FREE Investor Database

Top Venture Investors in France 2025 | Unicorn Nest Directory

Top Venture Investors in France 2025 | Unicorn Nest Directory

Browse verified VC and CVC firms funding startups in France. Discover your ideal investor match and find contacts of the right investors on Unicorn Nest.

Intro

France has emerged as a thriving hub for venture capital investments in recent years. Since 2022, the French startup ecosystem has witnessed a surge in VC activity, with a record number of funding rounds. According to industry reports, over 1,500 venture capital deals were closed in the last three years, totaling more than €25 billion in investments.

Some of the notable startups that have received significant funding include Sorare, a blockchain-based fantasy football platform that raised €580 million, and Ledger, a leading cryptocurrency hardware wallet provider, which secured €380 million. Additionally, Doctolib, a leading telemedicine platform, has attracted substantial investments, raising over €500 million.

The French VC landscape is dominated by prominent funds such as Eurazeo, Partech, and Daphni, which have been actively investing in the country's thriving startup ecosystem. These funds have played a crucial role in fueling the growth and innovation of French tech companies.

In summary, France has emerged as a powerhouse in the European venture capital landscape, with a robust startup ecosystem and a steady flow of investments in recent years.

Some of the notable startups that have received significant funding include Sorare, a blockchain-based fantasy football platform that raised €580 million, and Ledger, a leading cryptocurrency hardware wallet provider, which secured €380 million. Additionally, Doctolib, a leading telemedicine platform, has attracted substantial investments, raising over €500 million.

The French VC landscape is dominated by prominent funds such as Eurazeo, Partech, and Daphni, which have been actively investing in the country's thriving startup ecosystem. These funds have played a crucial role in fueling the growth and innovation of French tech companies.

In summary, France has emerged as a powerhouse in the European venture capital landscape, with a robust startup ecosystem and a steady flow of investments in recent years.

99 active VC investors in France

In the past three years, France's venture capital landscape has seen significant activity, with leading firms like Partech, Daphni, and Idinvest Partners driving investments across various sectors. One notable example is Doctolib, an online medical appointment booking platform, which raised a $170 million Series E round in 2021, one of the largest venture capital deals in France during this period. This late-stage investment highlights the growing maturity of the French startup ecosystem and the confidence of investors in the country's ability to nurture and scale innovative technology companies.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Sofimac Innovation | France | ||||

| Id4 ventures | climate, healthcare, computer vision, ai | Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Seed | EUR 16000000 | |

| Adelie | Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Generalist, Series A, Series B | |||

| Sopromec Participations | France | ||||

| MAIF Avenir | climate tech, future of work, digital health, responsible consumption, ethical data | France; Chile | Seed | ||

| INCO Ventures | green innovation, energy, health, accessibility, collaborative, circular economy, education, sustainable employment, local development | France | Seed | EUR 110000000 | |

| Notus Technologies | food brands, world of outdoor sports | France | Pre-Seed, Seed | ||

| Myrtus Venture | insurance, technology, digital, security, operations | Series A, Series B, Seed | |||

| IRDI | Seed | ||||

| Label Capital | retail, consumer | Series E, Series D, Series A, Series C, Series B, Seed |

21 active CVC investors in France

Active corporate venture capital firms in France have been increasingly investing in innovative startups across various sectors, from fintech to sustainability. In the last 3 years, these firms have played a significant role in shaping the French tech ecosystem, with notable deals such as Schneider Electric's investment in Volta Trucks.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| OBRATORI | beautytech, e-health, retailtech, tech4good | Denmark; Estonia; Finland; Iceland; Latvia; Lithuania; Norway; Sweden; Albania; Bosnia and Herzegovina; Croatia; Cyprus; Greece; Italy; Malta; Montenegro; North Macedonia; Portugal; San Marino; Serbia; Slovenia; Spain; Bulgaria; Czechia; Hungary; Poland; Romania; Slovakia; Austria; Belgium; France; Germany; Ireland; Liechtenstein; Luxembourg; Monaco; Netherlands; Switzerland; United Kingdom | Seed | ||

