FREE Investor Database

Top Venture Investors in the Netherlands 2025 | Unicorn Nest Directory

Top Venture Investors in the Netherlands 2025 | Unicorn Nest Directory

Browse verified VC and CVC firms funding startups in the Netherlands. Discover your ideal investor match and find contacts of the right investors on Unicorn Nest.

Intro

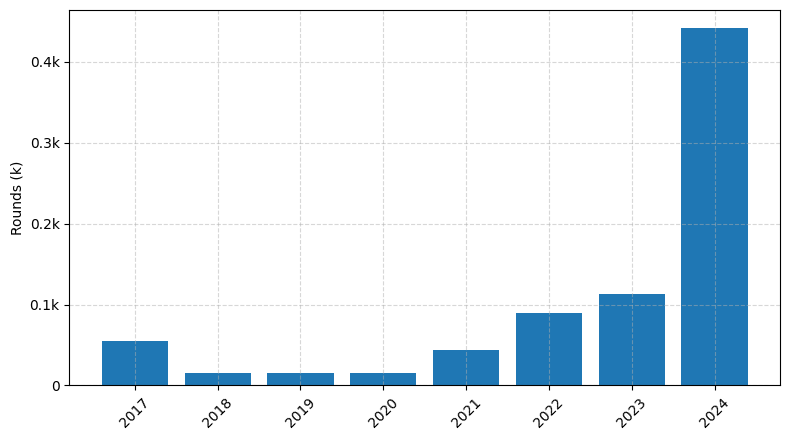

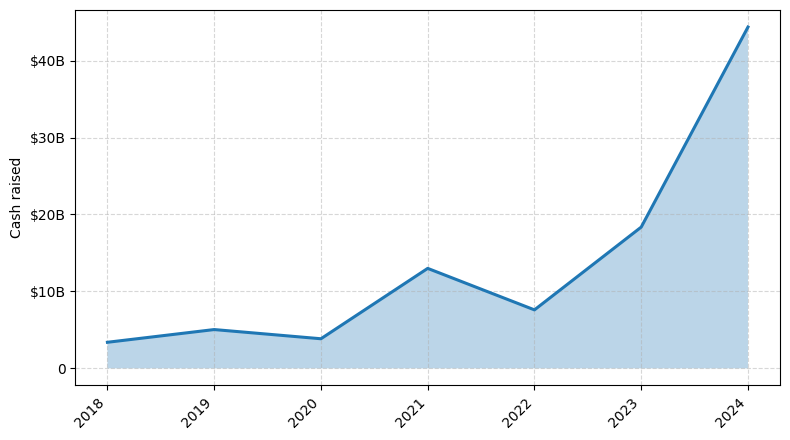

The Netherlands has emerged as a thriving hub for venture capital (VC) investments in recent years. Since 2022, the country has witnessed a surge in VC activity, with a significant increase in the number of venture capital rounds and the total amount of money invested.

Over the past three years, the Netherlands has seen a total of 1,200 venture capital rounds, with a staggering €8.2 billion invested in various startups. Some of the core startups that have received notable investments include Picnic, a leading online grocery delivery service that raised €600 million, and Messagebird, a cloud communications platform that secured €200 million.

The Netherlands' VC landscape is dominated by prominent funds such as Inkef Capital, Endeit Capital, and Volta Ventures, which have been actively investing in the country's thriving startup ecosystem. These funds have played a crucial role in supporting the growth and development of innovative companies across various industries.

In summary, the Netherlands has emerged as a prime destination for venture capital investments, with a robust startup ecosystem and a growing pool of successful VC-backed companies.

Over the past three years, the Netherlands has seen a total of 1,200 venture capital rounds, with a staggering €8.2 billion invested in various startups. Some of the core startups that have received notable investments include Picnic, a leading online grocery delivery service that raised €600 million, and Messagebird, a cloud communications platform that secured €200 million.

The Netherlands' VC landscape is dominated by prominent funds such as Inkef Capital, Endeit Capital, and Volta Ventures, which have been actively investing in the country's thriving startup ecosystem. These funds have played a crucial role in supporting the growth and development of innovative companies across various industries.

In summary, the Netherlands has emerged as a prime destination for venture capital investments, with a robust startup ecosystem and a growing pool of successful VC-backed companies.

