FREE Investor Database

Top Venture Investors in Saudi Arabia 2025 | Unicorn Nest Directory

Top Venture Investors in Saudi Arabia 2025 | Unicorn Nest Directory

Browse verified VC and CVC firms funding startups in Saudi Arabia. Discover your ideal investor match and find contacts of the right investors on Unicorn Nest.

Intro

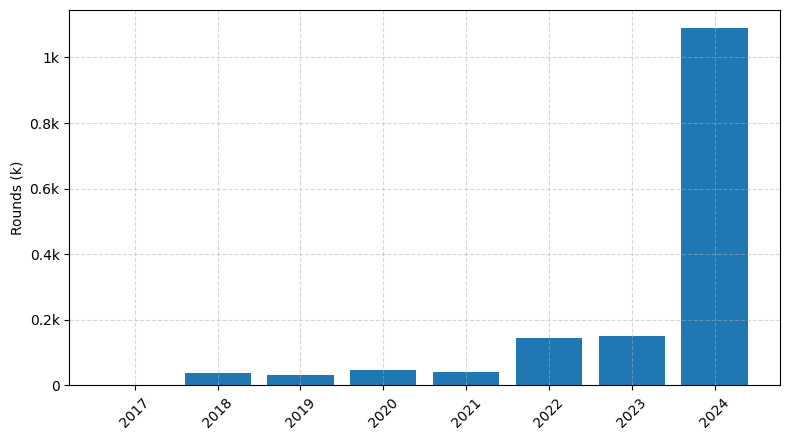

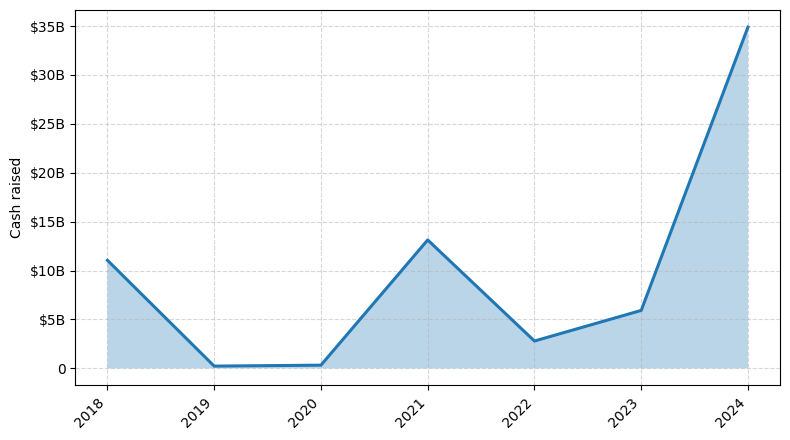

Saudi Arabia has emerged as a rising star in the global venture capital (VC) landscape, with a surge of investment activity in the last three years. Since 2022, the Kingdom has witnessed a remarkable increase in VC rounds, with over 100 deals completed, totaling more than $2 billion in investments.

Some of the core startups that have received significant funding include Foodics, a leading restaurant management platform, which raised $170 million in a Series C round, and Tamara, a buy-now-pay-later (BNPL) platform, which secured $110 million in a Series B round. Additionally, prominent VC funds such as STV, a $500 million fund, and Raed Ventures, a $70 million fund, have been at the forefront of driving this investment boom, backing innovative startups across various sectors.

In summary, Saudi Arabia's VC ecosystem has experienced a transformative period, attracting substantial investments and nurturing a thriving startup landscape, positioning the Kingdom as a hub for innovation and entrepreneurial growth.

Some of the core startups that have received significant funding include Foodics, a leading restaurant management platform, which raised $170 million in a Series C round, and Tamara, a buy-now-pay-later (BNPL) platform, which secured $110 million in a Series B round. Additionally, prominent VC funds such as STV, a $500 million fund, and Raed Ventures, a $70 million fund, have been at the forefront of driving this investment boom, backing innovative startups across various sectors.

In summary, Saudi Arabia's VC ecosystem has experienced a transformative period, attracting substantial investments and nurturing a thriving startup landscape, positioning the Kingdom as a hub for innovation and entrepreneurial growth.

