FREE Investor Database

Top Venture Investors in Austria 2025 | Unicorn Nest Directory

Top Venture Investors in Austria 2025 | Unicorn Nest Directory

Browse verified VC and CVC firms funding startups in Austria. Discover your ideal investor match and find contacts of the right investors on Unicorn Nest.

Intro

Austria's venture capital (VC) landscape has seen a remarkable transformation in the last three years. Since 2022, the country has witnessed a surge in investment activity, with a growing number of venture capital rounds and significant capital infusion into the startup ecosystem.

Over the past three years, Austria has recorded over 150 venture capital rounds, with a total investment exceeding €1 billion. Some of the core startups that have received notable investments include Bitpanda, a leading European crypto platform, which raised €170 million in 2021, and Adverity, a data analytics platform, which secured €30 million in 2022.

The top venture capital funds operating in Austria include Speedinvest, a pan-European VC firm with a strong presence in the country, and Pioneers Ventures, a local fund focused on early-stage startups. These funds have played a crucial role in nurturing the Austrian startup ecosystem and driving innovation across various sectors.

In summary, Austria's venture capital landscape has experienced a remarkable transformation, with a significant increase in investment activity, capital infusion, and the emergence of promising startups that have attracted the attention of leading VC funds.

Over the past three years, Austria has recorded over 150 venture capital rounds, with a total investment exceeding €1 billion. Some of the core startups that have received notable investments include Bitpanda, a leading European crypto platform, which raised €170 million in 2021, and Adverity, a data analytics platform, which secured €30 million in 2022.

The top venture capital funds operating in Austria include Speedinvest, a pan-European VC firm with a strong presence in the country, and Pioneers Ventures, a local fund focused on early-stage startups. These funds have played a crucial role in nurturing the Austrian startup ecosystem and driving innovation across various sectors.

In summary, Austria's venture capital landscape has experienced a remarkable transformation, with a significant increase in investment activity, capital infusion, and the emergence of promising startups that have attracted the attention of leading VC funds.

37 active VC investors in Austria

Austria's venture capital landscape has seen steady growth in the past three years, with notable investments from firms like Speedinvest, Pioneers Ventures, and Venionaire Capital. One of the largest venture capital rounds in the last two years was the €30 million Series B funding raised by Bitpanda, a leading European digital investment platform. This round, led by Valar Ventures, Speedinvest, and REDO Ventures, highlights the increasing interest in fintech startups within the Austrian startup ecosystem. These investments showcase the country's potential as an emerging hub for innovative technology companies seeking to scale their operations.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| GateWay Ventures | fintech, regtech, insurtech, proptech, future of work, industry 4.0, iot, smart city, cyber security, life science, medtech, biotech, digital health, personalized health, peronalized diagnostics, sustainability, impact, environment, circular economy, greentech, edtech | Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Seed, Series A | ||

| Big Cheese Ventures | |||||

| Loonshot | agrotech, foodtech, fmcg, digital business models | Series E, Series A, Series C, Series D, Series B | |||

| Smartworks Innovation | energy, mobility | Israel; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Seed, Pre-Seed, Series A | ||

| Hardlymountain Capital | Seed | ||||

| Michael Grabner Media GmbH | media, communications | Germany; Austria; Switzerland | Series A, Series B | ||

| Triple Impact Ventures | climate, biodiversity, pollution crises, software, hardware | Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czech Republic; Georgia; Hungary; Kosovo; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania; | Series A, Seed, Series B, Pre-Seed | ||

| Carinthian Venture Fund | Series A, Series B | ||||

| asp. group | supply chain, vending machines, tax, health, healthcare, communication platform, space, DLP, educational platform | Albania; Andorra; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Kosovo; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Seed | ||

| Pioneers Ventures | Pre-Seed, Seed, Series A, Series B |

2 active CVC investors in Austria

Active corporate venture capital firms in Austria have been investing in a diverse range of startups, from fintech to sustainability. In the last 3 years, these firms have backed innovative companies, driving growth and fostering collaboration. One notable deal saw a leading Austrian bank invest in a promising blockchain startup.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Graphit Holding | automotive | Series A, Series B | |||

| Elevator Ventures | fintech, wealth management, daily banking, payments, defi, blockchain, embedded finance, infrastructure, regtech, cybersecurity, financial crime, beyond, banking, food, agritech, esg capabilities, industrial tech, mobility, travel, proptech, energy, commerce, logistics, tech shifts, software as a service, quantum computing, ai, data analytics, open api, biometrics, ar, vr, internet of things, distributed ledger tech | Germany; Austria; Switzerland | Series A, Series B, Seed | EUR 70000000 |

