FREE Investor Database

Top Venture Capital investors in Italy in 2025 | Unicorn Nest Directory

Top Venture Capital investors in Italy in 2025 | Unicorn Nest Directory

Browse verified VC and CVC firms funding startups in Italy. Discover your ideal investor match and find contacts of the right investors on Unicorn Nest.

Intro

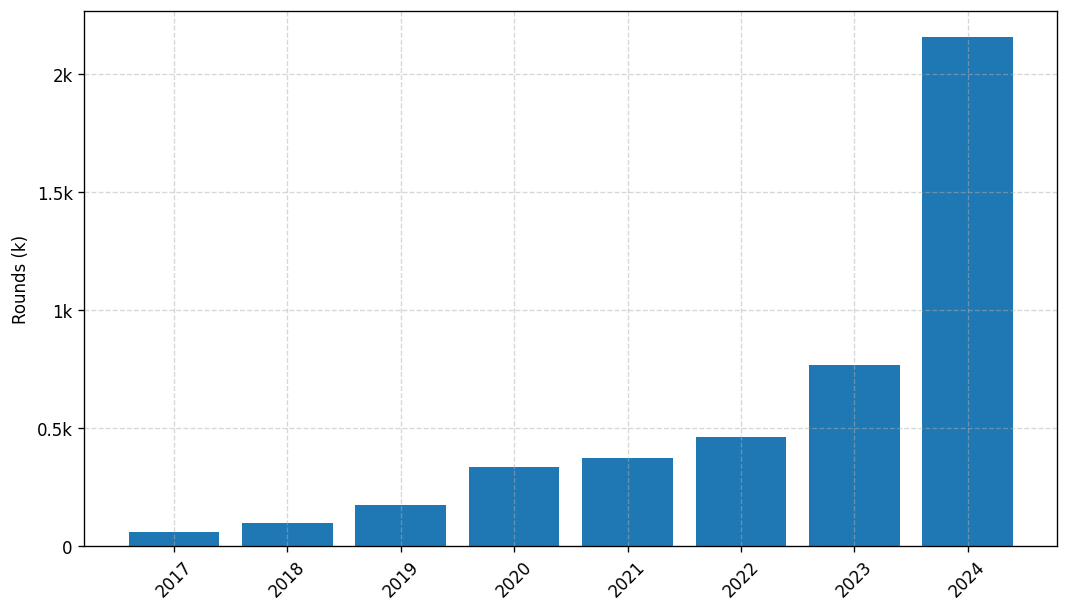

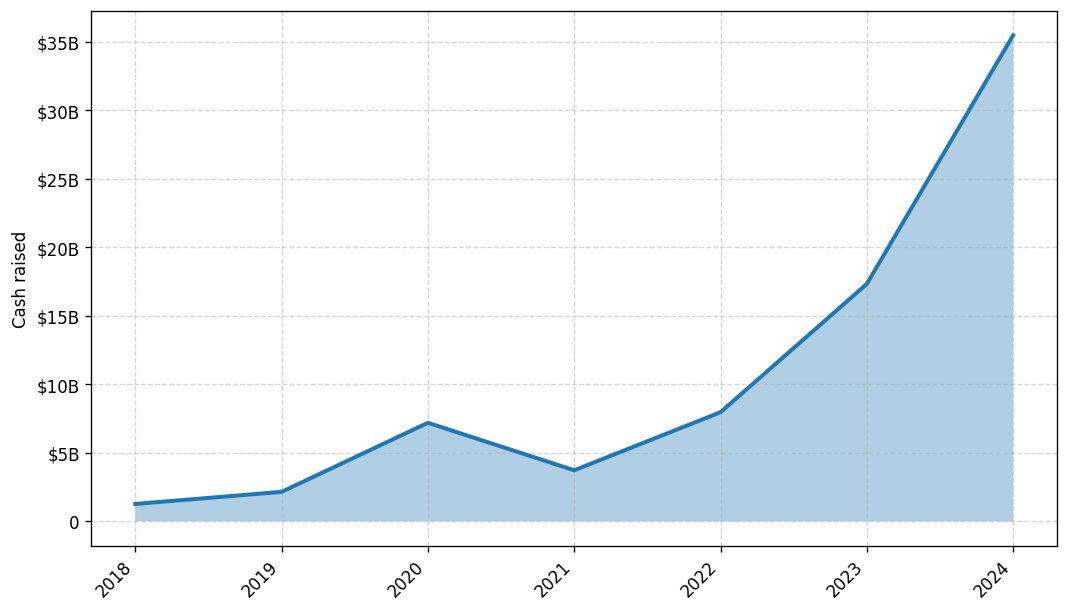

Italy's venture capital (VC) landscape has seen a remarkable transformation in the last three years, with a surge in investment activity and the emergence of promising startups. Since 2022, the country has witnessed a significant increase in the number of VC rounds, with over 300 deals completed. The total amount of capital invested during this period has exceeded €2 billion, showcasing the growing appetite for innovative businesses.

