FREE Investor Database

Top Venture Investors in Poland 2025 | Unicorn Nest Directory

Top Venture Investors in Poland 2025 | Unicorn Nest Directory

Browse verified VC and CVC firms funding startups in Poland in 2025. Discover your ideal investor match and find contacts of the right investors on Unicorn Nest.

Intro

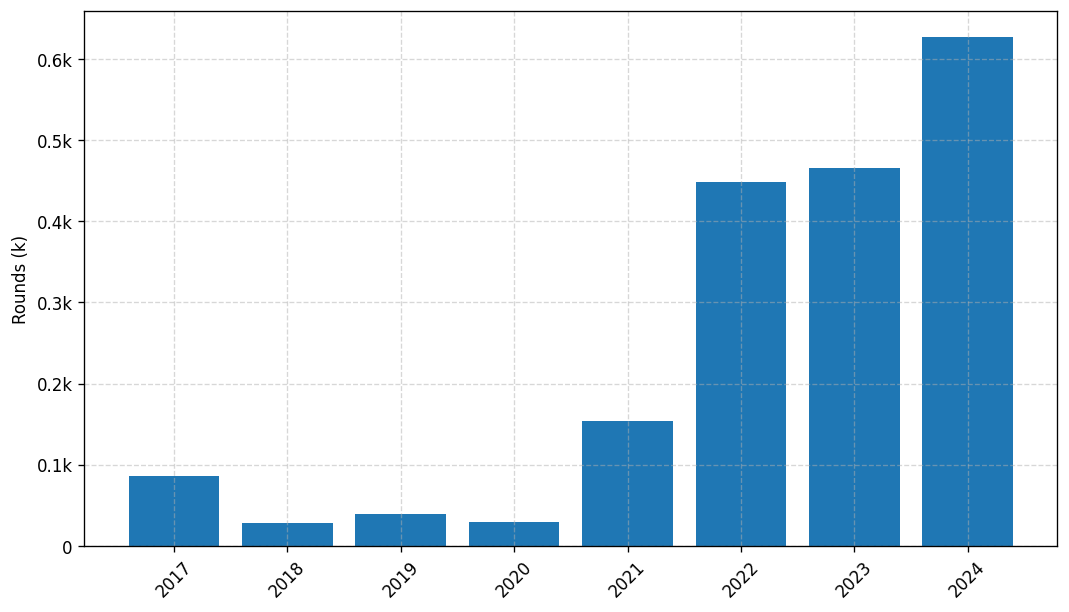

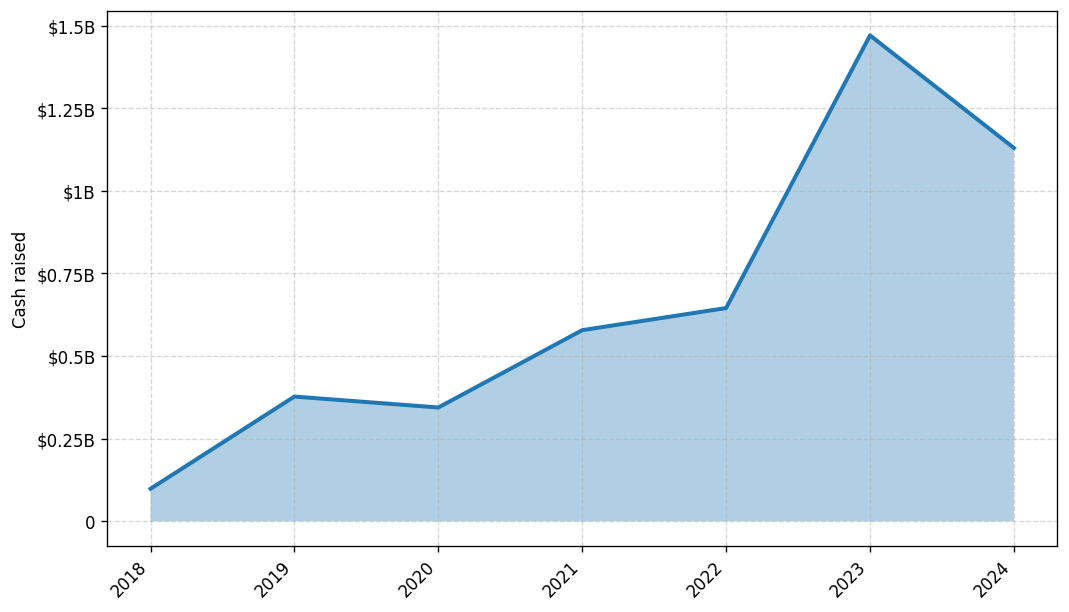

Poland's venture capital (VC) landscape has seen a remarkable transformation in the last three years. Since 2022, the country has witnessed a surge in VC activity, with a significant increase in the number of venture capital rounds. According to industry reports, over 150 VC deals were closed in the last three years, with a total investment value exceeding $1 billion.

