FREE Investor Database

Top Venture Investors in Romania 2025 | Unicorn Nest Directory

Top Venture Investors in Romania 2025 | Unicorn Nest Directory

Browse verified VC and CVC firms funding startups in Romania. Discover your ideal investor match and find contacts of the right investors on Unicorn Nest.

Intro

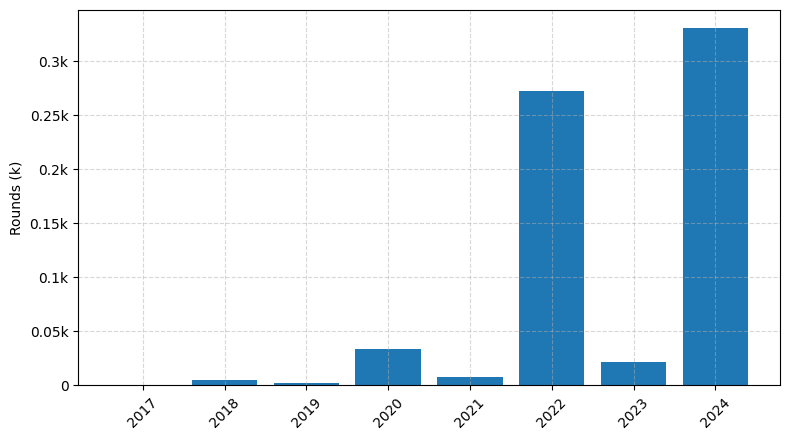

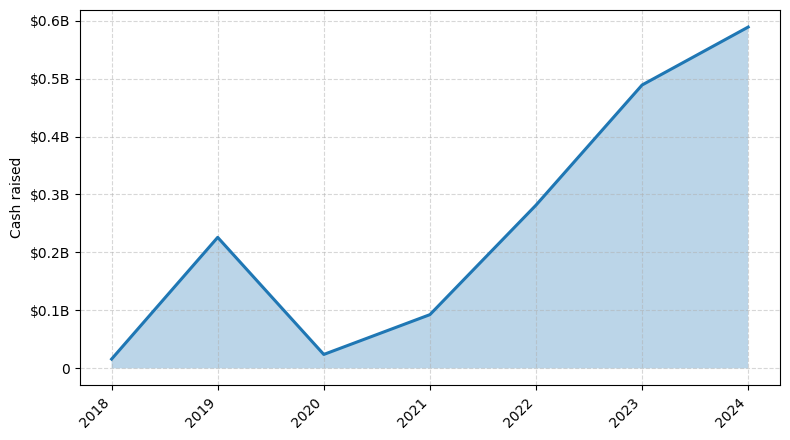

Romania's venture capital (VC) landscape has seen a remarkable transformation in the last three years, with a surge in investment activity and the emergence of promising startups. Since 2022, the country has witnessed a significant increase in the number of VC rounds, with over 50 deals completed, totaling more than €200 million in investments.

Among the core startups that have received notable funding are This.cm, a leading e-commerce platform, which secured €15 million in a Series A round, and Neurolabs, an AI-powered computer vision startup, which raised €12 million in a Series B round. Additionally, Questo, a digital tourism platform, has attracted €8 million in a Series A investment.

The top venture capital funds operating in Romania include Catalyst Romania, which has invested in several promising startups, and GapMinder Venture Partners, a prominent player in the local VC ecosystem. These funds have played a crucial role in fueling the growth and innovation of Romania's startup landscape.

In summary, Romania's VC market has experienced a remarkable transformation, with a growing number of investment rounds and significant capital infusion, supporting the development of innovative startups and positioning the country as an emerging hub for entrepreneurial talent.

Among the core startups that have received notable funding are This.cm, a leading e-commerce platform, which secured €15 million in a Series A round, and Neurolabs, an AI-powered computer vision startup, which raised €12 million in a Series B round. Additionally, Questo, a digital tourism platform, has attracted €8 million in a Series A investment.

The top venture capital funds operating in Romania include Catalyst Romania, which has invested in several promising startups, and GapMinder Venture Partners, a prominent player in the local VC ecosystem. These funds have played a crucial role in fueling the growth and innovation of Romania's startup landscape.

In summary, Romania's VC market has experienced a remarkable transformation, with a growing number of investment rounds and significant capital infusion, supporting the development of innovative startups and positioning the country as an emerging hub for entrepreneurial talent.

12 active VC investors in Romania

In the last three years, Romania's venture capital landscape has seen increased activity, with several prominent firms investing in the country's thriving startup ecosystem. Notable players include Roca X, a leading Romanian VC firm, and Catalyst Romania, which has backed numerous promising startups. One of the biggest venture capital rounds in the past two years was Uipath's $750 million Series E funding in 2021, led by Alkeon Capital and Coatue. This record-breaking round solidified UiPath's position as a global leader in robotic process automation, showcasing Romania's ability to produce high-growth, innovative technology companies.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Underline Ventures | manufacturing, dev tools, cybersecurity, agtech, e-commerce, travel tech, ai, big data, hr tech, legal tech | Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine | Seed | USD 20000000 | |

| The Mavers Ventures | food, emerging | ||||

| Sparking Capital | consumer internet, marketing-tech, supply chain-tech, fin-tech, property-tech, circular economy-tech | Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Pre-Seed, Seed | USD 2300000000 | |

| Roca X | Pre-Seed, Seed | ||||

| Netopia Ventures | e-tail & fintech | Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czech Republic; Estonia; Hungary; Kosovo; Latvia; Lithuania; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine | Series A, Series B | ||

| Metachain Capital | blockchain | United States | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | ||

| Legion Ventures | web3 | Series B, Series A | |||

| Hellen's Rock Capital | media, entertaiment, health, wellbeing, fintech, web3 | Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Estonia; Hungary; Latvia; Lithuania; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine | Seed | ||

| Gecad Ventures | cybersecurity, fintech, ai, ml, ar, vr, transportation, iot, agritech | Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czech Republic; Estonia; Hungary; Kosovo; Latvia; Lithuania; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine | Seed, Series A | ||

| Fortech Investments | energy, healthcare, manufacturing, automotive, fintech | Estonia; United States; Serbia; Romania; Bulgaria | Pre-Seed, Seed |

1 active CVC investors in Romania

Active corporate venture capital firms have been increasingly investing in Romania's thriving startup ecosystem over the past three years. Notable deals include Coca-Cola HBC's investment in Restart Energy, a renewable energy provider, and Siemens' backing of Neurolabs, an AI-powered computer vision startup.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Netopia Ventures | e-tail & fintech | Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czech Republic; Estonia; Hungary; Kosovo; Latvia; Lithuania; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine | Series A, Series B |