FREE Investor Database

Top Venture Investors in Belgium 2025 | Unicorn Nest Directory

Top Venture Investors in Belgium 2025 | Unicorn Nest Directory

Browse verified VC and CVC firms funding startups in Belgium. Discover your ideal investor match and find contacts of the right investors on Unicorn Nest.

Intro

Belgium's venture capital (VC) landscape has seen a surge of activity in the last three years, with a growing number of startups attracting significant investments. Since 2022, the country has witnessed a remarkable increase in VC rounds, with over 150 deals completed, totaling more than €1.2 billion in investments.

Some of the core startups that have received notable funding include Cowboy, a leading electric bike manufacturer, which raised €80 million in 2022, and Deliverect, a food delivery software provider, which secured €65 million in 2021. Additionally, Collibra, a data governance and management platform, has emerged as a Belgian success story, raising over €200 million in recent years.

The Belgian VC landscape is supported by a strong network of top-tier funds, such as Gimv, Fortino Capital, and Newion Investments, which have been actively investing in the country's thriving startup ecosystem.

In summary, Belgium's venture capital market has experienced a period of robust growth, with a surge in investment activity and the emergence of several promising startups that have captured the attention of both local and international investors.

Some of the core startups that have received notable funding include Cowboy, a leading electric bike manufacturer, which raised €80 million in 2022, and Deliverect, a food delivery software provider, which secured €65 million in 2021. Additionally, Collibra, a data governance and management platform, has emerged as a Belgian success story, raising over €200 million in recent years.

The Belgian VC landscape is supported by a strong network of top-tier funds, such as Gimv, Fortino Capital, and Newion Investments, which have been actively investing in the country's thriving startup ecosystem.

In summary, Belgium's venture capital market has experienced a period of robust growth, with a surge in investment activity and the emergence of several promising startups that have captured the attention of both local and international investors.

70 active VC investors in Belgium

In the last three years, Belgium's venture capital landscape has seen significant activity, with several prominent firms investing in promising startups. Two notable players are Volta Ventures and Imec.istart, which have backed innovative companies across various sectors. One of the largest venture capital rounds in Belgium during this period was the €80 million Series B funding raised by Deliverect, a cloud-based food delivery management platform, in 2021. This investment, led by Redpoint Ventures and Lightspeed Venture Partners, highlights the growing interest in Belgium's thriving startup ecosystem.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| WING by Digital Wallonia | saas, medtech, engineering tech, advanced tech, deep tech, artificial intelligence, the internet of things, saas software, blockchain technology, medtechs, augmented reality | Belgium, Wallonia | Pre-Seed, Seed, Series A | ||

| White Fund | medical technologies, disease prevention, diagnostic, monitoring, treatment solutions, medical device | Belgium; Netherlands; Luxembourg; France; Germany | Series A, Seed, Series B | EUR 38000000 | |

| VIB | (bio)pharmaceuticals, diagnostics, agricultural improvements | Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Series A, Series B | ||

| Verlinvest | food, beverage & fmcg, health, consumer technology, lifestyle | Generalist | Seed | ||

| V-Bio Ventures | healthcare, sustainable agriculture, therapeutics, diagnostics supporting medical therapies, sustainable agriculture | Albania; Andorra; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Kosovo; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Seed, Series A, Pre-Seed, Series B | EUR 110000000 | |

| V3 Ventures | consumer | Generalist | Seed, Series A | EUR 100000000 | |

| Ucb Ventures | generation cell, gene therapy, regenerative medicine, cell, tissue homeostasis, rna modulation, synthetic biology therapeutics | United States; Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Series A, Series B | ||

| Torus Capital | software & hardware tech | Luxembourg; Germany; United States; Belgium | Series B, Seed, Series A | ||

| Tioga Capital Partners | web3, defi infrastructure, nft infrastructure | Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Pre-Seed, Seed, Series A, Series B | EUR 80000000 | |

| The Faktory Fund | Belgium; Netherlands; Luxembourg; France | Seed, Series B, Series A |