| Safran Corporate Ventures | aviation, space, defense, data analytics, on-demand aviation, new maintenance methods, co-creation, collaborative engineering, ai, blockchain, connectivity, augmented cabin, comfort, in-flight entertainment, human-machine interface, nanotechnologies, surface treatment processes, composites, ceramics, advanced manufacturing processes, low-carbon materials, industry 4.0, non-destructive testing, augmented reality, industrial iot, robotics/cobotics, additive manufacturing, industrial cyber security | Generalist | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | ||

| 574 Invest | mobility, industry 4.0, climate tech- micro-mobility, mass transit, shared mobility, green mobility, goods mobility, smart cities, maas, iot, intelligent robots, predictive maintenance, industrial assets' optimisation, decarbonation, digital responsibility, waste management, circular economy, smart city | Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Series A, Series B, Series C, Pre-IPO | ||

| Air Liquide ALIAD | climate tech, healthtech and industrial innovation | Italy; Belgium; United States; France | Series A, Series B | ||

| Opera Tech Ventures | fintech, insurtech, alternative data, cyber, embedded finance, mobility tech, neo banking, open banking, open insurance, payment, proptech, regtech, sustainable finance | Albania; Andorra; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Kosovo; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom; Canada; United States; Antigua and Barbuda; Argentina; The Bahamas; Barbados; Belize; Bolivia; Brazil; Chile; Colombia; Costa Rica; Cuba; Dominica; Dominican Republic; Ecuador; El Salvador; Grenada; Guatemala; Guyana; Haiti; Honduras; Jamaica; Mexico; Nicaragua; Panama; Paraguay; Peru; Saint Kitts and Nevis; Saint Lucia; Saint Vincent and the Grenadines; Suriname; Trinidad and Tobago; Uruguay; Venezuela; Armenia; Azerbaijan; Bahrain; Bangladesh; Bhutan; Brunei; Cambodia; China; Cyprus; East Timor; Egypt; Georgia; India; Indonesia; Iraq; Israel; Japan; Jordan; Kazakhstan; Kuwait; Kyrgyzstan; Laos; Lebanon; Malaysia; Maldives; Mongolia; Myanmar; Nepal; Oman; Pakistan; Philippines; Qatar; Saudi Arabia; Singapore; South Korea; Sri Lanka; Taiwan; Tajikistan; Thailand; Turkey; Turkmenistan; United Arab Emirates; Uzbekistan; Vietnam; Yemen | Series B, Series A, Series C | ||

| EDF Ventures | cleantech | Canada; United States; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Series A, Series B | ||

| I-Neo capital | Seed, Series A | ||||

| Sanofi Ventures | biotech, digital health, rare diseases, immunology and inflammation, oncology, cell and gene therapy, vaccines | United States; United Kingdom | Generalist, Seed, Series A, Series B, Series C | ||

| Bpifrance | France | ||||

| CEA Investissement | life sciences, energy, including microelectronics, materials, equipment for industry. | France | Seed | EUR 75000000 |