99 active VC investors in Netherlands

In the Netherlands, the venture capital landscape has been dynamic, with several active firms investing in promising startups. Top venture capital firms like Inkef Capital, Endeit Capital, and Volta Ventures have been at the forefront, backing innovative companies across various industries. One notable example is the $80 million Series B round raised by Picnic, an online grocery delivery platform, in 2021. This significant investment highlights the growing appetite for disruptive solutions in the e-commerce and logistics sectors within the Dutch startup ecosystem.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Volve Capital | enterprise, saas, b2b, b2b2c | Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Spain; Portugal; Switzerland; Denmark; Finland; Iceland; Norway; Sweden | Pre-Seed, Series B, Seed, Series A | ||

| Volta Ventures | Belgium; Netherlands; Luxembourg | Seed | |||

| VOC Capital Partners | b2c, b2b | ||||

| Vivid Ventures | Series A, Series B | ||||

| Vinci Venture Capital | logistics, energy, mobility, industry 4 | Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Seed, Series A, Series B | USD 10000000 | |

| VIE Tech Capital | hr | United States; Austria; Belgium; Bulgaria; Croatia; Republic of Cyprus; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Ireland; Italy; Latvia; Lithuania; Luxembourg; Malta; Netherlands; Poland; Portugal; Romania; Slovakia; Slovenia; Spain; Sweden | Seed | ||

| Velocity Fintech Ventures | fintech | Generalist; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Canada; United States; Algeria; Cameroon; Ethiopia; Kenya; Morocco; Nigeria; South Africa; Tunisia; Uganda | Series A, Series B | ||

| Velar Capital | enterprise, it infrastructure | United States; Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam; China; India; Japan; South Korea; Taiwan; Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam; China; India; Japan; South Korea; Taiwan; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czech Republic; Georgia; Hungary; Kosovo; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania; | |||

| Van Herk Ventures | real estate | Austria; Belgium; Bulgaria; Croatia; Cyprus; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Ireland; Italy; Latvia; Lithuania; Luxembourg; Malta; Netherlands; Poland; Portugal; Romania; Slovakia; Slovenia; Spain; Sweden | |||

| Value Creation Capital | deep tech, b2b, medical devices, medical analysis, industry5, grc, cybersecurity, quantum infrastructure, optics, photonics, nano technology, robotics, extended reality, advanced sensoring, ai software, healthy life, energy reduction, materials reduction, security, safety, life sciences, research | Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Spain; Portugal; Switzerland | Seed, Series A |

10 active CVC investors in Netherlands

Active corporate venture capital firms in the Netherlands have been investing heavily in innovative startups across various sectors. Notable deals include Philips' investment in digital health startup Onera and Shell's backing of sustainable energy solutions provider Eneco. These strategic partnerships aim to drive technological advancements and foster a thriving startup ecosystem.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Shell Ventures | energy, mobility | Generalist; United States; India; United Kingdom; Norway | Seed, Series A, Series B, Series C, Series D, Series E | ||

| Randstad Innovation Fund | hr, digital platforms, talent management, edtech, upskilling, reskilling, fintech, worktech, big data analytics, machine learning | United States; Netherlands | Series A, Series B, Series D, Series C, Series E | ||

| M Ventures (Merck) | biotechnology, healthcare, life sciences, technology, electronics, frontier tech, sustainability | Generalist | Seed | ||

| MCE Group | digital assets, defi, infrastructure, gamefi, data, nfts, metaverse | Seed, Series A, Series B | |||

| ING Ventures | fintech, regtech, proptech, advanced analytics | Generalist; United States; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam; China; India; Japan; South Korea; Taiwan | Series A, Series B, Series C, Series D | ||

| Exor Ventures | Generalist | Series A, Series B | |||

| dsm-firmenich Venturing | nutrition, health, beauty, perfumery, taste texture, care | Series A, Series B, Series C | |||

| Brightlands Life Sciences Ventures | health, life sciences | ||||

| Alliance Ventures | automotive, new mobility, autonomous driving, connected services, ev & energy, enterprise 2.0 | United States | Generalist, Series B, Series A, Series C | ||

| ABN AMRO Ventures | technology | United States; Israel; Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Series A, Series B, Seed |

Investments by year: Round

Investments by year: Cash raised

VCs in countries neighboring to Netherlands

| Country | Total raised | Investments |

|---|---|---|

| United Kingdom | 93.82$B | 2670 |

| France | 55.74$B | 922 |

| Germany | 42.68$B | 784 |

| Switzerland | 33.72$B | 469 |

| Denmark | 27.53$B | 175 |

| Luxembourg | 8.04$B | 44 |

| Belgium | 5.39$B | 131 |

| Austria | 1.94$B | 97 |

| Poland | 1.10$B | 91 |

| Czech Republic | 0.05$B | 26 |