FREE Investor Database

Top investors in Germany

Intro

Germany's venture capital (VC) landscape has seen a remarkable transformation in the last three years. Since 2022, the country has witnessed a surge in investment activity, with a record number of venture capital rounds taking place. According to industry reports, over 1,500 VC deals were closed in Germany during this period, totaling a staggering €15 billion in investments.

Some of the core startups that have received significant funding include Celonis, a process mining software company that raised €1 billion, and Gorillas, a rapid grocery delivery service that secured €1.2 billion. Additionally, leading VC funds such as Earlybird Venture Capital, Lakestar, and HV Capital have been at the forefront of this investment boom, providing crucial support and resources to the thriving German startup ecosystem.

In summary, Germany's VC landscape has experienced a remarkable transformation, with a substantial increase in investment activity, funding, and the emergence of high-profile startups that have captured the attention of both domestic and international investors.

Some of the core startups that have received significant funding include Celonis, a process mining software company that raised €1 billion, and Gorillas, a rapid grocery delivery service that secured €1.2 billion. Additionally, leading VC funds such as Earlybird Venture Capital, Lakestar, and HV Capital have been at the forefront of this investment boom, providing crucial support and resources to the thriving German startup ecosystem.

In summary, Germany's VC landscape has experienced a remarkable transformation, with a substantial increase in investment activity, funding, and the emergence of high-profile startups that have captured the attention of both domestic and international investors.

97 active VC investors in Germany

In the past three years, Germany's venture capital landscape has seen significant activity, with leading firms like Earlybird Venture Capital, Lakestar, and HV Capital leading the charge. One notable example is the $900 million Series E funding round raised by Celonis, a process mining and execution management software startup, in 2021. This record-breaking round, one of the largest in Germany's history, underscores the country's growing appeal as a hub for high-growth technology companies and the increasing appetite of venture capitalists to invest in the region's thriving startup ecosystem.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Haniel | clean tech | Germany; Austria; Switzerland; Belgium; Netherlands; Luxembourg; Denmark; Finland; Iceland; Norway; Sweden | Series A, Series B | ||

| BitStone Capital | construction, real estate industries | ||||

| WENVEST Capital | b2b software | Albania; Andorra; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Kosovo; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Seed, Pre-Seed, Series A | ||

| Forward31 | ai, technology, machine learning , mobility, startups, innovation, digital development, app development , connectivity, company building, venturing, partnering, entrepreneurship, business development, mentoring, founders, business growth, business design, venture buildung | Seed | |||

| Zeal Investments | |||||

| Kizoo Ventures | saas, biotech | Series A, Series B, Seed | |||

| Atlantic Food Labs | food, nutrition, health, synthetic biology, decentralized food production, alternative protein sources, increased performance, transparent & sustainable brands | Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Seed | ||

| Smart Infrastructure Ventures | smart city, energy, proptech, e-mobility, iot, ehealth, b2b software, security, health | Germany | Seed, Series A, Pre-Seed, Series B | ||

| Unger Group | real estate | ||||

| M-Venture | nightlife, entertainment, consumer | Generalist | Seed |

49 active CVC investors in Germany

Active corporate venture capital firms in Germany have been investing heavily in innovative startups across various sectors, including fintech, e-commerce, and sustainability. One notable deal was Siemens' investment in Lilium, a pioneering electric vertical take-off and landing (eVTOL) aircraft company, highlighting the growing interest in future mobility solutions.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| M-Venture | nightlife, entertainment, consumer | Generalist | Seed | ||

| Deutsche Invest Venture Capital | United States; Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Seed, Series A, Series B | |||

| HHLA Next | maritime logistics, climate neutral transport | ||||

| Deutsche Bahn Digital Ventures | sustainability, production, rail transport | Germany | |||

| STIHL Digital | smart forestry, advanced gardening, landscaping, agriculture technology, construction technology, sustainability | United States; Israel; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Seed, Series A, Series B | ||

| Archimedes New Ventures | logistics, procurement, robotics, automation, joining technologies, advanced materials, manufacturing, b2b saas solutions, climate tech, artificial intelligence, data management | Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czech Republic; Georgia; Hungary; Kosovo; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania; | Pre-Seed, Seed, Series A | ||

| Investitionsbank Berlin | ict, life science, industrial technologies, creative industries | Germany, Berlin, Berlin | Series A, Series B, Seed | EUR 100000000 | |

| DDG AG | artificial intelligence | Seed | |||

| 10K Ventures | green energy, decarbonisation, healthcare, longevity, consumer | Germany; Austria; Switzerland; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy | Series A, Series B | ||

