FREE Investor Database

Top Venture Investors in Ireland 2025 | Unicorn Nest Directory

Top Venture Investors in Ireland 2025 | Unicorn Nest Directory

Browse verified VC and CVC firms funding startups in Ireland. Discover your ideal investor match and find contacts of the right investors on Unicorn Nest.

Intro

Ireland has emerged as a thriving hub for venture capital (VC) investments in recent years. Since 2022, the Irish VC landscape has witnessed a surge in activity, with a significant increase in the number of funding rounds and the total amount of capital invested.

Over the past three years, Ireland has seen a total of 247 venture capital rounds, with a staggering €1.8 billion invested in the country's startups. Some of the notable startups that have received substantial investments include Intercom, a customer communication platform that raised €125 million, and Wayflyer, a financial technology company that secured €150 million.

The Irish VC ecosystem is supported by a strong network of top-tier funds, such as Draper Esprit, Frontline Ventures, and Accel, which have all made significant investments in the country's thriving startup scene.

In summary, Ireland's venture capital landscape has experienced a remarkable transformation, with a growing number of funding rounds and a substantial influx of capital, positioning the country as an attractive destination for innovative startups and savvy investors.

Over the past three years, Ireland has seen a total of 247 venture capital rounds, with a staggering €1.8 billion invested in the country's startups. Some of the notable startups that have received substantial investments include Intercom, a customer communication platform that raised €125 million, and Wayflyer, a financial technology company that secured €150 million.

The Irish VC ecosystem is supported by a strong network of top-tier funds, such as Draper Esprit, Frontline Ventures, and Accel, which have all made significant investments in the country's thriving startup scene.

In summary, Ireland's venture capital landscape has experienced a remarkable transformation, with a growing number of funding rounds and a substantial influx of capital, positioning the country as an attractive destination for innovative startups and savvy investors.

34 active VC investors in Ireland

In the last three years, Ireland has seen a surge in venture capital investments, with leading firms like Draper Esprit, Frontline Ventures, and Elkstone Partners playing a significant role. One of the biggest venture capital rounds in the past two years was Intercom's $125 million Series D funding in 2020, led by Kleiner Perkins. This late-stage investment solidified Intercom's position as a leading customer communication platform, highlighting Ireland's growing reputation as a hub for innovative startups and the increasing appetite of global investors to back the country's thriving tech ecosystem.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Western Development Commission | cleantech, creative industries, food, natural resources, information, communications technology, manufacturing services, internationally-traded services, medtech, life sciences, tourism, advertising, architecture, art, antiques, crafts, design, digital media, fashion, internet, software, music, visual arts, performing arts, publishing | Ireland, County Galway; Ireland, County Mayo; Ireland, County Roscommon; Ireland, County Donegal; Ireland, County Leitrim; Ireland, County Sligo; Ireland, County Clare | Generalist, Seed, Series D, Series C, Series A, Pre-Seed, Series B, Pre-IPO | EUR 75000000 | |

| WakeUp Capital | sustainable production, sustainable consumption, agritech, foodtech, circular economy, smart energy, sustainable energy, inclusive services, accessible services, early diagnosis, detection, prevention, fem tech, financial inclusion, mobility, future of work | Albania; Andorra; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Kosovo; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Series A, Series B, Seed | ||

| Two Culture Capital | ai, machine learning, robotics | Generalist | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | ||

| Tribal.vc | SaaS | Ireland; United States | Seed, Series A | ||

| The Yield Lab Europe | genetics, crop protection, animal welfare, bioenergy, biomaterials, other renewables; novel farming systems; big data, precision farming; innovative food, beverages | Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Pre-Seed, Seed, Series A | EUR 55000000 | |

| The EIIS Innovation Fund | Austria; Belgium; Bulgaria; Croatia; Cyprus; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Ireland; Italy; Latvia; Lithuania; Luxembourg; Malta; Netherlands; Poland; Portugal; Romania; Slovakia; Slovenia; Spain; Sweden; Iceland; Liechtenstein; Norway | ||||

| Techstart Ventures | United Kingdom, Scotland; United Kingdom, Northern Ireland | Series A, Seed | |||

| Stratos Ventures | climate, low carbon economy | ||||

| Small Foundation | Seed | ||||

| Seroba Life Sciences | life sciences, biotech, medtech | Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania; Canada; United States | Series A, Series B | USD 134000000 |

