FREE Investor Database

Top Venture Investors in Denmark 2025 | Unicorn Nest Directory

Top Venture Investors in Denmark 2025 | Unicorn Nest Directory

Browse verified VC and CVC firms funding startups in Denmark. Discover your ideal investor match and find contacts of the right investors on Unicorn Nest.

Intro

Denmark has emerged as a thriving hub for venture capital investments in recent years. Over the past three years, since 2022, the country has witnessed a surge in VC activity, with a significant number of venture capital rounds taking place. According to industry reports, Denmark has seen over 150 venture capital rounds during this period, with a total investment of more than €1.5 billion.

Some of the core startups that have received notable investments include Lunar, a leading digital banking platform, which raised €210 million in a Series D round, and Pleo, a corporate expense management solution, which secured €150 million in a Series C round. Additionally, Templafy, a cloud-based document creation platform, has also attracted significant investment, raising €100 million in a Series C round.

The Danish venture capital landscape is dominated by prominent funds such as Seed Capital, Vækstfonden, and Heartcore Capital, which have played a crucial role in supporting the growth of the country's thriving startup ecosystem.

In summary, Denmark's venture capital landscape has experienced a remarkable transformation in the last three years, with a substantial increase in investment activity and the emergence of several promising startups that have received significant funding.

Some of the core startups that have received notable investments include Lunar, a leading digital banking platform, which raised €210 million in a Series D round, and Pleo, a corporate expense management solution, which secured €150 million in a Series C round. Additionally, Templafy, a cloud-based document creation platform, has also attracted significant investment, raising €100 million in a Series C round.

The Danish venture capital landscape is dominated by prominent funds such as Seed Capital, Vækstfonden, and Heartcore Capital, which have played a crucial role in supporting the growth of the country's thriving startup ecosystem.

In summary, Denmark's venture capital landscape has experienced a remarkable transformation in the last three years, with a substantial increase in investment activity and the emergence of several promising startups that have received significant funding.

58 active VC investors in Denmark

Denmark's venture capital landscape has seen significant activity in the past three years, with leading firms like Seed Capital, Vækstfonden, and Heartcore Capital playing a prominent role. One of the biggest venture capital rounds in the last two years was the $100 million Series B funding raised by Pleo, a fintech startup that provides smart company cards and expense management solutions. This round, led by Alkeon Capital, highlights the growing interest in Danish startups, particularly in the financial technology sector, and the country's ability to attract substantial investments from global venture capital firms.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| VÅR Ventures | energy innovation, food, agriculture, education technology | Generalist; Denmark; Finland; Iceland; Norway; Sweden | Seed, Series A | EUR 80000000 | |

| Upfin | fintech | Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Pre-Seed, Seed | EUR 30000000 | |

| Underground Ventures | geothermal energy | ||||

| Unconventional Ventures | climate, environment, health, femtech, education, financial | Denmark; Norway; Sweden; Finland; Iceland; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Seed | EUR 30000000 | |

| Ugly Duckling Ventures | Denmark; Norway; Sweden; Finland; Iceland | Seed | DKK 150000000 | ||

| The Nordic Web Ventures | Denmark; Norway; Sweden; Finland; Iceland | Series A, Series B | USD 1500000 | ||

| The Footprint Firm | energy, food, agriculture, built environment, frontier solutions, circular economy, bio solutions, climate tech, solar, battery, mobility, ev, software | Denmark; Finland; Iceland; Norway; Sweden | Series A, Series B | EUR 50000000 | |

| The Aventures | ai, automation, space explorers, gaming, virtual worlds, web3, blockchain, crypto natives, culture, alts collectables, climate movement | Seed | |||

| Sunstone Life Science Ventures | therapeutics | Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Series A, Series B | EUR 92000000 | |

| Sortedam Ventures | Energy, Maritime, Health, Data Infrastructure, Market Research |

2 active CVC investors in Denmark

Active corporate venture capital firms in Denmark have been investing in a diverse range of industries, from fintech to sustainability. One notable deal was Novo Holdings' investment in Pleo, a leading expense management platform, highlighting the growing interest in innovative solutions that streamline business operations.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| NREP | real estate | Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | |||

| ALFA Ventures | real estate, proptech |

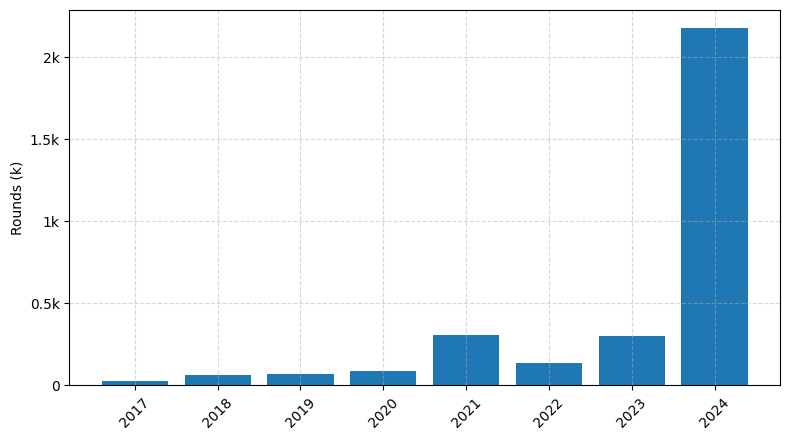

Investments by year: Round

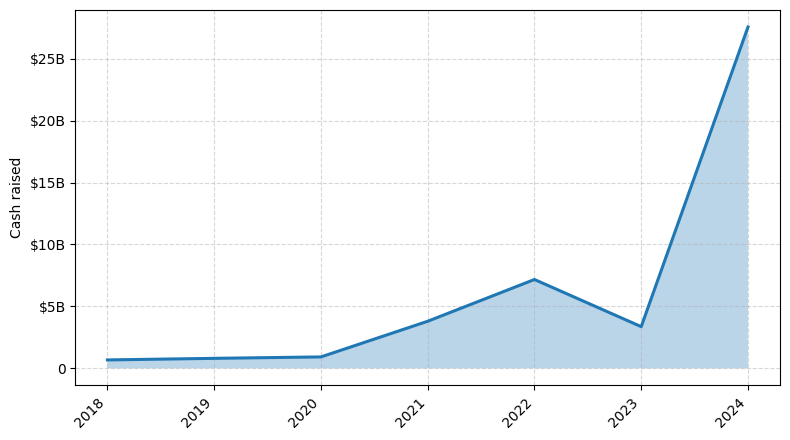

Investments by year: Cash raised

VCs in countries neighboring to Denmark

| Country | Total raised | Investments |

|---|---|---|

| United Kingdom | 93.88$B | 2670 |

| Germany | 42.64$B | 784 |

| Ireland | 23.08$B | 225 |

| Sweden | 15.25$B | 423 |

| Norway | 5.75$B | 157 |

| Belgium | 5.39$B | 131 |

| Netherlands | 3.86$B | 94 |

| Iceland | 1.18$B | 18 |

| Poland | 1.10$B | 91 |