FREE Investor Database

Top Venture Investors in Greece 2025 | Unicorn Nest Directory

Top Venture Investors in Greece 2025 | Unicorn Nest Directory

Browse verified VC and CVC firms funding startups in Greece. Discover your ideal investor match and find contacts of the right investors on Unicorn Nest.

Intro

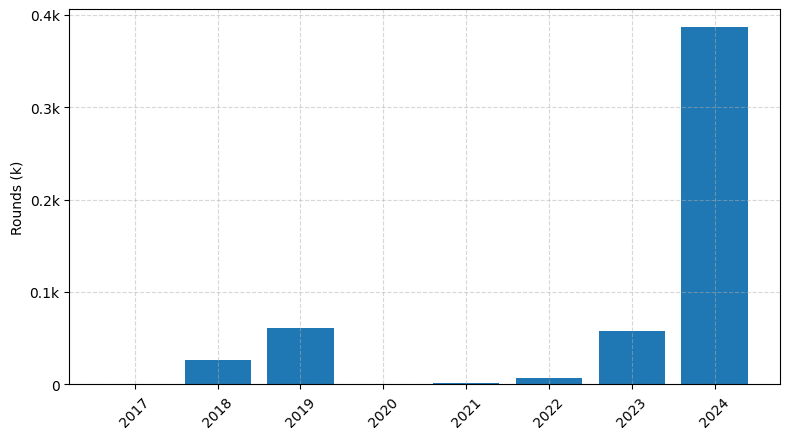

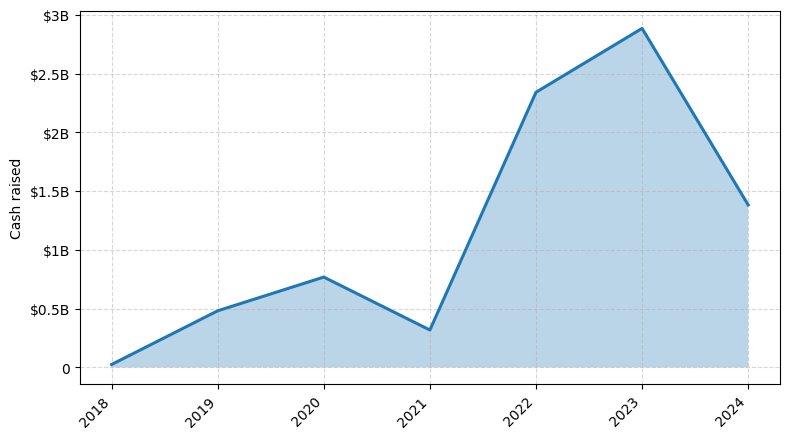

Greece's venture capital (VC) landscape has seen a remarkable transformation in the last three years. Since 2022, the country has witnessed a surge in investment activity, with a growing number of venture capital rounds and significant capital infusions.

Over the past three years, Greece has seen a total of 45 venture capital rounds, with a cumulative investment of over €250 million. Some of the core startups that have received notable investments include Blueground, a property-tech company that raised €120 million, and Viva Wallet, a fintech startup that secured €80 million. Additionally, Accusonus, an audio technology company, has also attracted significant funding.

The Greek VC landscape is dominated by prominent funds such as Venture Friends, Marathon VC, and Metavallon VC, which have been actively investing in the country's thriving startup ecosystem.

In summary, Greece's venture capital landscape has experienced a remarkable transformation, with a significant increase in investment activity, funding, and the emergence of promising startups that have attracted the attention of leading VC funds.

Over the past three years, Greece has seen a total of 45 venture capital rounds, with a cumulative investment of over €250 million. Some of the core startups that have received notable investments include Blueground, a property-tech company that raised €120 million, and Viva Wallet, a fintech startup that secured €80 million. Additionally, Accusonus, an audio technology company, has also attracted significant funding.

The Greek VC landscape is dominated by prominent funds such as Venture Friends, Marathon VC, and Metavallon VC, which have been actively investing in the country's thriving startup ecosystem.

In summary, Greece's venture capital landscape has experienced a remarkable transformation, with a significant increase in investment activity, funding, and the emergence of promising startups that have attracted the attention of leading VC funds.

14 active VC investors in Greece

In the last three years, Greece has seen a surge in venture capital investments, with several prominent firms taking an active interest in the country's startup ecosystem. Notable players include Marathon Venture Partners, Venture Friends, and Metavallon VC. One of the most significant deals was Viva Wallet's $80 million Series B round in 2021, led by Tencent and EBRD. Viva Wallet, a fintech startup, provides digital banking solutions and has been at the forefront of Greece's financial technology revolution. This investment highlights the growing confidence of international investors in Greece's ability to foster innovative startups with global potential.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| VentureFriends | proptech, marketplace, fintech, logistics tech, adtech, healthtech, hrtech, food tech, audiotech, consumer tech, govtech, big data, marketing tech, enterprise tech, b2c, b2b | Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom; Algeria; Bahrain; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Libya; Morocco; Oman; Qatar; Saudi Arabia; Tunisia; United Arab Emirates; Djibouti | Series A, Seed | USD 112000000 | |

| Velocity.Partners | technology | Greece | Pre-Seed, Seed | ||

| TECS Capital | science, technology, industry4, artificial intelligence, big data, internet of things, deep tech, transformative tech | Generalist | Series B, Pre-Seed, Seed, Series A | ||

| Signal Ventures | Singapore; Germany; Israel; United Kingdom; India | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Odyssey Ventures L.P. | new computing environment, cloud computing, global positioning, multi media convergence, multi device convergence, open source development methods, saas licensing models, ict | Greece | Seed, Series A, Series B | ||

| Metavallon VC | b2b, deep tech, fintech, energy, manufacturing, cybersecurity, machine learning/artificial intelligence, blockchain, microelectronics, robotics | Greece | Series A, Pre-Seed, Seed | EUR 32000000 | |

| Marathon Venture Capital | tech | United Kingdom; Greece; Switzerland; Germany | Seed | ||

| L-Stone Capital | technology, digital evolution, operational improvement, digital transformation, artificial intelligence, fintech, insuretech, ecommence, silver economy, remote working, agrifood, agritech, healthier living habits, esg, circular economy, esg analysis, sustainability, diversity, inclusion, equity, carbon reduction, offsetting | Generalist; Greece | Series A, Seed | ||

| Loggerhead Ventures | deep tech | Greece | Series A, Series B, Seed | EUR 10000000 | |

| Helidoni Group | zero pollution, zero environmental impact, climate tech, renewable energy sources, smart energy systems, electrification, climate fintech, green buildings, green cities, recycling, reuse, sustainable agriculture, circular economy, ethical brands, agtech | Greece |

1 active CVC investors in Greece

Active corporate venture capital firms have been increasingly investing in Greece's thriving startup ecosystem over the past three years. Notable deals include Coca-Cola HBC's investment in Augmented Pixels, a computer vision startup, and Vodafone's backing of Accusonus, an audio technology company. These investments highlight Greece's potential as an emerging hub for innovation.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Signal Ventures | Singapore; Germany; Israel; United Kingdom; India | Generalist, Pre-Seed, Seed, Series A, Series B, Series C |