3 active CVC investors in Ireland

Active corporate venture capital firms have been increasingly investing in Ireland's thriving startup ecosystem over the past three years. Notable deals include Accenture's investment in fintech firm Fenergo and Vodafone's backing of cybersecurity startup Tines, showcasing Ireland's appeal as a hub for innovative technologies.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Redesdale | food, beverage, nutrition | Ireland | Seed | ||

| Co-FundNI | United Kingdom, Northern Ireland | Seed | |||

| Allegion Ventures | building analytics, iot, data security, construction lifecycle, property management. | Generalist | Seed, Series A, Series B, Series C | USD 100000000 |

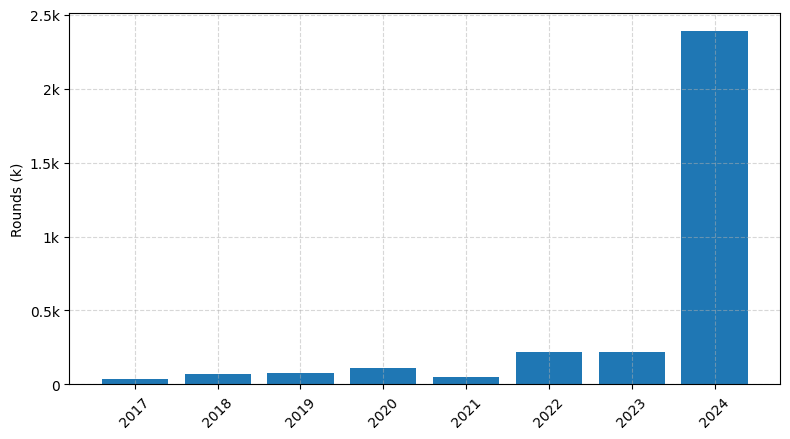

Investments by year: Round

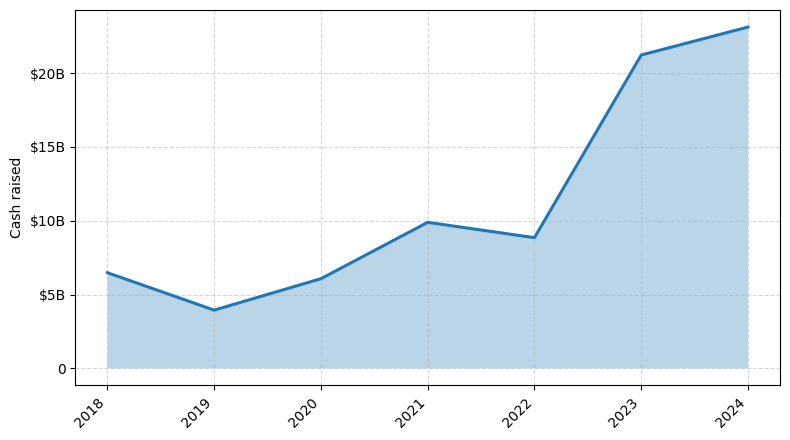

Investments by year: Cash raised

VCs in countries neighboring to Ireland

| Country | Total raised | Investments |

|---|---|---|

| United Kingdom | 93.82$B | 2670 |

| France | 55.74$B | 922 |

| Germany | 42.68$B | 784 |

| Denmark | 27.53$B | 175 |

| Spain | 16.78$B | 480 |

| Sweden | 15.26$B | 423 |

| Norway | 5.75$B | 157 |

| Belgium | 5.39$B | 131 |

| Netherlands | 3.86$B | 94 |

| Portugal | 0.40$B | 47 |