Some of the notable startups that have received substantial investments include Brainly, a leading online learning platform, which raised $80 million in a Series D round, and Booksy, a leading appointment booking platform, which secured $70 million in a Series C round. Additionally, Ramp, a fintech startup, raised $52 million in a Series B round.

The Polish VC landscape is dominated by prominent funds such as Inovo Venture Partners, Tar Heel Capital, and Market One Capital, which have been actively investing in the country's thriving startup ecosystem.

In summary, Poland's venture capital market has experienced a remarkable growth trajectory in the last three years, with a significant increase in the number of VC deals and the total investment value, showcasing the country's potential as an attractive destination for startup investments.

Some of the notable startups that have received substantial investments include Brainly, a leading online learning platform, which raised $80 million in a Series D round, and Booksy, a leading appointment booking platform, which secured $70 million in a Series C round. Additionally, Ramp, a fintech startup, raised $52 million in a Series B round.

The Polish VC landscape is dominated by prominent funds such as Inovo Venture Partners, Tar Heel Capital, and Market One Capital, which have been actively investing in the country's thriving startup ecosystem.

In summary, Poland's venture capital market has experienced a remarkable growth trajectory in the last three years, with a significant increase in the number of VC deals and the total investment value, showcasing the country's potential as an attractive destination for startup investments.

69 active VC investors in Poland

In the past three years, Poland's venture capital landscape has seen significant activity, with several prominent firms investing in the country's thriving startup ecosystem. Notable players include Inovo Venture Partners, Tar Heel Capital, and Speedup Group, which have collectively backed a diverse range of startups. One of the largest venture capital rounds in the last two years was the $35 million Series A funding raised by Ramp, a fintech startup, in 2021. This investment, led by Avenir Growth Capital, highlights the growing interest in Poland's financial technology sector and the country's potential as an attractive destination for venture capital.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Renaissance Partners | all industries, particularly new technology, it, medical projects, clean energy, environment | Poland; Czech Republic; Slovakia; Estonia; Latvia; Lithuania | |||

| bValue Venture Capital | Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine | Seed | EUR 90000000 | ||

| Invento Capital | deeptech, fintech, foodtech, robotics, web3, impact, medtech | Generalist; United States; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam; China; India; Japan; South Korea; Taiwan; Australia; Argentina; Brazil; Chile; Colombia; Ecuador; Guatemala; Honduras; Mexico; Paraguay; Peru; Uruguay | Series B, Series A | ||

| Green Ventures | smart farming, social & industrial robotics, m-health, e-textiles & smart clothing, energy harvesting | Series A, Series B, Seed | |||

| Arkley Brinc VC | iot, hardware, foodtech, industrial tech, iot+media, energy, environmental tech, mobility, and smart cities | Albania; Andorra; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Kosovo; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Series A, Series B, Seed | USD 15000000 | |

| Kogito Ventures | Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czech Republic; Estonia; Hungary; Kosovo; Latvia; Lithuania; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine | Series B, Series A, Pre-Seed, Seed | |||

| Aligo Venture Capital | healthtech, cleantech | Poland | Pre-Seed, Series A, Series B, Seed | ||

| INNOventure | biotechnology, medicine, internet of things, intelligent networks, geoinformation technologies | Seed, Series A, Series B | |||

| INventures | Poland | ||||

| Tangent Line Ventures | industry 4.0, life sciences, biotechnology, food, agriculture technologies, technical, environmental sciences, automation, new processes and products, chemistry, energy, electronics, robotics, food, biotech, medtech, environemental tech, cybersec, industry digitalization, waste and recycling | United States; Poland; Denmark; France; Germany; Switzerland | Seed, Series D, Series C, Series A, Series E, Series B |

2 active CVC investors in Poland

Active corporate venture capital firms have been increasingly investing in Poland's thriving startup ecosystem over the last three years. Notable deals include Allegro's acquisition of Shoper, a leading e-commerce platform, and Comarch's investment in Synerise, an AI-powered marketing automation startup. Poland's strong talent pool and growing tech sector continue to attract global corporate investors.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| PGNiG Ventures | power generation, oil, gas, energy, exploration, mining, emission reduction, carbon capture, carbon storage, smart grids, energy storage, alternative transport, circular economy, waste management, iot, ai, machine learning, big data, robotics, vr, ar, smart utilities, smart infrastructure. | ||||

| ORLEN VC | petrochemicals, advanced materials, power generation, renewables, energy transition, efficiency, digitisation, storage, circular economy, recycling, waste management, modern retail business, automation of procurement, digitisation of sales, logistics, new generation of fuels, biofuels, synthetic fuels, new mobility, emobility, alternative fuels, digitisation, software, iot | Albania; Andorra; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Kosovo; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom; Israel | Series A, Series B |