FREE Investor Database

Top Venture Investors in Hungary 2025 | Unicorn Nest Directory

Top Venture Investors in Hungary 2025 | Unicorn Nest Directory

Browse verified VC and CVC firms funding startups in Hungary. Discover your ideal investor match and find contacts of the right investors on Unicorn Nest.

Intro

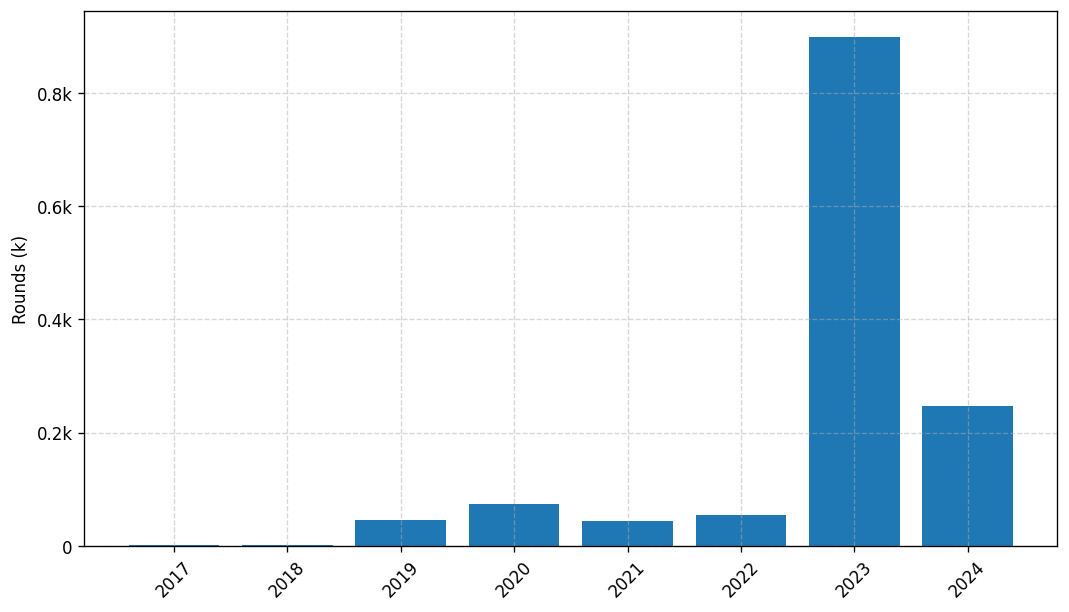

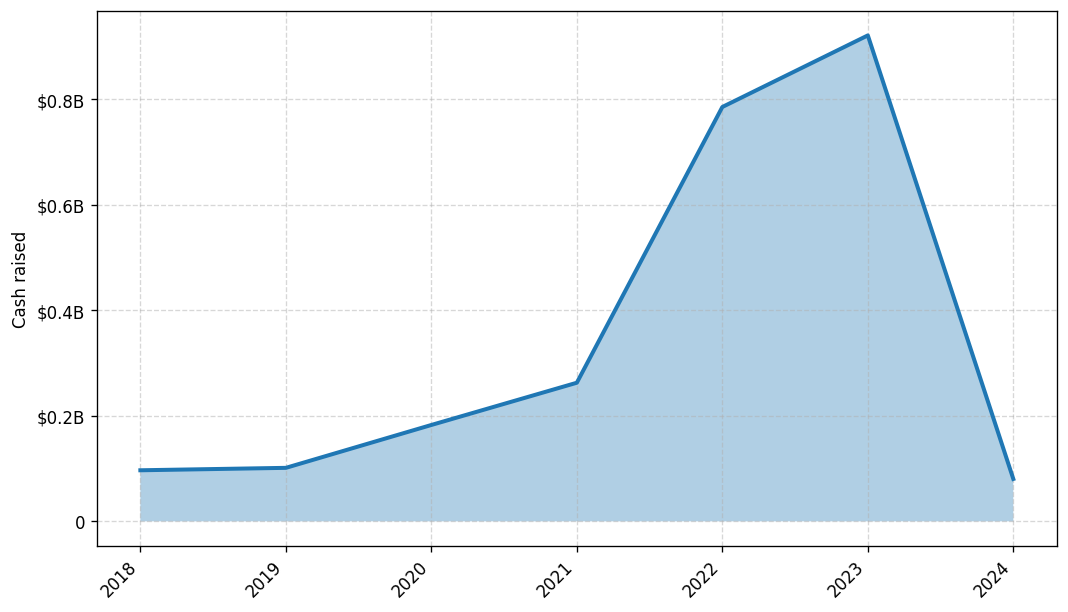

Hungary's venture capital (VC) landscape has seen a remarkable transformation in the last three years. Since 2022, the country has witnessed a surge in VC activity, with a significant increase in the number of funding rounds and the total amount invested.

In the past three years, Hungary has seen over 50 venture capital rounds, with a total investment exceeding €200 million. Some of the core startups that have received notable investments include Tresorit, a leading cloud storage and collaboration platform, Bitrise, a mobile DevOps platform, and Prezi, a renowned presentation software company.

The top venture capital funds operating in Hungary include Hiventures, a state-backed fund with a focus on early-stage startups, and Portfolion, a private VC firm that has invested in a diverse range of tech companies. These funds have played a crucial role in driving the growth and development of the Hungarian startup ecosystem.

In summary, Hungary's venture capital landscape has experienced a remarkable transformation, with a surge in funding rounds, increased investment, and the emergence of promising startups that have attracted the attention of leading VC funds.

In the past three years, Hungary has seen over 50 venture capital rounds, with a total investment exceeding €200 million. Some of the core startups that have received notable investments include Tresorit, a leading cloud storage and collaboration platform, Bitrise, a mobile DevOps platform, and Prezi, a renowned presentation software company.

The top venture capital funds operating in Hungary include Hiventures, a state-backed fund with a focus on early-stage startups, and Portfolion, a private VC firm that has invested in a diverse range of tech companies. These funds have played a crucial role in driving the growth and development of the Hungarian startup ecosystem.

In summary, Hungary's venture capital landscape has experienced a remarkable transformation, with a surge in funding rounds, increased investment, and the emergence of promising startups that have attracted the attention of leading VC funds.

14 active VC investors in Hungary

