FREE Investor Database

Top Venture Investors in Canada 2025 | Unicorn Nest Directory

Top Venture Investors in Canada 2025 | Unicorn Nest Directory

Browse verified VC and CVC firms funding startups in Canada. Discover your ideal investor match and find contacts of the right investors on Unicorn Nest.

Intro

Canada's venture capital (VC) landscape has seen a remarkable transformation in the last three years. Since 2022, the country has witnessed a surge in VC activity, with a record number of funding rounds and substantial investments. According to industry reports, over 1,500 venture capital deals were closed in the past three years, totaling more than $25 billion in investments.

Some of the notable startups that have received significant funding include Shopify, a leading e-commerce platform that has raised over $2 billion, and Wealthsimple, a fintech company that has secured over $1 billion in investments. Additionally, top VC funds such as Sequoia Capital, Andreessen Horowitz, and BDC Capital have been actively investing in Canadian startups, further solidifying the country's position as a hub for innovation and entrepreneurship.

In summary, Canada's venture capital landscape has experienced a remarkable transformation, with a surge in funding rounds, substantial investments, and the emergence of high-profile startups that have attracted the attention of leading VC funds.

Some of the notable startups that have received significant funding include Shopify, a leading e-commerce platform that has raised over $2 billion, and Wealthsimple, a fintech company that has secured over $1 billion in investments. Additionally, top VC funds such as Sequoia Capital, Andreessen Horowitz, and BDC Capital have been actively investing in Canadian startups, further solidifying the country's position as a hub for innovation and entrepreneurship.

In summary, Canada's venture capital landscape has experienced a remarkable transformation, with a surge in funding rounds, substantial investments, and the emergence of high-profile startups that have attracted the attention of leading VC funds.

98 active VC investors in Canada

In the last three years, Canada's venture capital landscape has seen significant activity, with leading firms like Inovia Capital, OMERS Ventures, and BDC Capital spearheading investments across various industries. One notable example is Shopify's $1.5 billion Series E round in 2020, which was the largest venture capital deal in Canada's history. This late-stage funding round, led by Fidelity Investments and General Atlantic, underscored the country's growing appeal as a hub for e-commerce and technology startups. The influx of venture capital has fueled the growth of Canadian innovation, solidifying the nation's position as a competitive player in the global startup ecosystem.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| York Entrepreneurship Development Institute | Series B, Series A | ||||

| YOLO Ventures | disruptive hospitality businesses and applications, blockchain technologiesand digital assets' ecosystem, music production and entertainment-related ventures and applications | Series A, Seed | |||

| Yaletown Partners | software, data, iot, ai, cloud | Canada | Series C, Series D, Series F, Series E | USD 200000000 | |

| Wittington Ventures | climate, commerce, food, healthcare | Canada; United States | |||

| well health ventures | digital health | Canada | |||

| Walter Ventures | healthcare | Generalist; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine | Series A, Series B | ||

| ventureLAB | artificial intelligence, hardware, automobility, medtech | ||||

| Venture Grade | Canada; United States | Seed | |||

| Vanedge Capital | hard tech, ai & analytics. applied analytics, analytics tools & platforms, computational biology, hard tech, cyber security, saas & digital media | United States; Canada | Series A, Series B | USD 10M | |

| Valon Capital | b2b, saas, fintech, and deep tech | Armenia; Azerbaijan; Bahrain; Bangladesh; Bhutan; Brunei; Cambodia; China; Cyprus; Georgia; India; Indonesia; Iraq; Israel; Japan; Jordan; Kazakhstan; Kuwait; Kyrgyzstan; Laos; Lebanon; Malaysia; Maldives; Mongolia; Nepal; Oman; Pakistan; Palestine; Philippines; Qatar; Saudi Arabia; Singapore; South Korea; Sri Lanka; Syria; Taiwan; Tajikistan; Thailand; Timor-Leste; Turkey; Turkmenistan; United Arab Emirates; Uzbekistan; Vietnam; Yemen; Antigua and Barbuda; Argentina; Bahamas; Barbados; Belize; Bolivia; Brazil; Canada; Chile; Colombia; Costa Rica; Cuba; Dominica; Dominican Republic; Ecuador; El Salvador; Grenada; Guatemala; Guyana; Haiti; Honduras; Jamaica; Mexico; Nicaragua; Panama; Paraguay; Peru; Saint Kitts and Nevis; Saint Lucia; Saint Vincent and the Grenadines; Suriname; Trinidad and Tobago; United States; Uruguay; Venezuela; |