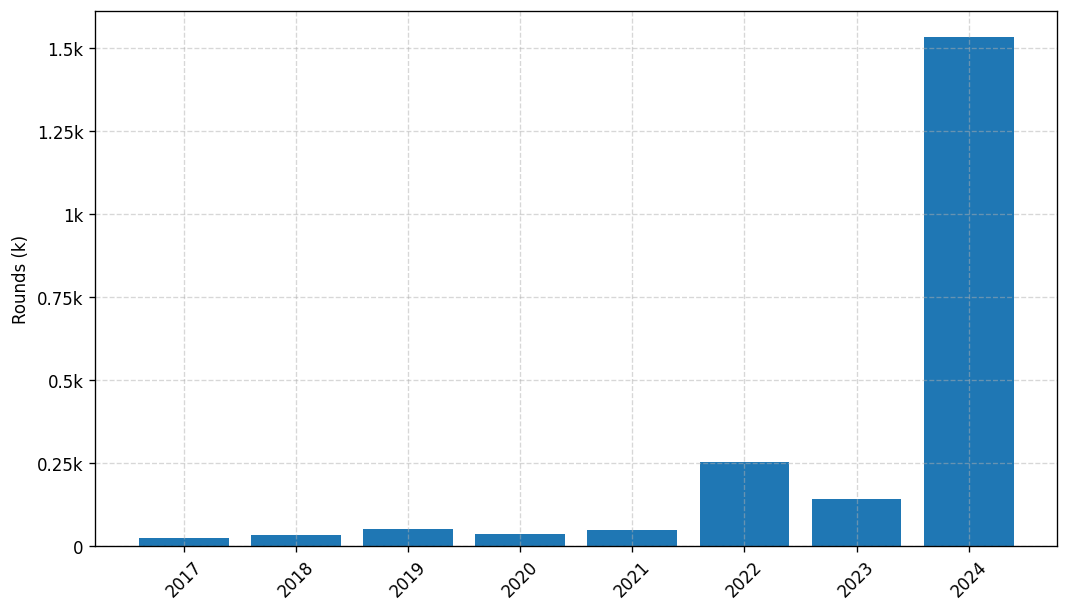

Investments by year: Round

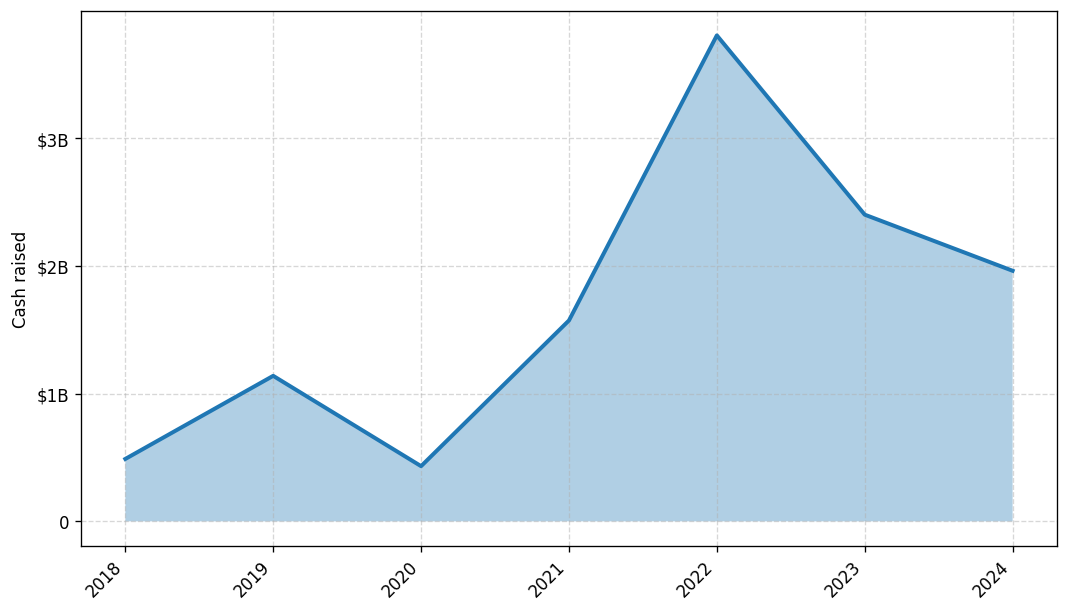

Investments by year: Cash raised

VCs in countries neighboring to Austria

| Country | Total raised | Investments |

|---|---|---|

| Germany | 43.04$B | 784 |

| Italy | 35.40$B | 353 |

| Switzerland | 33.84$B | 469 |

| Liechtenstein | 6.90$B | 3 |

| Poland | 1.11$B | 91 |

| Croatia | 0.58$B | 18 |

| Slovenia | 0.12$B | 7 |

| Hungary | 0.08$B | 22 |

| Czech Republic | 0.05$B | 26 |

| Slovakia | 0.04$B | 4 |