest.

Intro

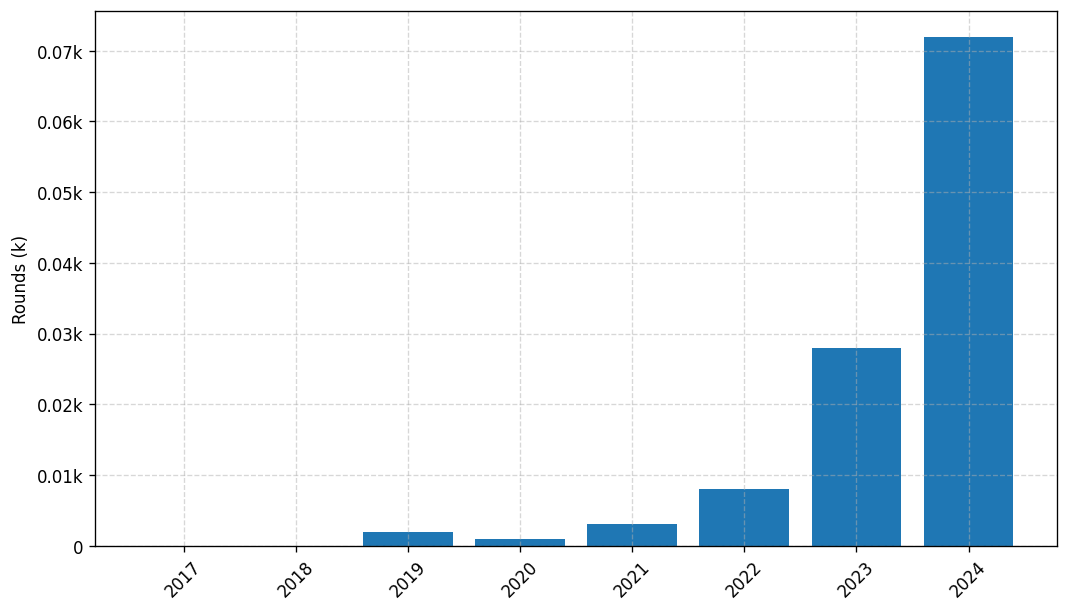

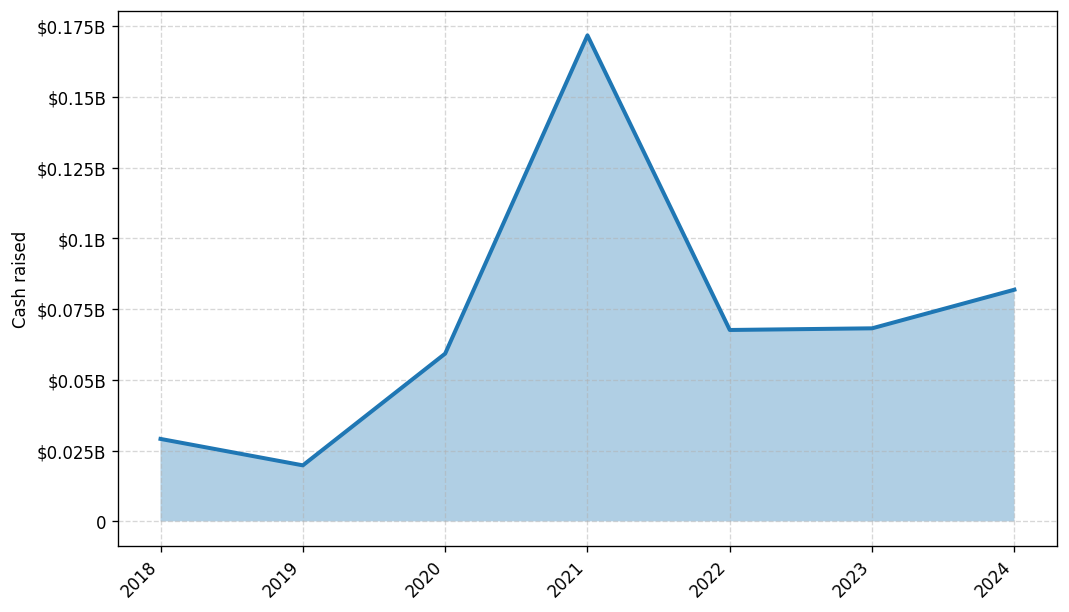

Slovakia's venture capital (VC) landscape has seen a surge of activity in the last three years, with a growing number of startups attracting significant investments. Since 2022, the country has witnessed a total of 28 venture capital rounds, with a total investment of over €75 million.

