FREE Investor Database

Top Venture Investors in Finland 2025 | Unicorn Nest Directory

Top Venture Investors in Finland 2025 | Unicorn Nest Directory

Browse verified VC and CVC firms funding startups in Finland. Discover your ideal investor match and find contacts of the right investors on Unicorn Nest.

Intro

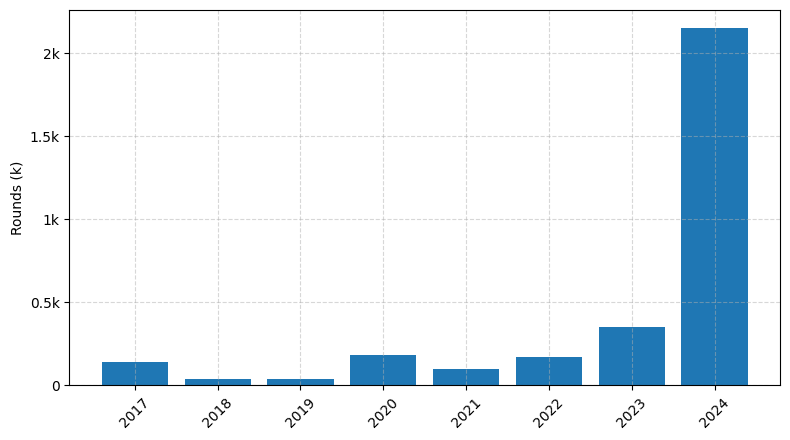

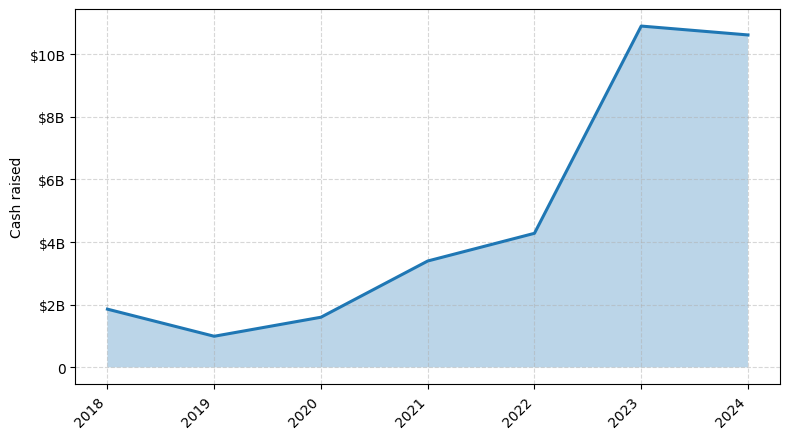

Finland has emerged as a hub for innovative startups and a thriving venture capital (VC) ecosystem. Over the past three years, since 2022, the country has witnessed a surge in VC activity, with a significant increase in the number of funding rounds and the total amount invested.

According to industry reports, Finland has seen over 300 venture capital rounds in the last three years, with a total investment value exceeding €2 billion. Some of the core startups that have received notable investments include Wolt, a food delivery platform that raised €440 million, Oura, a health-tracking wearable company that secured €100 million, and Varjo, a leading provider of professional-grade virtual and mixed reality headsets, which raised €54 million.

The Finnish VC landscape is dominated by prominent funds such as Lifeline Ventures, Inventure, and Superhero Capital, which have been actively investing in the country's thriving startup ecosystem.

In summary, Finland's VC landscape has experienced remarkable growth in the last three years, with a substantial increase in funding rounds and investment values, showcasing the country's potential as a hub for innovative startups and a thriving entrepreneurial ecosystem.

According to industry reports, Finland has seen over 300 venture capital rounds in the last three years, with a total investment value exceeding €2 billion. Some of the core startups that have received notable investments include Wolt, a food delivery platform that raised €440 million, Oura, a health-tracking wearable company that secured €100 million, and Varjo, a leading provider of professional-grade virtual and mixed reality headsets, which raised €54 million.

The Finnish VC landscape is dominated by prominent funds such as Lifeline Ventures, Inventure, and Superhero Capital, which have been actively investing in the country's thriving startup ecosystem.

In summary, Finland's VC landscape has experienced remarkable growth in the last three years, with a substantial increase in funding rounds and investment values, showcasing the country's potential as a hub for innovative startups and a thriving entrepreneurial ecosystem.

54 active VC investors in Finland

Finland's venture capital landscape has seen significant activity in the past three years, with leading firms like Lifeline Ventures, Inventure, and Superhero Capital leading the charge. One notable example is the $100 million Series B round raised by Wolt, a food delivery startup, in 2020. This investment, one of the largest in Finland's history, highlights the country's growing appeal for venture capitalists seeking high-growth opportunities in the technology and e-commerce sectors. Finland's robust startup ecosystem, coupled with a favorable business environment, has attracted the attention of global investors, driving the country's position as a hub for innovation and entrepreneurship.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Wave Ventures | Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Seed, Pre-Seed | EUR 75000000 | ||

| Voima Ventures | advanced manufacturing, imaging & optics, iot & electronics, life sciences, new materials, quantum & ai, sensing & diagnostics | Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Seed, Series A, Pre-Seed, Series B | EUR 90000000 | |

| VNT Management | renewables, electrical systems, energy savings | Seed, Series A | EUR 77M | ||

| Vendep Capital | b2b saas | Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Series A, Pre-Seed, Seed | EUR 70000000 | |

| Valve Ventures | Construction, Construction materials, Energy, Design, Circular fashion, Healthcare | Finland | Seed, Series A | ||

| Valkea Growth Club | clean energy, energy | Albania; Andorra; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Kosovo; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | |||

| Vaens | social sustainability, environmental sustainability, economic sustainability | Finland | |||

| Trado | b2b saas, b2b2c marketplaces, e-commerce | Estonia | Series B, Series A, Seed | ||

| Tesi | deep tech, clean economy, health, life sciences, industrial, services, consumer, circular economy, healthcare, life sciences, software, saas | Finland | Series E, Series C, Series D, Series A, Series B | ||

| Superhero Capital | software, marketplace, open platform, chatbot | Estonia; Latvia; Lithuania; Finland | Seed |

3 active CVC investors in Finland

Active corporate venture capital firms in Finland have been investing in a diverse range of startups, from fintech to cleantech, in the last three years. One notable deal was Neste's investment in Alterra Energy, a chemical recycling startup, to advance sustainable plastic solutions.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Valkea Growth Club | clean energy, energy | Albania; Andorra; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Kosovo; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | |||

| Kiilto Ventures | environment | Albania; Andorra; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Kosovo; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Series A, Series B | ||

| Helen Ventures | energy, e-mobility, circular economy, decarbonisation and digital solutions sectors, renewable energy, smart energy solutions, smart building solutions, distributed energy solutions, circular economy in energy, carbon circularity, batteries, digital solutions applicable to energy sector | Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Series D, Series B, Series C, Series A, Series E | EUR 50000000 |