FREE Investor Database

Top Venture Investors in Portugal 2025 | Unicorn Nest Directory

Top Venture Investors in Portugal 2025 | Unicorn Nest Directory

Browse verified VC and CVC firms funding startups in Portugal. Discover your ideal investor match and find contacts of the right investors on Unicorn Nest.

Intro

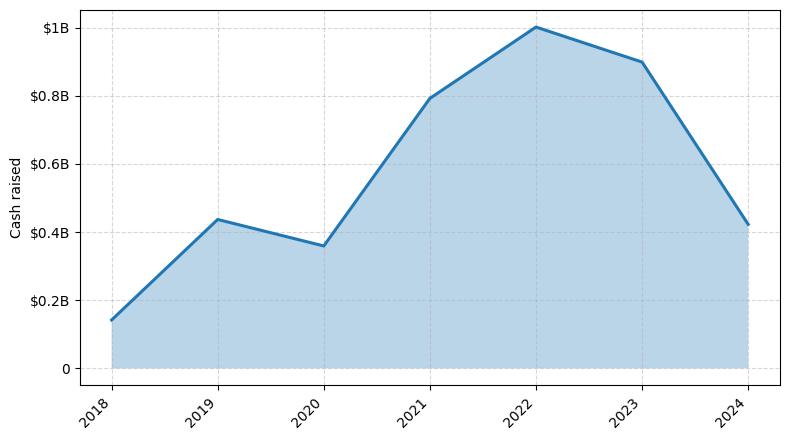

Portugal has emerged as a rising star in the European venture capital (VC) landscape, with a surge of investment activity in the last three years. Since 2022, the country has witnessed a significant increase in the number of venture capital rounds, with over 150 deals completed. The total amount of money invested during this period has exceeded €1 billion, showcasing the growing confidence of investors in the Portuguese startup ecosystem.

Some of the core startups that have received notable investments include Farfetch, a leading global luxury fashion platform, which raised $250 million in 2022, and Talkdesk, a cloud-based contact center solution, which secured $230 million in 2021. Additionally, top venture capital funds such as Atomico, Sequoia Capital, and Softbank have all made strategic investments in Portuguese startups, further validating the country's potential.

In summary, Portugal's venture capital landscape has experienced a remarkable transformation, attracting significant investment and attention from both domestic and international investors, positioning the country as a hub for innovation and entrepreneurship.

Some of the core startups that have received notable investments include Farfetch, a leading global luxury fashion platform, which raised $250 million in 2022, and Talkdesk, a cloud-based contact center solution, which secured $230 million in 2021. Additionally, top venture capital funds such as Atomico, Sequoia Capital, and Softbank have all made strategic investments in Portuguese startups, further validating the country's potential.

In summary, Portugal's venture capital landscape has experienced a remarkable transformation, attracting significant investment and attention from both domestic and international investors, positioning the country as a hub for innovation and entrepreneurship.

39 active VC investors in Portugal

In the past three years, Portugal has seen a surge in venture capital investments, with several prominent firms leading the charge. Notably, Caixa Capital, Indico Capital Partners, and Armilar Venture Partners have been at the forefront, backing promising startups across various industries. One of the largest venture capital rounds in the last two years was Farfetch's $250 million Series F funding in 2020, led by Dragoneer Investment Group. This late-stage investment underscores Portugal's growing appeal as a hub for innovative e-commerce and fashion technology startups, attracting significant global attention and capital.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| WISENEXT | Food delivery, Food tech, Real Estate Agents, AI, Payment, Electric Vehicle | Portugal; United States | Pre Seed, Seed | ||

| Venture Catalysts | high technology, agriculture, food technology, biotechnology, energy, environment, health, materials, software development | Series B, Series A | |||

| Tejo Ventures | solar developers, utility scale solar, energy, battery storage, merchant plant models | United States; Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Seed | EUR 50000000 | |

| StableNode | blockchain, crypto, defi | Series B, Series A, Series E, Series D, Seed, Series C | |||

| Shilling | Portugal | Seed, Series A, Series B | EUR 50000000 | ||

| Shapers | supply chain, enterprise solutions, fintech | United Kingdom; France | Seed, Series A | ||

| Semapa Next | Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czech Republic; Georgia; Hungary; Kosovo; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania; | Series A | |||

| Portugal Ventures | Portugal | Pre-Seed, Seed, Series A | |||

| Polkastarter | web3 | Series A, Series B, Seed | |||

| Pacific Capital Partners | real estate, infrastructure, consumer goods, technology, entertainment, publishing, lending platforms, renewable energy, smart farming, green technologies | United Kingdom; Albania; Andorra; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Kosovo; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine | Series A, Series B |

3 active CVC investors in Portugal

Active corporate venture capital firms have been increasingly investing in Portugal's thriving startup ecosystem over the past three years. Notable deals include Galp Energia's investment in Feedzai, a leading AI-powered financial risk management platform. This trend highlights Portugal's growing appeal as a hub for innovation and entrepreneurship.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Pacific Capital Partners | real estate, infrastructure, consumer goods, technology, entertainment, publishing, lending platforms, renewable energy, smart farming, green technologies | United Kingdom; Albania; Andorra; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Kosovo; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine | Series A, Series B | ||

| EDP Ventures | energy, renewable energy sources, grid, distributed energy resources, green hydrogen, storage, flexibility, mobility, energy usage decarbonization, ai, digital | Series B, Seed, Series A | |||

| Bright Pixel Capital | cybersecurity, retail technologies, digital infrastructure, emerging technologies | Generalist | Seed |

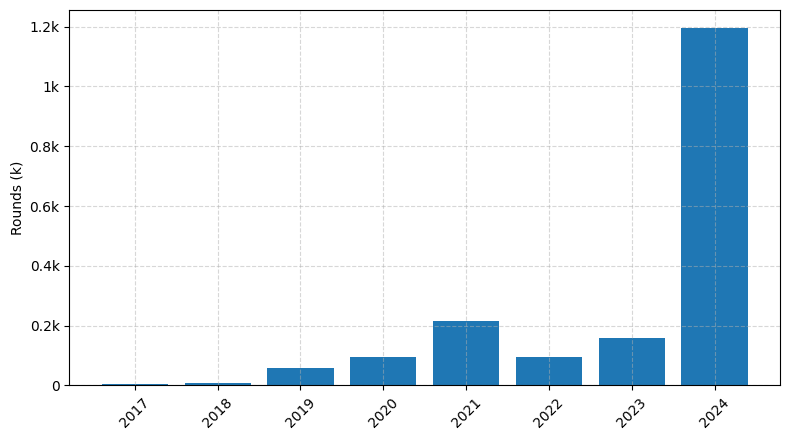

Investments by year: Round

Investments by year: Cash raised

VCs in countries neighboring to Portugal

| Country | Total raised | Investments |

|---|---|---|

| United Kingdom | 93.70$B | 2670 |

| France | 55.55$B | 922 |

| Germany | 42.52$B | 784 |

| Italy | 34.93$B | 353 |

| Switzerland | 33.67$B | 469 |

| Ireland | 23.06$B | 225 |

| Spain | 16.72$B | 480 |

| Belgium | 5.38$B | 131 |

| Netherlands | 3.85$B | 94 |

| Austria | 1.93$B | 97 |