11 active CVC investors in Canada

Active corporate venture capital firms have been increasingly investing in Canadian startups over the past three years, diversifying their portfolios and tapping into the country's thriving tech ecosystem. Notable deals include Shopify's acquisition of Deliverr for $2.1 billion, showcasing the growing appeal of Canadian innovation.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| TELUS Ventures | ag tech, connected consumer, digital health, smart cities and iot | Canada; United States | |||

| SWS Ventures | fashion, lifestyle | Canada | Pre-Seed, Series B, Series A | ||

| RBCx | tech, life sciences, climate | Canada | Generalist | ||

| NAventures | fintechs | United Kingdom; United States; Canada | Series A, Series B | ||

| Maropost Ventures | commerce, marketing automation, service | ||||

| KreaMedica | biotechnology | Seed, Pre-Seed | |||

| Energizing Life Community Fund | community wellbeing | Canada | |||

| Desjardins Venture Capital | most sectors | Canada, Quebec | Generalist, Seed | ||

| Desjardins-Innovatech | Canada, Quebec | ||||

| Bell Ventures | network, enterprise solutions and media and data | Canada | Series E, Series D, Series C, Series A, Series B |

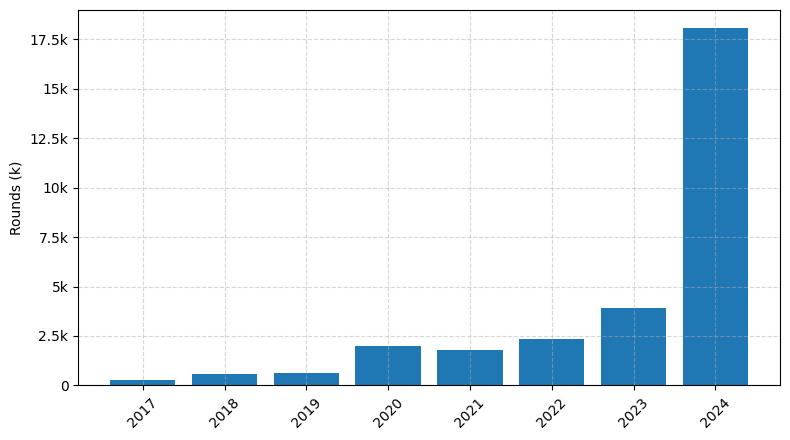

Investments by year: Round

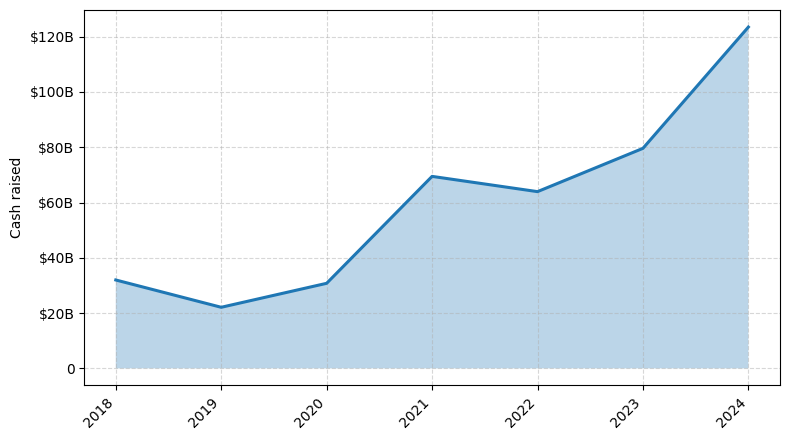

Investments by year: Cash raised

VCs in countries neighboring to Canada

| Country | Total raised | Investments |

|---|---|---|

| United States | 1144.21$B | 17386 |

| Mexico | 29.10$B | 120 |

| Bermuda | 4.06$B | 18 |