In the past three years, Hungary's venture capital landscape has seen increased activity, with several prominent firms investing in the country's thriving startup ecosystem. Notable players include Hiventures, a state-backed VC fund, and Portfolion, a private VC firm. One of the largest venture capital rounds in the last two years was Tresorit's $15 million Series B funding, led by Northzone and Creandum. Tresorit, a cloud-based file-sharing and collaboration platform, secured this significant investment to expand its global reach and further develop its secure data storage solutions.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Euroventures | Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine | Series C, Series D, Series E | |||

| Unity Ventures | healthcare, responsible consumer goods, environment, resource efficiency | Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czech Republic; Estonia; Hungary; Kosovo; Latvia; Lithuania; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine | Pre-Seed, Seed, Series A, Series B | ||

| PortfoLion Capital Partners | Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Bonitas Venture Capital Fund | medical therapies, instrumental therapies, early diagnosis, clinical methods, drug research, drug development, innovative healthcare solutions, clean energy, renewable energy, environmental technologies, foods, infocommunication technologies | Hungary | Series B, Series C, Series E, Series A, Series D | ||

| Oktogon Ventures | b2b saas | Hungary; Slovakia; Czech Republic; Poland; Croatia; Romania; Slovenia; Bulgaria | Series A, Series B, Seed | USD 11240000 | |

| Impact Ventures Hungary | Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czech Republic; Georgia; Hungary; Kosovo; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania; | Series B, Series A, Seed | EUR 4000000 | ||

| Lead Ventures | Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Seed | |||

| Hiventures | creative industries, deeptech, life sciences, agriculture, energy, e-commerce, e-learning, software, application, big data, analytics, agrotech, hr tech, adtech, media, mobility, consumer services, marketplace, iot, medtech, animation, gaming, food and beverages, fintech, insuretech, logistics, business products, consumer products, sport, travel, social media, ingatlanipar, tourism, energy tech | Hungary | |||

| StartupWorld | Hungary | ||||

| Valor Capital Venture Capital Fund Management Ltd. | it, green energy, media, entertainment | Series E, Series C, Series B, Series D, Series A |