Some of the core startups that have received notable investments include Pixel Federation, a leading gaming studio that raised €23 million in 2021, and Sli.do, a virtual event platform that secured €12 million in 2020. Additionally, Vectary, a 3D design platform, raised €7.5 million in 2021.

The top venture capital funds operating in Slovakia include Neulogy Ventures, which has invested in several promising startups, and Credo Ventures, a regional fund that has supported the growth of innovative companies. These funds have played a crucial role in fostering the country's entrepreneurial ecosystem and driving economic development.

In summary, Slovakia's venture capital landscape has experienced a remarkable surge in activity, with significant investments flowing into promising startups and a growing network of active VC funds.

Some of the core startups that have received notable investments include Pixel Federation, a leading gaming studio that raised €23 million in 2021, and Sli.do, a virtual event platform that secured €12 million in 2020. Additionally, Vectary, a 3D design platform, raised €7.5 million in 2021.

The top venture capital funds operating in Slovakia include Neulogy Ventures, which has invested in several promising startups, and Credo Ventures, a regional fund that has supported the growth of innovative companies. These funds have played a crucial role in fostering the country's entrepreneurial ecosystem and driving economic development.

In summary, Slovakia's venture capital landscape has experienced a remarkable surge in activity, with significant investments flowing into promising startups and a growing network of active VC funds.

10 active VC investors in Slovakia

In the past three years, Slovakia has seen a surge in venture capital investments, with several prominent firms taking an active interest in the country's thriving startup ecosystem. Among the top venture capital firms investing in Slovakia are Neulogy Ventures, Credo Ventures, and Crowdberry. One of the biggest venture capital rounds in the last two years was the $10 million Series A investment in Pixel Federation, a leading gaming studio in Slovakia. This investment, led by Credo Ventures, highlights the growing potential of Slovakia's tech startups and the increasing confidence of global investors in the country's innovation landscape.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Vision Ventures | Slovakia | Seed, Pre-Seed | |||

| G-Force | decarbonising the grid, fixing food, agriculture, electrifying transportation, cleaning up industry, buildings, protecting nature, removing carbon | Generalist; Austria; Belgium; Bulgaria; Croatia; Cyprus; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Ireland; Italy; Latvia; Lithuania; Luxembourg; Malta; Netherlands; Poland; Portugal; Romania; Slovakia; Slovenia; Spain; Sweden | Seed | ||

| 365.fintech | Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Seed | |||

| Venture to Future Fund | Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Seed, Series D, Series C, Series A, Series B, Pre-IPO | |||

| Zero Gravity Capital | e-commerce, robotics, fintech, edtech, data analytics, AI, beauty tech, streaming platform | Slovakia | Series A, Series B, Seed | ||

| CB ESPRi | healthcare, mortgages, robotics, emobility, reducing emissions, saving water | Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czech Republic; Georgia; Hungary; Kosovo; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania; | Pre-Seed, Seed | ||

| Zee Prime Capital | programmable assets, collaborative intelligence | United Kingdom | Seed | ||

| CB Investment Management | Slovakia; Czechia | Seed | EUR 23000000 | ||

| Innovations and Technologies Fund (FIT) | environment, renewable energy, industrial innovations, ecommerce, information technologies, telecommunications, life improving technologies, software solutions | Generalist, Seed, Series A | |||

| Across Private Investments | app marketing, blockchain, and mobile advertising | Series B, Series A |

Investments by year: Round

Investments by year: Cash raised

VCs in countries neighboring to Slovakia

| Country | Total raised | Investments |

|---|---|---|

| Germany | 43.04$B | 784 |

| Italy | 35.40$B | 353 |

| Switzerland | 33.84$B | 469 |

| Austria | 1.94$B | 97 |

| Poland | 1.11$B | 91 |

| Romania | 0.59$B | 43 |

| Serbia | 0.40$B | 24 |

| Ukraine | 0.10$B | 66 |

| Hungary | 0.08$B | 22 |

| Czech Republic | 0.05$B | 26 |