FREE Investor Database

Top Venture Investors in Estonia 2025 | Unicorn Nest Directory

Top Venture Investors in Estonia 2025 | Unicorn Nest Directory

Browse verified VC and CVC firms funding startups in Estonia. Discover your ideal investor match and find contacts of the right investors on Unicorn Nest.

Intro

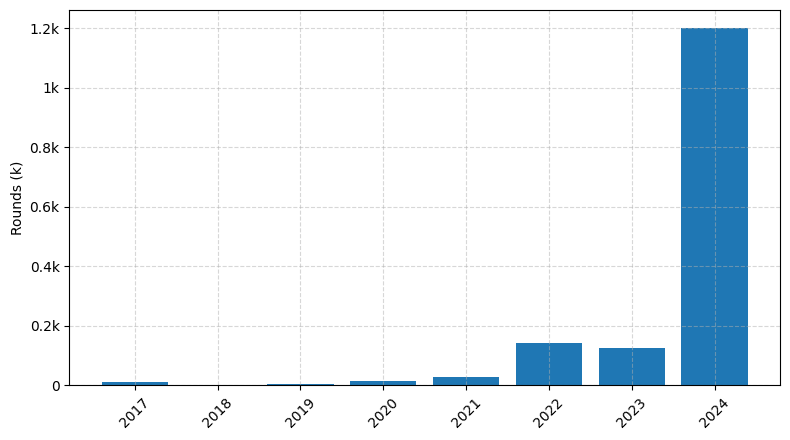

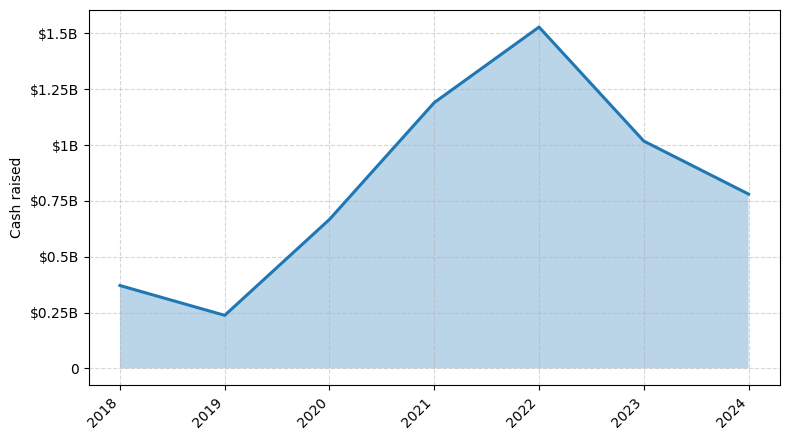

Estonia has emerged as a thriving hub for venture capital investments in recent years. Over the past three years, since 2022, the country has witnessed a surge in VC activity, with a significant number of funding rounds taking place. According to industry reports, Estonia has seen over 100 venture capital rounds during this period, with a total investment value exceeding €500 million.

Some of the core startups that have received notable investments include Bolt, a leading ride-hailing and micromobility platform, which has raised over €600 million; Pipedrive, a sales CRM software provider, which has secured over €100 million in funding; and Veriff, a leading identity verification solution, which has raised more than €150 million.

The Estonian VC landscape is dominated by prominent funds such as Tera Ventures, Superangel, and Karma Ventures, which have been actively investing in the country's thriving startup ecosystem. These funds have played a crucial role in supporting the growth and development of Estonia's innovative companies.

In summary, Estonia's venture capital landscape has experienced a remarkable transformation in the last three years, with a significant increase in funding rounds and investment values, showcasing the country's growing appeal as a destination for tech-driven startups and investors.

Some of the core startups that have received notable investments include Bolt, a leading ride-hailing and micromobility platform, which has raised over €600 million; Pipedrive, a sales CRM software provider, which has secured over €100 million in funding; and Veriff, a leading identity verification solution, which has raised more than €150 million.

The Estonian VC landscape is dominated by prominent funds such as Tera Ventures, Superangel, and Karma Ventures, which have been actively investing in the country's thriving startup ecosystem. These funds have played a crucial role in supporting the growth and development of Estonia's innovative companies.

In summary, Estonia's venture capital landscape has experienced a remarkable transformation in the last three years, with a significant increase in funding rounds and investment values, showcasing the country's growing appeal as a destination for tech-driven startups and investors.

27 active VC investors in Estonia

In the past three years, Estonia has seen a surge in venture capital investments, attracting the attention of prominent firms. Skype co-founders' Atomico and Ambient Sound Investments have been particularly active, backing innovative startups across various sectors. One notable example is the $100 million Series B round raised by Bolt, an Estonian ride-hailing and micromobility platform, in 2021. This investment, led by Naya Capital Management, underscores Estonia's growing reputation as a hub for tech startups and the increasing confidence of global investors in the country's entrepreneurial ecosystem.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Yolo Investments | gaming, fintech | Generalist | Seed, Series A | EUR 100000000 | |

| United Partners | Estonia; Latvia; Lithuania | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| UniTartu Ventures | deep tech, life sciences, processing & computing, food & agritech, energy & cleantech, infrastructure | Series A, Series B | |||

| UG Investments | energy, industrial, infrastructure, utility | Estonia; Finland; Latvia | |||

| Trind Ventures | b2c, c2c, consumerized b2b, marketplaces, platforms | Denmark; Estonia; Finland; Iceland; Latvia; Lithuania; Norway; Sweden; United Kingdom; Austria; Croatia; Czechia; Germany; Hungary; Liechtenstein; Poland; Slovakia; Slovenia; Switzerland; Romania, Transylvania | Seed | EUR 55000000 | |

| Thorgate Ventures | Estonia | Seed | |||

| Tera Ventures | fintech, automation, 3d printing software, defensive cyber solutions, ai | Estonia; Denmark; Sweden; Finland; Latvia; Lithuania; Poland; Czechia | Seed, Pre-Seed | EUR 43000000 | |

| Superangel | ai, robotics, data, infrastructure, deeptech, science | Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Seed, Pre-Seed | ||

| Spring Capital | technology | Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Estonia; Hungary; Latvia; Lithuania; Montenegro; North Macedonia; Poland; Romania; Serbia; Slovakia; Slovenia | Seed | ||

| Specialist VC | b2b, saas, fintech, platforms, software, enabled hardware, deep tech | United States; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Pre-Seed, Seed, Series A | EUR 50000000 |