Among the core startups that have received substantial investments are Satispay, a digital payments platform that raised €320 million, and Scalapay, a buy-now-pay-later solution that secured €497 million. Additionally, Casavo, a real estate tech company, has attracted the attention of top venture capital funds, such as Greenoaks, Bertelsmann, and Exor.

The Italian VC landscape is being shaped by prominent players like Innogest, Principia, and United Ventures, which have been actively investing in the country's thriving startup ecosystem. This dynamic environment has positioned Italy as an increasingly attractive destination for entrepreneurs and investors alike.

Among the core startups that have received substantial investments are Satispay, a digital payments platform that raised €320 million, and Scalapay, a buy-now-pay-later solution that secured €497 million. Additionally, Casavo, a real estate tech company, has attracted the attention of top venture capital funds, such as Greenoaks, Bertelsmann, and Exor.

The Italian VC landscape is being shaped by prominent players like Innogest, Principia, and United Ventures, which have been actively investing in the country's thriving startup ecosystem. This dynamic environment has positioned Italy as an increasingly attractive destination for entrepreneurs and investors alike.

72 active VC investors in Italy

In the last three years, Italy's venture capital landscape has seen increased activity, with prominent firms like Barcamper Ventures, Innogest, and United Ventures leading the charge. One notable example is the €80 million Series B round raised by Scalapay, a fintech startup, in 2021. This investment, one of the largest in Italy during this period, highlights the growing interest in the country's tech ecosystem, particularly in the financial technology sector. These investments showcase Italy's potential to nurture innovative startups and attract significant venture capital funding.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Alecla7 | Generalist | Generalist | |||

| LCA Ventures | hitech | Italy | Seed | ||

| Pariter Partners | deeptech | Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czech Republic; Georgia; Hungary; Kosovo; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania; | Series A, Pre-Seed, Series B, Seed | ||

| Moffu Labs | ai, b2b, b2c, cloud, cybersecurity, entertainment, financial services, food, health, manufacturing, media, payments, platform, saas, sustainability, textile, travel | Seed | |||

| ADR Ventures | aerospace, automation, robotics, future travel, sustainability | Generalist | Series A, Series B, Seed | ||

| TIM Ventures | network, cloud, iot, cybersecurity, payments, education, sustainability | ||||

| Oltre Impact | community & local development | education & employment | sustainable finance | health | personal care & well-being | food & agricolture | smart: cities & clean mobility | clean energy | sustainable good & services | Austria; Belgium; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Ireland; Italy; Latvia; Lithuania; Luxembourg; Malta; Netherlands; Poland; Portugal; Romania; Slovakia; Slovenia; Spain; Sweden; Switzerland; United Kingdom | Series A, Series B, Series C | EUR 72000000 | |

| NextSTEP | climate tech | United Kingdom; Italy; United States; Sweden | Seed, Pre-Seed | ||

| Ulixes Capital | Italy | Seed, Pre-Seed, Series A | |||

| Fondazione Telethon | diagnosis, cure, prevention of muscular dystrophies, human genetic diseases |

5 active CVC investors in Italy

Active corporate venture capital firms have been increasingly investing in Italy's thriving startup ecosystem over the past three years. Notable deals include Intesa Sanpaolo's investment in fintech startup Satispay and Enel's backing of renewable energy innovator Nuvve. These investments highlight Italy's growing appeal as a hub for cutting-edge technologies.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| ADR Ventures | aerospace, automation, robotics, future travel, sustainability | Generalist | Series A, Series B, Seed | ||

| LCA Ventures | hitech | Italy; Israel | |||

| Ad4Ventures | b2c, digital goods, physical goods, services, ecommerce, comparison, marketplace, metasearch | Italy; Spain | Series C, Series D, Series E, Series A | ||

| Grey Silo Ventures | Generalist | Seed, Series A | |||

| Venture Factory | Series A, Series B |