| Klambt holdings | Seed |

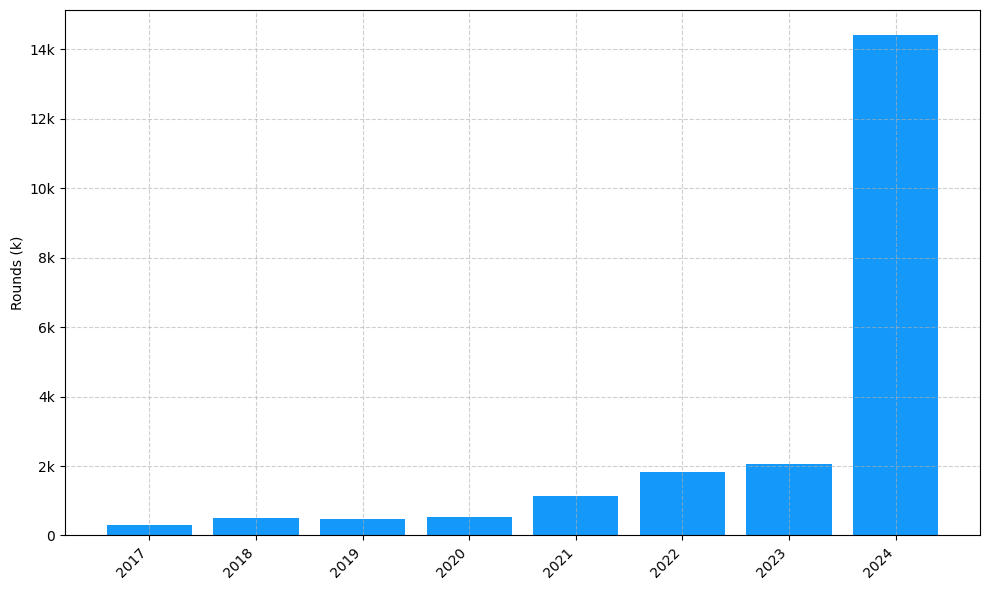

Investments by year: Round

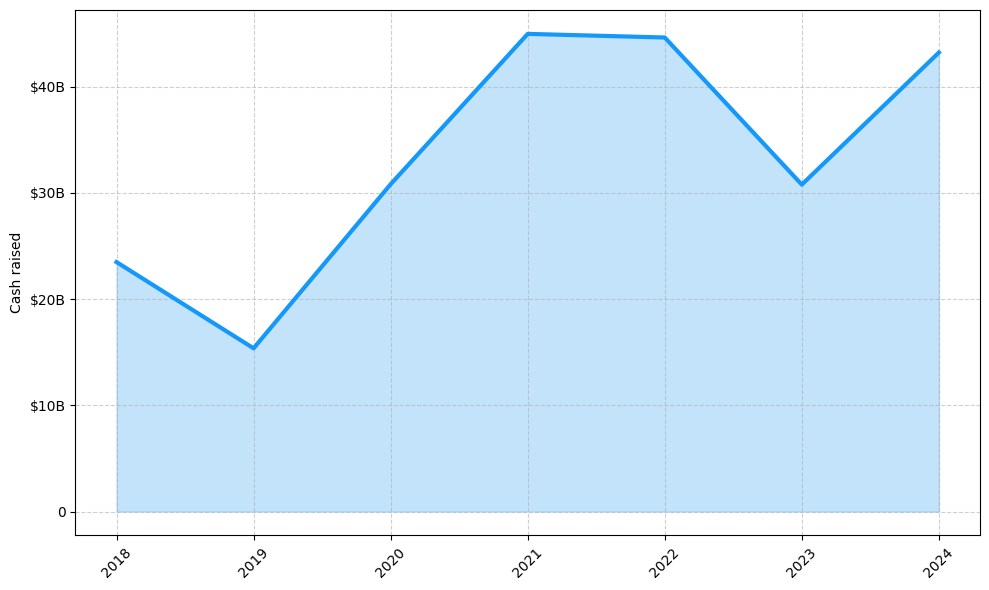

Investments by year: Cash raised

VCs in countries neighboring to Germany

| Country | Total raised | Investments |

|---|---|---|

| United Kingdom | 94.56$B | 2670 |

| France | 56.20$B | 922 |

| Switzerland | 33.84$B | 469 |

| Denmark | 27.56$B | 175 |

| Luxembourg | 8.10$B | 44 |

| Belgium | 5.43$B | 131 |

| Netherlands | 3.89$B | 94 |

| Austria | 1.94$B | 97 |

| Poland | 1.11$B | 91 |

| Czech Republic | 0.05$B | 26 |