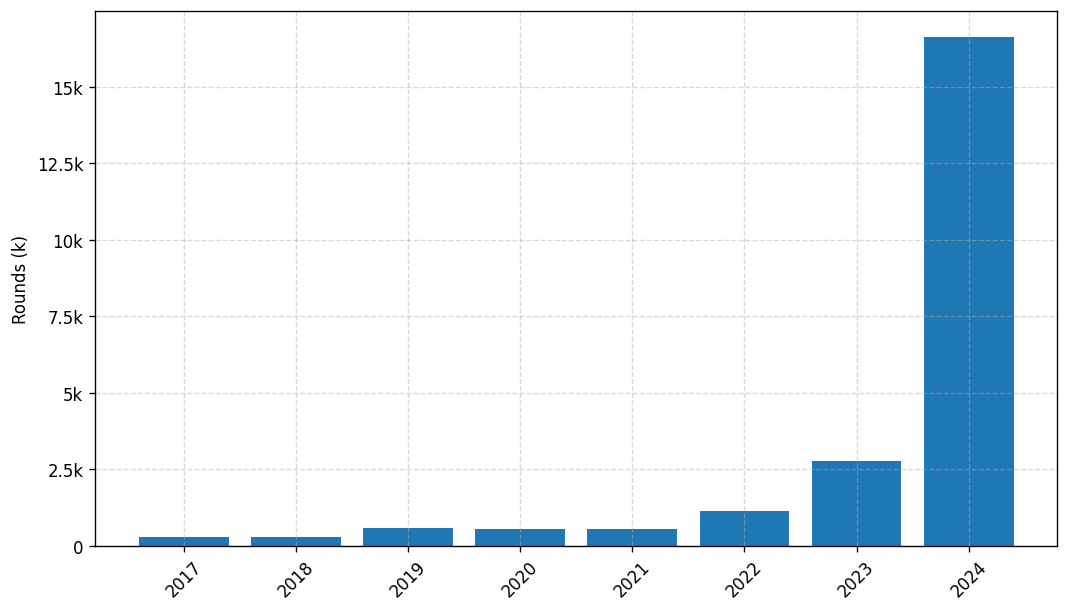

Investments by year: Round

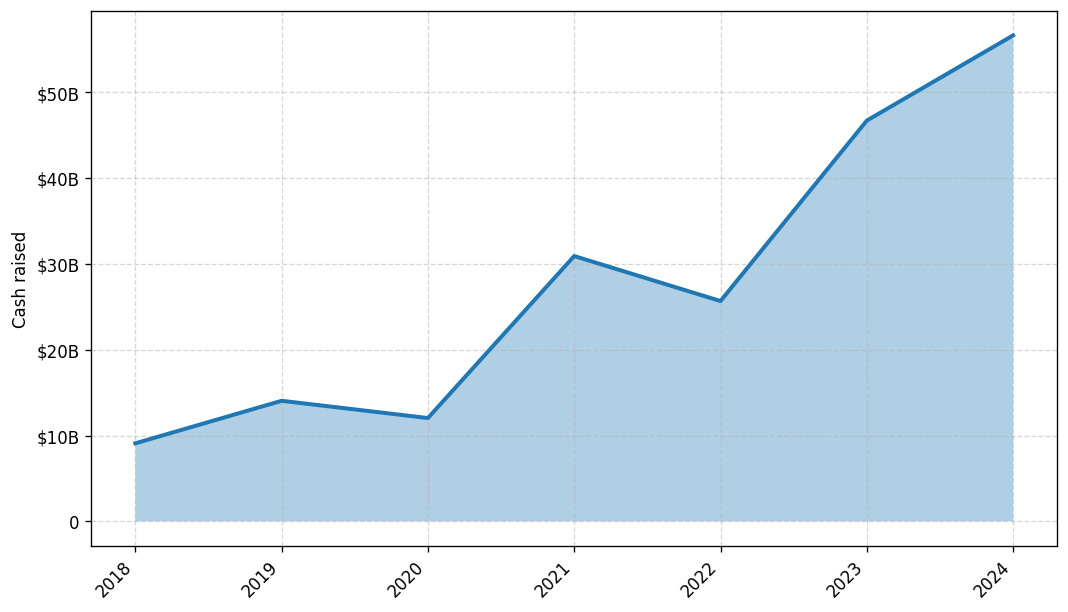

Investments by year: Cash raised

VCs in countries neighboring to France

| Country | Total raised | Investments |

|---|---|---|

| United Kingdom | 94.56$B | 2670 |

| Germany | 43.04$B | 784 |

| Italy | 35.40$B | 353 |

| Switzerland | 33.84$B | 469 |

| Spain | 16.95$B | 480 |

| Luxembourg | 8.10$B | 44 |

| Belgium | 5.43$B | 131 |

| Netherlands | 3.89$B | 94 |