FREE Investor Database

Top Venture Investors in Norway 2025 | Unicorn Nest Directory

Top Venture Investors in Norway 2025 | Unicorn Nest Directory

Browse verified VC and CVC firms funding startups in Norway. Discover your ideal investor match and find contacts of the right investors on Unicorn Nest.

Intro

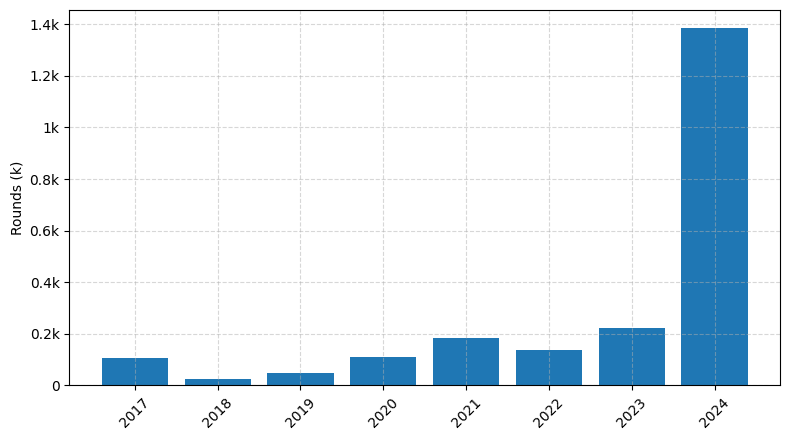

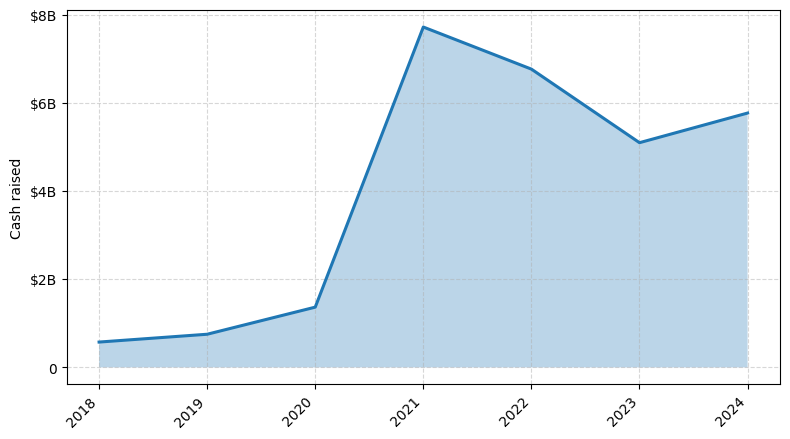

Norway's venture capital (VC) landscape has seen a remarkable surge in activity over the past three years. Since 2022, the country has witnessed a significant increase in the number of VC rounds, with over 150 deals completed. This influx of investment has resulted in a total of more than $1.5 billion being poured into the Norwegian startup ecosystem.

Some of the core startups that have received notable investments include Kahoot!, a leading educational technology platform, which raised $215 million in a Series C round in 2021. Additionally, Cognite, a leading industrial AI software company, secured $150 million in a Series B round in 2020. Kahoot! and Cognite have become shining examples of Norway's thriving startup scene.

The top venture capital funds operating in Norway include Northzone, Investinor, and Schibsted Growth, all of which have played a crucial role in fueling the growth of the country's innovative startups.

In summary, Norway's VC landscape has experienced a remarkable surge in activity, with a significant increase in the number of deals and the total amount of investment, showcasing the country's growing reputation as a hub for innovative startups.

Some of the core startups that have received notable investments include Kahoot!, a leading educational technology platform, which raised $215 million in a Series C round in 2021. Additionally, Cognite, a leading industrial AI software company, secured $150 million in a Series B round in 2020. Kahoot! and Cognite have become shining examples of Norway's thriving startup scene.

The top venture capital funds operating in Norway include Northzone, Investinor, and Schibsted Growth, all of which have played a crucial role in fueling the growth of the country's innovative startups.

In summary, Norway's VC landscape has experienced a remarkable surge in activity, with a significant increase in the number of deals and the total amount of investment, showcasing the country's growing reputation as a hub for innovative startups.

43 active VC investors in Norway

Norway's venture capital landscape has seen significant activity in the past three years, with leading firms like Northzone, Investinor, and Kistefos leading the charge. One notable example is the $200 million Series B round raised by Kahoot!, a leading educational technology startup, in 2021. This investment, one of the largest in Norway's history, highlights the country's growing reputation as a hub for innovative startups, particularly in the edtech and software sectors. These investments showcase Norway's potential to attract global attention and foster the growth of its thriving entrepreneurial ecosystem.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Yara Growth Ventures | agriculture, clean hydrogen | ||||

| Watrium AS | real estate and infrastructure, energy, financial services, professional services, health care, maritime services, aquaculture | ||||

| Viking Venture Management | b2b saas | Denmark; Norway; Sweden; Finland; Iceland | Series D, Series E, Series C | ||

| Vestland Group | business-to-business | United Kingdom; United States; Denmark; Finland; Iceland; Norway; Sweden; Germany | |||

| TeleVenture Management | industrials, software, oil, gas, consumer, marine | Series A, Series B | |||

| TD Veen | circularity, food, health, technology | Series B, Series A | |||

| Stratel | Seed, Pre-Seed | ||||

| Sprettert | proptech, ecommerce, software, cloud platform | Norway, Stavanger, Stavanger; Norway | Series A, Series B | ||

| Sondo Capital | Norway | Seed | |||

| SNÖ Ventures | technology, blockchain, gaming, web3, ai-driven interactive audio, software | Denmark; Finland; Iceland; Norway; Sweden | Seed | USD 100000000 |

5 active CVC investors in Norway

Active corporate venture capital firms have been increasingly investing in Norway's thriving startup ecosystem over the past three years. Notable deals include Equinor's investment in renewable energy startup Otovo and Telenor's backing of fintech innovator Kahoot. These strategic partnerships are driving innovation and growth in Norway's tech landscape.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Yara Growth Ventures | agriculture, clean hydrogen | ||||

| Eviny Ventures | sustainable future | United States; Norway | Seed, Series B | ||

| Equinor Technology Ventures | future of energy | Generalist; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Canada; United States | Seed | ||

| Bertel O Steen Kapital | enterprises, sustainability, b2b services, b2b distributors, technology, healthcare sector | Norway | Series C, Series D, Series E | ||

| Alligate | proptech, real estate |