4 active CVC investors in Belgium

Active corporate venture capital firms have been increasingly investing in Belgium over the past three years, seeking to tap into the country's thriving startup ecosystem. Notable deals include Solvay Ventures' investment in Agidens, a leading industrial automation company, and Proximus Ventures' backing of Cowboy, a Belgian electric bike startup.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| VIB | (bio)pharmaceuticals, diagnostics, agricultural improvements | Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Series A, Series B | ||

| Ucb Ventures | generation cell, gene therapy, regenerative medicine, cell, tissue homeostasis, rna modulation, synthetic biology therapeutics | United States; Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Series A, Series B | ||

| Mediahuis Ventures | edtech, hrtech | United Kingdom; Sweden; Germany; Switzerland; Netherlands; Denmark; | Series A, Seed, Series B | ||

| Lab Box | Albania; Andorra; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Kosovo; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Seed, Series A |

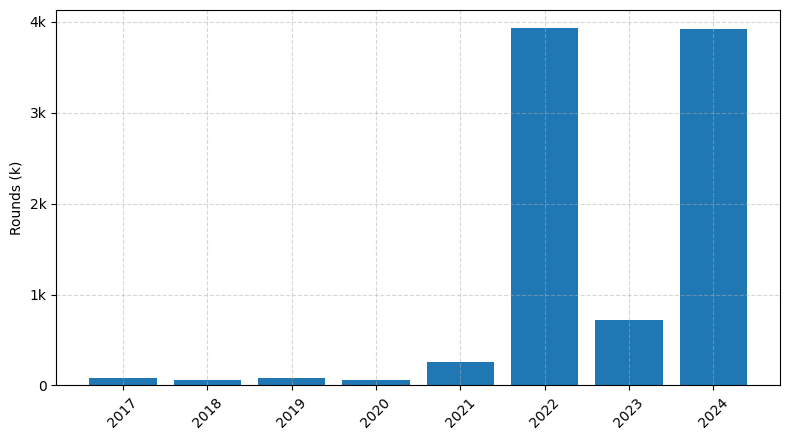

Investments by year: Round

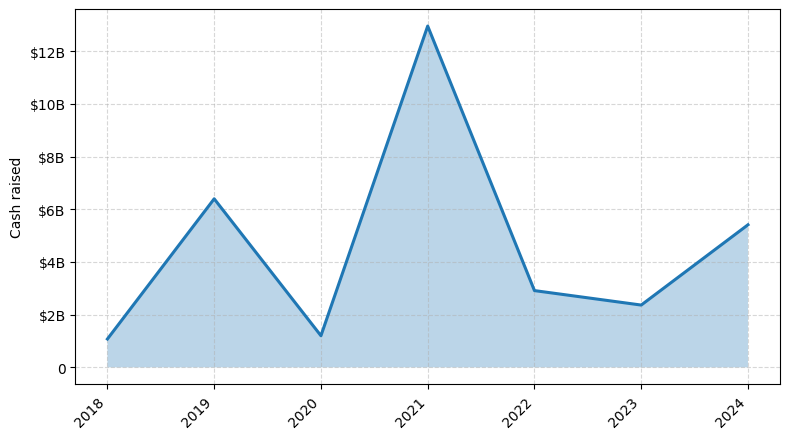

Investments by year: Cash raised

VCs in countries neighboring to Belgium

| Country | Total raised | Investments |

|---|---|---|

| United Kingdom | 93.88$B | 2670 |

| France | 55.70$B | 922 |

| Germany | 42.64$B | 784 |

| Switzerland | 33.71$B | 469 |

| Denmark | 27.52$B | 175 |

| Ireland | 23.08$B | 225 |

| Luxembourg | 8.04$B | 44 |

| Netherlands | 3.86$B | 94 |

| Austria | 1.94$B | 97 |

| Poland | 1.10$B | 91 |