21 active VC investors in Saudi Arabia

In the last three years, Saudi Arabia has seen a surge in venture capital investments, with leading firms like STV, Saudi Venture Capital Company (SVC), and Raed Ventures leading the charge. One of the biggest venture capital rounds in the past two years was the $125 million Series B funding raised by Foodics, a cloud-based restaurant management platform. This investment, led by STV, was the largest Series B round in the Saudi startup ecosystem, highlighting the growing appetite for technology-driven solutions in the country's food and hospitality industry.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Vision Ventures | travel/tourism, insuretech, ecommerce, smart transportation, services, saas/foodtech, saas/cyber security, saas, retail & marketing, medtech, media/saas, logistics, foodtech, fintech, entertainment, edutech, agritech | Algeria; Bahrain; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Libya; Morocco; Oman; Qatar; Saudi Arabia; Tunisia; United Arab Emirates; Djibouti | Series A, Pre-Seed, Seed | ||

| Tech Invest Com | Algeria; Bahrain; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Libya; Morocco; Oman; Qatar; Saudi Arabia; Tunisia; United Arab Emirates; Djibouti | Seed, Series A, Series B | |||

| Sukna Ventures | Algeria; Bahrain; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Libya; Morocco; Oman; Qatar; Saudi Arabia; Tunisia; United Arab Emirates; Djibouti; Algeria; Bahrain; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Libya; Morocco; Oman; Qatar; Saudi Arabia; Tunisia; United Arab Emirates; Djibouti | Seed, Series A, Pre-Seed, Series B | |||

| SRMG Ventures | media creators, digital media, media enablers, tools, immersive & interactive entertainment | Series A, Series B, Series C | |||

| SEEDRA Ventures | Saudi Arabia; United Arab Emirates | Pre-Seed, Seed, Series A, Series B | |||

| Saudi Aramco Energy Ventures | Generalist | Seed, Series A, Series B, Series C, Series D | |||

| RZM Investments | healthcare, education, information technology | Saudi Arabia; United States; Bahrain; Egypt | Seed | ||

| Riyadh Valley Company | healthcare, life sciences, renewable energy, sustainable resources, financial technology, logistics, transportation, education | Generalist; Saudi Arabia | Series C, Series D, Series F, Series E | ||

| Raed Ventures | Algeria; Bahrain; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Libya; Morocco; Oman; Qatar; Saudi Arabia; Tunisia; United Arab Emirates; Djibouti | Series B, Series A, Seed | USD 150000000 | ||

| Prosperity7 Ventures | Generalist | Series A, Series B |

5 active CVC investors in Saudi Arabia

Active corporate venture capital firms have been increasingly investing in Saudi Arabia over the past three years, tapping into the country's growing startup ecosystem. Notable deals include Aramco Ventures' investment in Lucid Motors, showcasing the kingdom's ambitions to diversify its economy beyond oil and gas.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Saudi Aramco Energy Ventures | Generalist | Seed, Series A, Series B, Series C, Series D | |||

| Riyadh Valley Company | healthcare, life sciences, renewable energy, sustainable resources, financial technology, logistics, transportation, education | Generalist; Saudi Arabia | Series C, Series D, Series F, Series E | ||

| Prosperity7 Ventures | Generalist | Series A, Series B | |||

| NEOM Investment Fund | biotech, design, construction, education, research, innovation, energy, entertainment, culture, financial services, food, health, wellbeing, manufacturing, media, mobility, sport, technology, digital, tourism, water | ||||

| Alturki Ventures | education technology, health tech, logistics, mobility tech, entertainment tech, fintech, ai, education, deep tech, digital health, synthetic biology, ecommerce | Albania; Andorra; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Kosovo; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom; Antigua and Barbuda; Bahamas; Barbados; Belize; Cuba; Dominica; Dominican Republic; Grenada; Guyana; Haiti; Jamaica; Saint Kitts and Nevis; Saint Lucia; Saint Vincent and the Grenadines; Suriname; Trinidad and Tobago; Argentina; Bolivia; Brazil; Chile; Colombia; Costa Rica; Ecuador; El Salvador; Guatemala; Honduras; Mexico; Nicaragua; Panama; Paraguay; Peru; Uruguay; Venezuela |